If our future is one of high inflation, then whether and how you deal with inflation taxes may be one of the biggest determinants of your personal standard of living for decades to come.

Why? Because government fiscal policy destroys the value of our dollars and government tax policy does not recognize what government fiscal policy does, and this blindness to inflation means that attempts to keep up with inflation generate very real – and whopping – tax payments, on what is from an economic perspective, imaginary income.

Let me illustrate that fact with three examples and suggest some remedial measures.

So says Daniel R. Amerman, CFA (www.danielamerman.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Amerman goes on to say, in part:

A time of severe monetary crisis could be the most dangerous time in our lifetimes to be uninformed [and those] investors who are unaware of this profoundly unfair tax, or who choose to ignore it,…[will] become helpless victims of the government. When investors become aware of perhaps the number one danger to long term precious metals investment, and adapt their strategies to deal with this danger – then they can unlock the true investment power of gold during times of currency crisis and turn potential $10,000…an ounce gold prices into the once-in-several-generation wealth creation opportunities that they should be.

Illustration #1: $2,000 An Ounce Gold

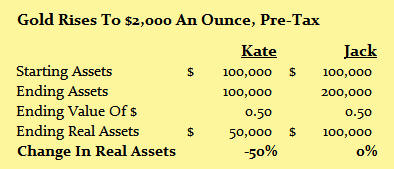

In the first step of our illustration, we will consider a situation and how it affects the life savings of two investors. [In this] situation… 50% of the value of the dollar gets destroyed by inflation. This is not a radical assumption [because] with modern…fiat currencies the value of money is always destroyed by inflation. The only question is one of speed. If we look at the United States, 80% of the value of the dollar was destroyed by inflation between 1972 and 2007 as measured by official government statistics. For this illustration we will assume there is a smaller loss in value of the dollar, but that it happens much faster – because the U.S. is in much worse shape right now than it was in 1972 in some key ways.

Kate is well educated, keeps up with the newspapers, and is concerned that the global financial crisis may get worse. [As such,] she liquidates her riskier investments, and to play it “safe”, moves her money into a $100,000 money market account.

For our illustration we will assume Kate’s money is safe – but the value of her money is not protected. Inflation destroys 50% of the value of the dollar. Kate still has her full $100,000, but it will now only buy what $50,000 used to. Kate has lost 50% of the value of her investments to inflation (for simplicity, we’re leaving out assumptions on interim money market interest payments).

Jack also reads the mainstream media, but reads more widely as well, and believes that high inflation is the logical outcome of the financial crisis. Jack, therefore, takes his $100,000 and buys 100 ounces of gold at $1,000 an ounce (using round numbers for ease of illustration).

We will assume that gold performs exactly like many investors hope it will, that is, it acts like “real” money and maintains its purchasing power in inflation-adjusted terms. Now, if the dollar is only worth half of what it used to be, and gold does maintain its purchasing power, there is only one way for gold to do so, and that is for gold to sell for twice the number of dollars per ounce than it did before. Therefore, gold goes from $1,000 an ounce to $2,000 an ounce. Those dollars are only worth fifty cents (in today’s terms), so we multiply $2,000 times 50%, and we end up with $1,000. Jack’s 100 ounces of gold at $2,000 each will buy exactly same amount of real consumption, of real goods and services, as gold used to buy for him at $1,000 an ounce. Some would say that this is an example of a perfectly successful inflation hedge, where gold has performed exactly like it is supposed to.

The powerful advantages of having your money in an inflation hedge when entering a period of substantial inflation, can be seen in the chart below, which compares what happened with Jack and Kate.

By placing her money in what is conventionally considered one of the safest possible investments, during a time of high inflation, Kate has lost 50% of her net worth…yet, when it comes time to fill in her tax return she starts with $100,000 in her money market fund and ends with $100,000 in principal in her money market fund, as far as the government is concerned, there is no loss to be deducted. Kate still has every dollar she started with.

