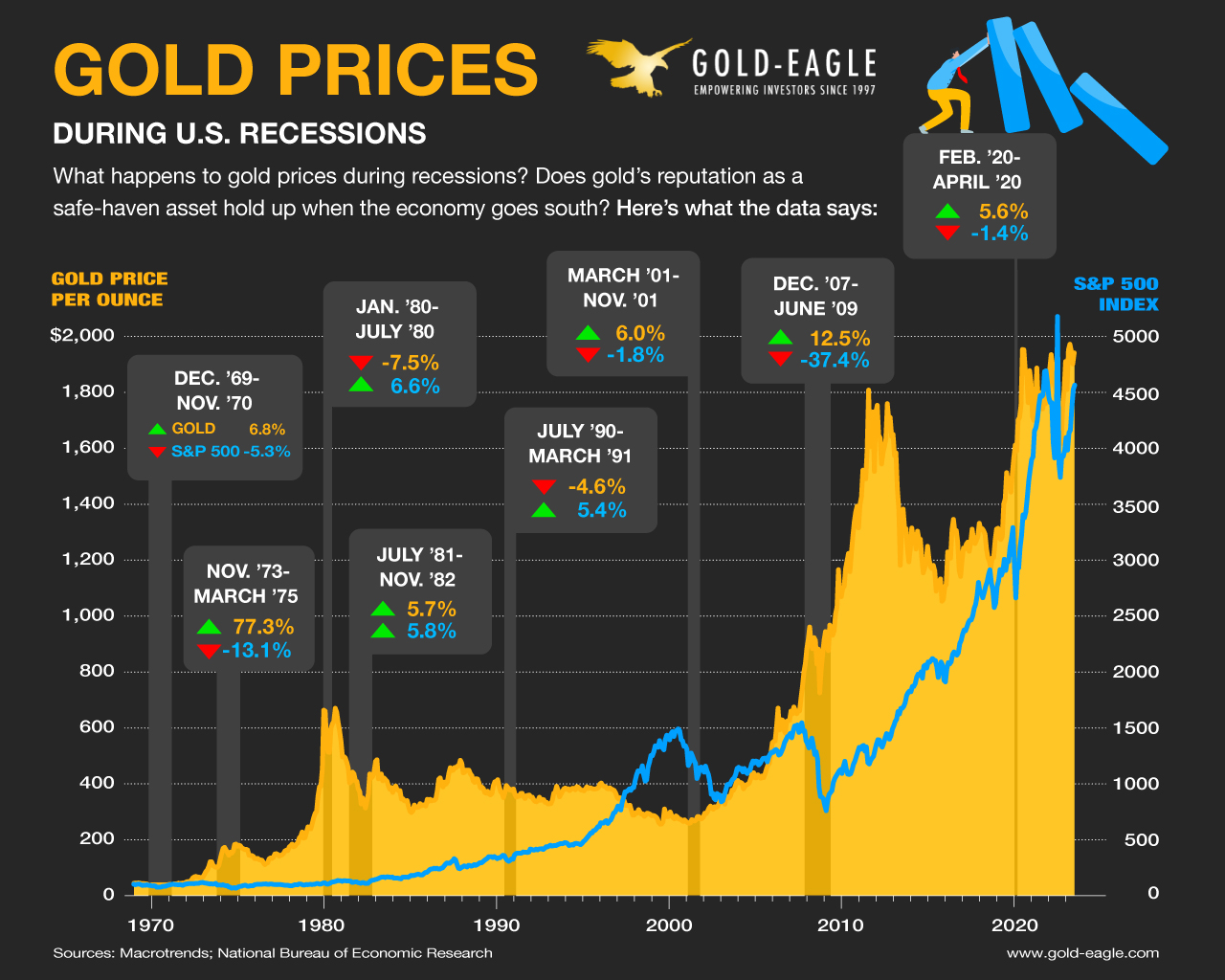

Gold has a long held reputation as a hedge against an uncertain or failing economy but does having gold in your investment portfolio provide meaningful protection during a recession? We decided to dig into the data for a definitive answer and present below an infographic that shows the eight U.S. recessions since 1970 along with S&P 500 data (a proxy for the stock market) with the performance of gold prices that provides a clear answer.

This post is an abridged version of the original article originally posted on gold-eagle.com.

Gold’s best performance occurred during the sixteen month Oil Shock Recession (November 1973 – March 1975). Oil prices quadrupled, inflation rose to double digits, and growth stagnated i.e. stagflation. The S&P 500 dropped 13% during this time but gold prices soared over 77%!

Gold’s worst performance was during the six month Energy Crisis recession of 1980 where it experienced a 7.5% decrease. This recession was triggered by record energy prices and huge interest rate hikes by Fed Chairman Volcker to tame inflation. Gold prices often have an inverse relationship with interest rates and this was a prime example. To put more context into this time period, just prior to the beginning of the 1980 recession gold experienced its largest bull market where it soared an astonishing 2,300% from its 1970 low.

Looking at the average percent change of all 8 US recessions the value of having gold in your investment portfolio as a hedge against a troubled economy becomes clear: while the S&P 500 declined an average of 5.2%, gold increased an average of 12.7%.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money