For relevant analysis of gold prices, the so-called “fundamentals” provide scant help. What is required is an understanding of the macroeconomic drivers at play. This article addresses 9 such factors.

The above comments, and those below, have been edited by munKNEE.com (Your Key to Making Money!) for the sake of clarity [] and brevity (…) to provide a fast and easy read and have been excerpted from an article* by Robert P. Balan of Diapason Commodities Management (diapason-cm.ch) originally entitled Making Sense Of Gold’s ‘Fundamentals’ And Future Prospects: A Case Study In Graphics which can be read in its unabridged format HERE.

Gold’s Macroeconomic Drivers

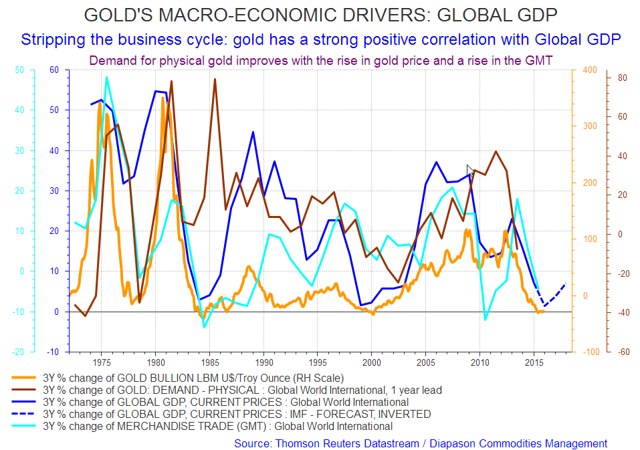

1. Rising global growth is a requisite for sustained gold bull trends (see chart below). It is general well-being in a global scope that promotes the right conditions that would be positive for the price of gold – like a rising pace of global merchandise trade as shown below, a precursor of higher global GDP.

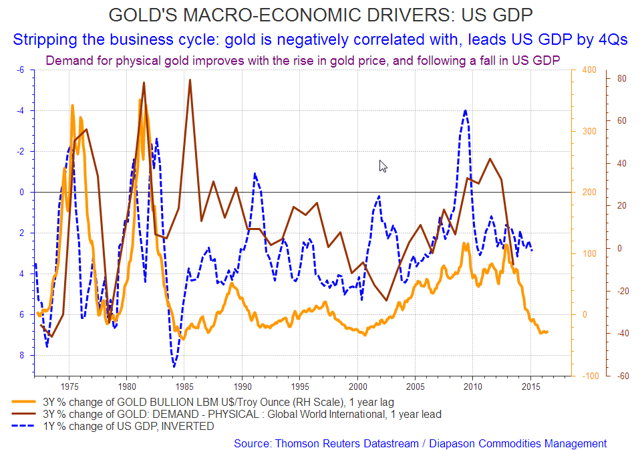

2. Gold is NEGATIVELY correlated with U.S. GDP growth, and now we see why. The negative correlation with U.S. GDP stems from gold’s positive correlation with U.S. aggregate debt, which in turn, has a negative relationship with U.S. growth, as we see below.

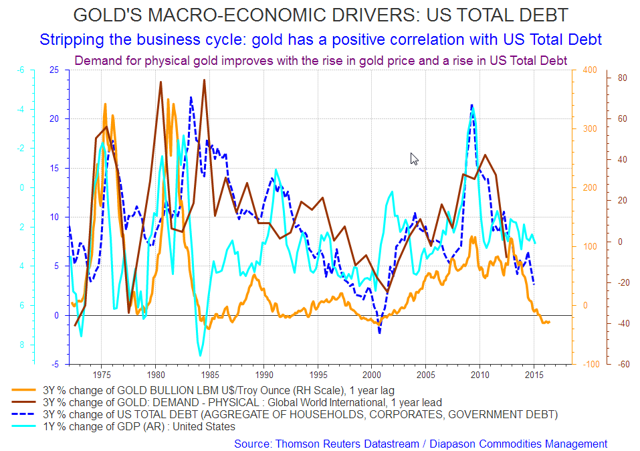

3. Gold is positively correlated with Total U.S. Debt, which on aggregate, is negatively correlated with U.S. GDP growth (see chart below). It is very easy to explain the inverse correlation between debt and U.S. GDP – that is, debt growth rises when GDP growth slows – in other words, debt growth is a function of GDP. To keep their living standards at the same level, individuals, corporations and the government borrow when GDP slows down. For the government, it is the automatic (spending) stabilizers that keep borrowings high (thereby making debt rise) when GDP slows down which reduces tax revenues. Those automatic stabilizers are there by law, even if spending for them increases the debt over GDP ratio.

The other complication is that GDP growth is also, to a large extent, dependent on government spending, especially during GDP growth recessions and, for a government to do that during a recession, they have to borrow, which further adds to the U.S. aggregate debt. Strongly rising U.S. aggregate debt has provided some of the most spectacular gold bull market trends in the past.

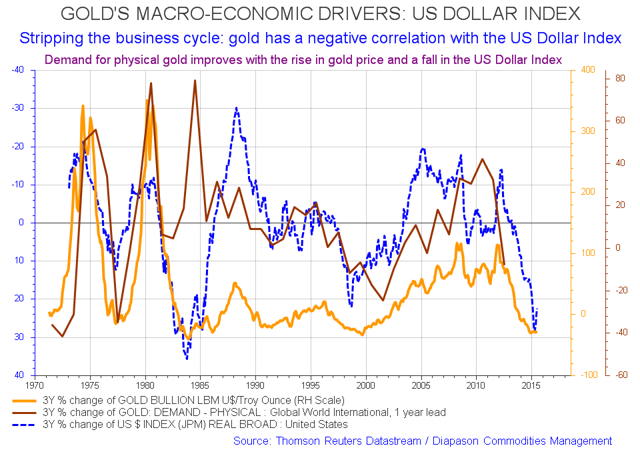

4. The U.S. dollar is negatively correlated with Gold (see chart below)…This relationship supports the arguments that changes in the U.S. dollar valuation are negatively correlated with Global GDP growth.