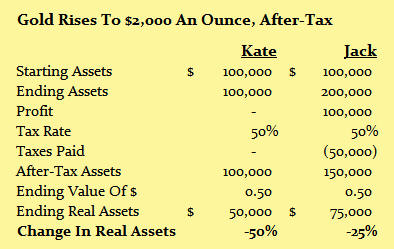

Jack decides to lock in his gains by selling his gold investment…When it comes time for Jack to fill in his tax return, it shows that he bought his gold for $100,000 and he sold it for $200,000, thereby generating a $100,000 profit. Effectively, the government looks at Jack’s having dodged the destruction of the value of the nation’s money, and says “Great move Jack, you made a lot of money! Now give us our share.”

In bullion form gold is currently taxed as a “collectible” in the U.S., with a 28% capital gains tax rate, or almost twice the long-term capital gains tax rate on investments that the financial industry and government prefer. We’ll call it 30% to allow for some state capital gains taxes, and to keep the numbers round. However, this rate is not sufficient to cover government spending as… [all the various levels of government federal, state and municipalities are] currently running enormous deficits [and, as such,] it is reasonable to expect potentially much higher taxes in the not-too-distant future, both in the U.S. and other nations. For illustration purposes then, we will assume a 50% future combined capital gains tax rate on gold – which is not unrealistically high from a historical perspective.

So for Jack, as shown in the chart below, paying a 50% tax rate on $100,000 in profits means $50,000 in required tax payments, and subtracting those taxes leaves Jack with $150,000.

Our final step is to adjust for a dollar being worth 50 cents, so we multiply $150,000 by 50%, and we find that Jack’s net worth after-inflation and after-tax has fallen to $75,000. When it comes to what matters, the purchasing power of what our money will buy for us, then Jack didn’t double his money, instead he lost a quarter of what he started with. Jack just encountered inflation taxes – and they ran him over.

Turning Gold Into Lead

From a gold investor’s perspective, $2,000 an ounce gold may seem like a dream come true and when we look at the results, $100,000 turning into $200,000, gold does look like a great investment [- that is] until we remember that the reason gold went to $2,000 an ounce was because of inflation and [when] we adjust our investment results for inflation, we [only] break even. [That being said,] while not a net improvement relative to today, this outcome is highly desirable compared to what happened to Kate. Gold did indeed act as “real money”.

Unfortunately, we then run into one of the most deeply unfair and little understood aspects of inflation and investing in anticipation of inflation.

- Government fiscal policy destroys the value of our dollars

- Government tax policy does not recognize what government fiscal policy does

- Government blindness to inflation means that attempts to keep up with inflation generate very real and whopping tax payments, on what is from an economic perspective, imaginary income

- These inflation taxes turn gold from a shimmering dream to a lead weight around one’s neck, and mean even a successful inflation hedge can lead to a devastating loss in net worth in after-tax and after-inflation terms.

Illustration #2: $5,000 An Ounce Gold

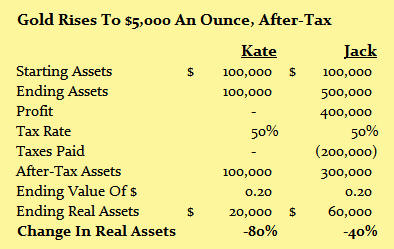

What if gold goes much higher than $2,000 an ounce? What if the dollar falls in value to twenty cents, and we assume that gold again performs as a perfect inflation hedge, and keeps its value? If the dollar drops to 1/5 its value, then the only way gold can keep up is to rise to 5X the dollar price, which means $5,000 an ounce gold.

First let’s take a quick look at Kate. She still has $100,000 in her money market account, each of those dollars are now worth twenty cents, and the real value of Kate’s “safe” investment is now down to $20,000. Kate has taken an 80% hit to the purchasing power of her net worth.

