The above introductory comments are edited excerpts from an article* by

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Singarella goes on to say in further edited excerpts:

I decided to use the 2008 financial crisis for this analysis because the impact was far more broad than any other crisis since the crash in 1929. The financial crisis started in August 2007 and I chose to use June 2009 as the end date. This gives enough room for the entire crisis to have passed, but not allowing the recovery to have a major impact on the analysis.

It can be somewhat hard to define exactly what it means for something to be a hedge against a financial crisis…[but] as I see it, the asset needs to:

- at least retain its value during the crisis,

- preferably increase in value to some extent…[and]

- exhibit a premium that is unexplained by normal factors, or, barring that, the hedge should prove to be less volatile than the underlying factors. What I mean by “underlying factors” will become more clear later in the analysis.

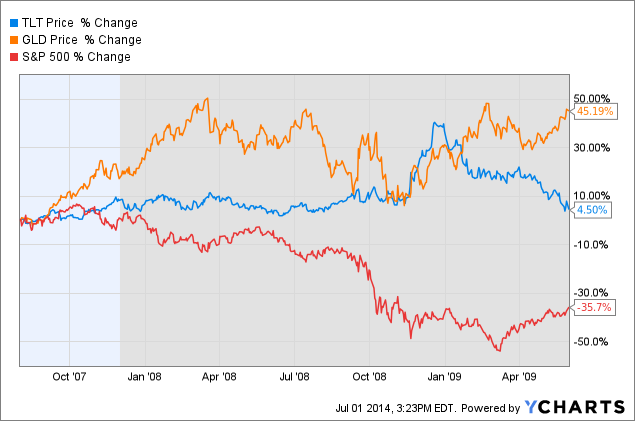

The chart below shows the relative performance differences between the S&P 500 (GSPC), Treasuries (TLT), and gold (GLD).

The stock market hit its lowest point in March of 2009, down more than 50%.

- Both GLD and TLT remained above the breakeven point for the entire period.

- GLD finished the period with the greatest gain by a considerable margin compared to TLT.

Now, TLT holds long dated Treasuries (20+ years), so it’s easy to see that the corresponding yields were falling as the prices of the bonds increased. However, of the various interest rates, GLD shows a particularly strong relationship with the 10-Year Treasury rate (TNX).

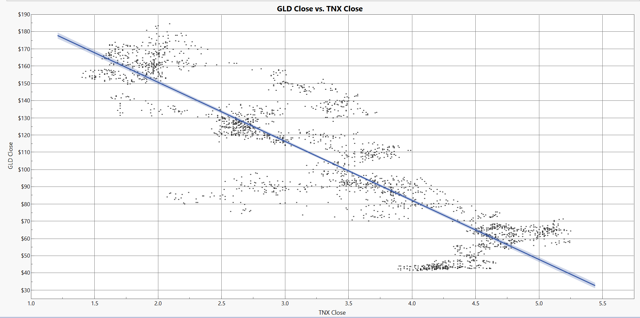

The plot below shows the relationship between GLD and TNX

This would be a good time to point out that I have a reason for using GLD rather than the actual price of gold. In short, some of my research on this matter indicates that:

- GLD could be responsible for a meaningful change in the way gold is traded…

- the connection between gold and inflation has been very weak for the entire time GLD has existed (since late 2004)…

Source: Data by Yahoo Finance for GLD and TNX.

It makes sense that there is a negative relationship between GLD and TNX because GLD has no yield. This is important because interest rates were falling during the crisis. Looking for a linear fit for the two variables yields the prediction equation: GLD = 219.24-34.28*(TNX) with R2=0.7717. Note, TNX is quoted in 100*0.01% (i.e., TNX=3.5—>3.5%; this formula assumes you’re using 3.5 not 0.035). This gives a simple model for estimating what the value of GLD should be given a particular interest rate. I used the model to assess the performance of GLD during the crisis relative to what would be expected.

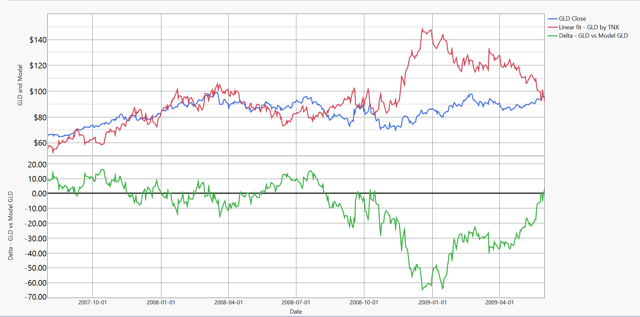

The chart below shows an overlay of the predicted value of GLD and the expected value of GLD from the model

The bottom chart shows the nominal difference between the two: GLD – model value.