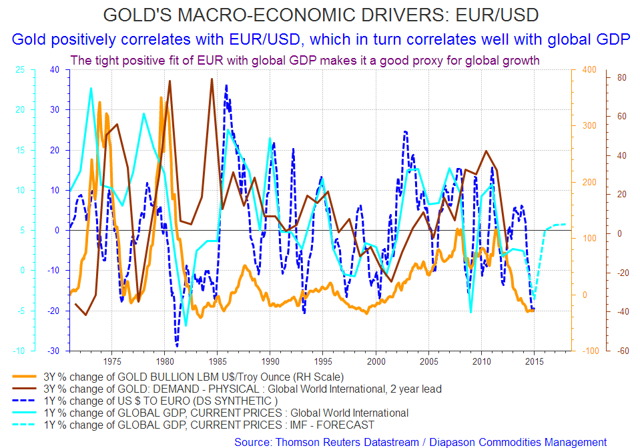

5. Because the U.S. dollar is negatively correlated with gold; gold is therefore positively correlated with EUR/USD and, also, the EUR has a very tight positive fit with global GDP. The relationship between the EUR and global GDP is so good that I tend to use EUR as a real-time proxy for global GDP (see chart below). The final link: the U.S. dollar’s negative correlation with Global GDP.

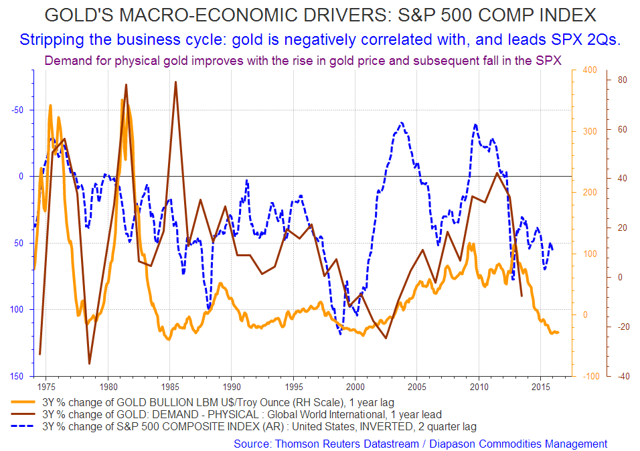

6. Gold prices are negatively correlated with the S&P 500 Composite Index. That is important from a portfolio hedging and diversification point of view. Even more importantly, changes in gold prices tend to lead changes in the SPX by 2 quarters (see chart below), enhancing its hedging and diversification properties.

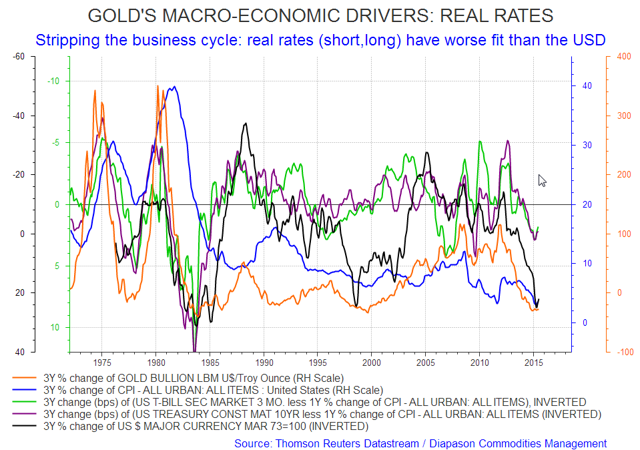

7. Real rate as a mover of gold prices is over-rated as illustrated in the chart below. Real rate, or its inverse, is after all led by the evolution of CPI inflation, which is the subtrahend in real rate derivation. It is more useful to track the U.S. dollar (or the EUR) in looking for clues as to the direction of gold prices.

8. Inflation and short-term rates are arguably positively correlated with gold. (Rising inflation, with a rising FFR, is doubly good for gold prices.) It has been in the past, and there has never been an instance (since 1950), that gold has negatively correlated with the FFR or CPI.

9. Then, there’s the China connection and there are obvious links between gold prices and:

- China’s FX and Gold Reserves,

- its Treasury Holdings,

- inflows and outflows of Foreign Direct Investments (FDI),

- the local currency CNY,

- China’s external trade and

- the PBoC’s balance sheet.

- In addition, if you understand how Chinese commercial bank assets are going to evolve over time, then you have advance knowledge of how gold prices will likely evolve over time as well.

- Also, it may help to watch how China’s FX policy unfolds over time – major economic policy shifts will get reflected in the changes in the FX policy first.

The devil in the details is how to isolate and validate those relationships or linkages, considering the dearth (and the poor quality) of information coming from China. [The original article* (access HERE) explains in detail the above-mentioned relationships and you are encouraged to access the article if you are so interested.]

10. It is futile to use gold’s demand-supply linkages to forecast the future price of gold, as the changes in price predates the changes in the demand-supply variables. The only “fundamental” variable that has a valid forecasting property is mine production. [For more a detailed explanation please visit the original article* HERE.]

*http://seekingalpha.com/article/3369275-making-sense-of-golds-fundamentals-and-future-prospects-a-case-study-in-graphics?ifp=0 and http://www.diapason-cm.ch/Mop/Site/main.php?module=mop.website.insightweekly&ID=-380

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money