Meanwhile, Jack has enjoyed some fantastic investment results from his investment acumen. With 100 ounces of gold at $5,000 an ounce, Jack is now half way to being a millionaire! Jack is ecstatic, at least until he tries to spend some of that half million dollars, and finds out what it will buy for him after he has paid his taxes.

Let’s repeat our chart from above, but with gold at $5,000 an ounce. When it’s time to file his tax return, Jack now has a $400,000 profit to report. Jack therefore has to write the government a check for $200,000 for taxes due, leaving him with $300,000.

When we adjust for a dollar being worth twenty cents, then Jack’s real after-inflation and after-tax net worth, what he can buy in today’s dollar terms after paying the government, is down to $60,000.

The difference between gold going to $5,000 an ounce, and gold going to $2,000 an ounce, is that Jack loses more of his real net worth. Jack loses 40% of the purchasing power of his net worth at $5,000 an ounce instead of 25%. The lead weight of inflation taxes is still around Jack’s neck, heavier than ever…

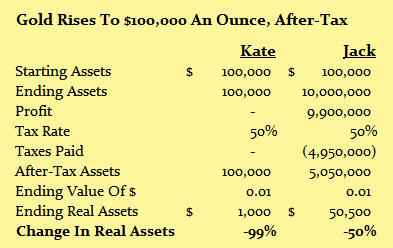

Illustration #3: $100,000 An Ounce Gold

Let’s explore what happens if there is hyperinflation and a dollar becomes worth a penny. For Kate, the situation becomes even bleaker as the $100,000 in her money market account will now only buy what $1,000 used to. Kate has lost 99% of her net worth to inflation. Instead of a comfortable nest egg for retirement, she is impoverished, as are the many millions of others who were not prepared for hyperinflation.

If gold (or silver) serves as “real money”, and maintains its purchasing power even as paper money collapses, then to offset a dollar becoming worth 1/100th of what it used to, gold must climb to a dollar value that is 100X greater than what it was. [Therefore,] gold must go to $100,000 an ounce in order to maintain the same purchasing power as $1,000 an ounce gold today. Once again, we’re assuming that gold acts as a perfect inflation hedge.

Jack’s 100 ounces of gold are now worth a cool $10 million! Jack decides to sell his gold locking in his $9.9 million in profits, as illustrated below, then the government looks at his profit and demands its $4,950,000 share. This still leaves Jack a millionaire multiple times over, as he has $5,050,000 in after-tax proceeds until we adjust for that technicality of a dollar only being worth a penny and [then] we find that instead of entering the ranks of the ultra-wealthy, Jack’s net worth on an after-tax and after-inflation basis has fallen by almost 50%, from $100,000 to $50,500.

Jack has made one of the most brilliant market timing moves of all time but the end result is that he loses almost half of his starting net worth in purchasing power terms. What’s going on?

What’s Wrong Here?

Something seems seriously, seriously wrong here. Jack bets his net worth that inflation will skyrocket, and he buys an inflation hedge in the form of gold. His prediction comes true, a high rate of inflation does occur, and his gold investment does perform as a perfect inflation hedge. Yet the ending bottom-line is that Jack loses a big chunk of the value of his starting net worth, and the better that the gold performs and the more spectacular his returns, the bigger the chunk of his real net worth that Jack loses.

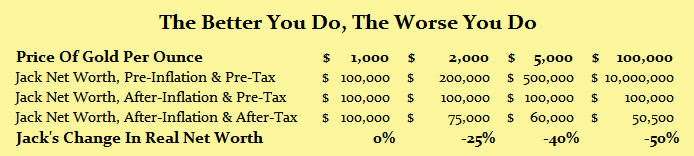

This relationship is summarized in the chart below. When Jack earns a 100% profit — he loses 25% of his net worth. When Jack earns a 400% profit — he loses 40% of his net worth. When Jack earns a 9900% profit — he loses 50% of his net worth. [Get the picture? The more profit he generates, the more net profit he loses!]