Source: Data by Yahoo Finance. Model as specified above.

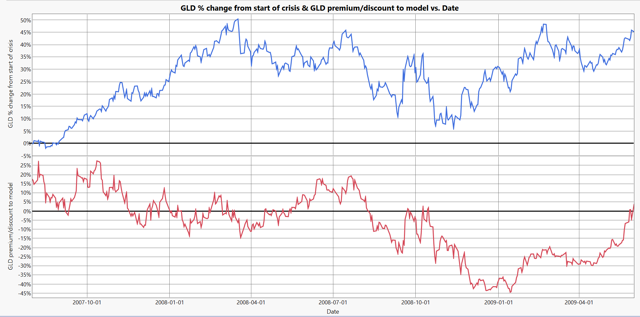

Using the model, I calculated the premium/discount of GLD vs. the model as shown below. The blue line shows the actual percentage change of GLD during the crisis. The red line is the premium/discount percentage vs. the model. This is the heart of my overall argument that gold does not effectively hedge against a financial crisis.

Source: Data by Yahoo Finance. This is simply a transformation of the first chart above.

- GLD did increase in value, as would be expected if it were a hedge, BUT the increase can be more than be accounted for by interest rates.

- GLD had a steadily decreasing premium vs. the model during the worst parts of the crisis which suggests that GLD was undervalued for the second half of the crisis period.

- GLD exhibited considerable volatility during that period relative to TLT…

Considering all of the analysis above, I have concluded that gold is not an effective hedge (as I defined it) against a financial crisis because:

- TLT peaked first and then slowly started to drift down as the markets began to move past the crisis.

- GLD continued to rise even as the crisis was coming to a close and would rise further after the crisis.

All of the evidence points to the rise in gold not being a result of it being a hedge against crisis (or a safe haven if you prefer the term) but as a result of interest rates which makes TLT a better choice than gold itself….

Counterpoints:

Now, before anyone loses their mind, I’ll point out a few counterpoints to my argument (believe it or not, I’m not in love with my own ideas and more than happy to accept counterarguments).

- This is a bit of single variable analysis. While the overall model seems to have a high correlation, that’s not the same thing as causation. To pin the price of gold to a single factor is pushing it. In fact, I didn’t want to only use single variable analysis in the first place (see next point).

- The crisis caused the usual relationships to stop working. There is very little I can do about that fact, no matter what the analysis is. It can be argued that the relationship between GLD and TNX just doesn’t hold in that environment or that other factors become more important.

- The next crisis will likely be different than any crisis that has come before…[so] it’s hard to see how anything can be considered a hedge against such a crisis. We cannot know the nature of a crisis in advance, so is it impossible to hedge against [it]…

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

1. What Could Possibly Be A Better Safe Haven Than Gold? Read On

Some market commentators are touting gold as a great portfolio diversifier, convincing investors that the precious metal could benefit their portfolio but there may be better alternatives than gold if the motivation is to find a hedge for economic uncertainty or political unrest. Read More »

2. Careful! Gold’s Performance in Times of Crisis Often Not As Expected

We can devise logical scenarios as to what the price of gold should or should not do, but gold doesn’t always follow the plan. To paraphrase an old Jewish saying: “Man plans. Gold laughs.” Read More »

3. Eric Janszen – Part 1: Is Gold a Good Hedge?

For the decade that began in the year 2000 the gold bug hypothesis was the right one: stocks, bonds, and real estate did, net of asset price inflation and deflation, performed worse and with higher volatility than the barbarous relic. Words: 401 Read More »

4. Gold is NOT a Perfect Inflation Hedge! Here’s Why

Almost any traditional inflation hedge [such as gold, silver as well as real estate, stocks or whatever,] has difficulty in reaching the break-even point on an after-inflation and after-tax basis when we take into account the pervasive problem of hidden “inflation taxes”…If our future is one of high inflation, then whether and how you deal with inflation taxes may be one of the biggest determinants of your personal standard of living for decades to come… Why? Because government fiscal policy destroys the value of our dollars and government tax policy does not recognize what government fiscal policy does, and this blindness to inflation means that attempts to keep up with inflation generate very real and whopping tax payments, on what is from an economic perspective, imaginary income. [Let me illustrate that fact with three examples and suggest some remedial measures.] Words: 3085 Read More »

5. 10 Myths That Suggest Gold Supposedly Has a Bright Future

…Hype, fear and outdated monetary theories simply aren’t enough to support the price of gold. Every finance and economics text book teaches that gold is basically an inflation hedge, and without inflation gold is simply a useless piece of yellow metal. Either the gold bugs are right or the Fed is right, and my money is on the Fed. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money