Inflation Taxes: A Pervasive & Difficult Problem

Inflation taxes are a basic fact of life which investors pay every year when there is inflation. These taxes are entirely real and are deeply painful when we look at the world in terms of what really matters – which is not the dollar amount of our savings, but what our savings will buy for us.

Real as they are, however, inflation taxes are not a line item on our tax returns. There’s no box that we check that says go to form “30236 IT” to calculate our inflation taxes. There is no check we write that’s specifically made out to inflation taxes. There’s never any discussion in the newspapers or magazines about how much money the average investor pays every year in inflation taxes... but inflation taxes are irrefutable.

Whenever you look at investment results on an after-tax and after-inflation basis in an environment of inflation, then inflation taxes make their ugly appearance. However, while our illustration of Jack and Kate was not all that complicated to follow, the numbers involved are just sophisticated enough where they are rarely acknowledged in conventional personal finance. That combination of just a slight bit of sophistication, while never explicitly appearing on a tax return, means that likely in excess of 99% of the general population is blissfully unaware of inflation taxes and, as such, represents a major opportunity for governments…even if the average senator, representative or member of parliament has no better understanding than the general public.

Indeed…when we take inflation taxes into account, then the real tax rate on investments in the U.S. has historically been about 256% higher than the statutory rates.

History is bad enough, but as we illustrated with Jack and Kate, the higher the rate of inflation – the worse inflation taxes get. Staying ahead of inflation is hard enough but even trying to tread water, to stay even with inflation, becomes extremely difficult when you have the lead weight of inflation taxes around your neck, pulling you down. The higher the rate of inflation, the heavier the weight of inflation taxes and the more difficult they are to overcome…

Reversing Inflation Taxes & Creating Wealth

There are two very sad aspects to what we covered in this article.

- Unlike most of their peers, millions of responsible, knowledgeable people are seeing through the soothing, complacent illusions created by the government and Wall Street. They understand the grave threat to the value of their money and their investments. They are moving to the real tangible protection of gold and other precious metals. Unfortunately, in the process, they are setting themselves up for victim status as illustrated in this article. Yes, the “Jacks” of the world are likely to do far, far better than the “Kates”, but despite the dizzying numbers involved with how high gold can go with a truly high rate of inflation — when we look to what our investments will buy for us after we’ve paid our taxes, our status is still that of a victim.

- The other sad aspect is that this simply doesn’t have to be. There are two things that gold does spectacularly well during times of financial and monetary crisis. Using these properties of gold, with a monetary crisis of historic proportions, a gold investor can come to the crisis not just with their net worth intact but possibly even having built wealth on a multi-generational scale…

Let gold do what gold does best. Let gold provide safety and security for you. Unleash the wealth creating abilities of gold during peak inflation to multiply your real wealth – but don’t rely on gold as an inflation hedge and don’t ignore inflation taxes.

To have a chance of beating inflation taxes, we not only have to realize they exist, but we need to thoroughly understand our opponent. Our opponent is an enormously powerful government that is deliberately blind to the effects of inflation. Government fiscal policy destroys the value of our money. Government tax policy is officially blind to inflation so a crushing hidden tax is created that keeps us from maintaining the purchasing power of our savings, with our attempts to survive the deadly effects of inflation merely acting to increase government tax revenues. [Read Stealth Taxation in the Form of Financial Repression is Coming! Here’s Why – and How]

Conclusion

The key to prospering in a world of inflation taxes is to understand that regardless of its strength, a blind opponent is ultimately a weak opponent.

Through careful study, and by focusing very closely on the intersection between taxes, net worth and inflation, we can discover how to turn inflation into gains in real wealth, to which the government is entirely blind. We can learn to reverse inflation taxes, so that instead of paying real taxes on imaginary gains, we are paying imaginary taxes on real gains [which would be] entirely legal – with every cent of taxes due paid in full – because remember, inflation taxes don’t appear on your tax return, and neither does their reversal!

*http://danielamerman.com/articles/GoldTaxes1.htm

Disagree? Concur? Have your say on the subject via:

We’d like to know what you have to say.

Related Articles:

Do we really honest-to-God no-fingers-crossed cherry-on-top believe that the powers-that-be will simply allow us to mosey up to the cashiers cage and redeem or convert our Gold for whatever monetary unit reigns supreme or is created [should our current financial system and currencies collapse? As such,] IF there comes a time when the best move forward is to sell most of our Gold and switch to another asset class, one more likely to survive the transition intact, will we be able to see this as obvious and a no brainer? [Let me explain what could well happen and the effect such a development would have on all things Gold.] Words: 303

2. Internationalize to Keep Your Assets Safe From Your Out-of-control Government – Here’s How

The politicians will do whatever they find convenient, because there is no longer anything to stop them – not an electorate that is jealous of its freedoms and certainly not the Constitution, which is now just a playhouse for judicial imagineering. No one can know what’s coming next from the government and the financial system it has fostered, but for many of us there is an awful suspicion that we are not going to like it. Most Americans still have yet to stick a single financial toe across the border, but more and more are considering it [and in this article I outline 10 ways to internationalize your assets to provide you with some much needed protection as the future unfolds.] Words: 3923

3. Where Is This Unprecedented Global Financial Crisis Headed? A Retrospective from Alf Field

Everyone must be wondering where this “unprecedented global financial crisis”, (the World Bank’s words), is heading. What follows, for what they are worth, are my cogitations on this crisis. Words: 1641

4. The U.S. is Headed Toward a Complete and Utter Collapse of its Financial System

The U.S. is headed inexorably toward a systemic failure, a complete and utter collapse of the financial system. TARP and all the other machinations have not improved the underlying insolvency of the banking system. They have, however, deferred a collapse and ensured that it will ultimately be worse. [Let me explain.] Words: 1385

5. Stealth Taxation in the Form of Financial Repression is Coming! Here’s Why – and How

Financial Repression is a form of wealth confiscation and redistribution that is in some ways as effective as taxation – but the government never directly calls it that. It never appears in the budget (directly), and while it is dependent on a comprehensive network of laws and regulations – none of those go through the legislature with a stated intention of creating Financial Repression. So while the economic net effects are similar to a huge and comprehensive set of investor taxes being used to pay down the national debt, the “taxes” are never a campaign issue because voters and investors don’t understand what is happening – they only feel the results. [In this article I lay out for you what is slowly developing and expected to escalate dramatically in the next few years.] Words: 5800

6. Another Economic Collapse and Great Depression are Coming! Here’s Why

It really is hard to find the words to describe the true horror of the national debt of the U.S. The U.S. government has been on the greatest debt binge in all of human history, and a day of reckoning is coming that is going to be so painful that it is going to shock America to the core. We have lived so far above our means for so long that none of us really has any concept of what “normal” is like anymore. The United States has enjoyed the greatest party in the history of the world, but now this decades-old party is ending and the bills are coming due. Our current system is headed for an inevitable collapse. There is no way of getting around it – a horrific economic collapse is coming [and] it is going to change the world. You better get ready. [Let me explain further.] Words: 1771

7. Alf Field’s 7 “D’s” of the Developing Disaster Revisited

When the supply of something is increased sharply relative to demand, the value of that commodity will decline. If the supply continues to increase rapidly and indefinitely, then that item will become worth less and less, with the potential to finally become nearly worthless. This is the Developing Disaster facing the US Dollar and the world. This is the factor that could become the single most important criterion in investment allocation decisions and possibly even for individual financial survival…[Let me explain this further by reviewing the 7 major problems facing the U.S. (and thus the world) and how they all will lead to problem #7 – devolution.] Words: 1520

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money