Diversification among natural resources is vital because there’s always an ebb and flow of commodities, both seasonal and cyclical and, as such, it is important to anticipate these global trends to know how to participate. [Let me explain.] Words: 528

and flow of commodities, both seasonal and cyclical and, as such, it is important to anticipate these global trends to know how to participate. [Let me explain.] Words: 528

So says Frank Holmes (www.usfunds.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Holmes goes on to say, in part:

Among investors these days, a fellow commodity bull is about as rare as finding a positive story in the media, especially when you look at the results of metals and natural resources during the first half of 2012. Only four commodities on our periodic table pulled off a positive return.

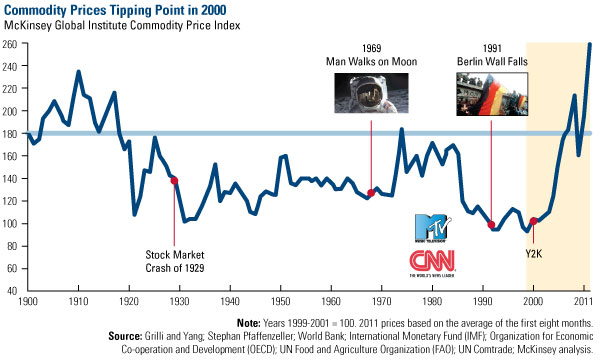

Fears of slowing global growth and how it will affect commodities have caused many investors to dig their heels in the ground and resist owning natural resources….During a natural resources conference, Jeremy Grantham of GMO pounded the table for an investment in resources….His argument focused on the swelling population in China, and the fact that the world has experienced a “great paradigm shift” around 2000, when commodity prices, which were negative for decades, “abruptly reversed course.” He told the crowd, “in the long run, you can’t afford to miss this opportunity.” We agree.

Take Note:

As you can see on McKinsey & Company’s chart below, the past decade shows a clear tipping point for resources….

Tremendous population growth, changes in government policies, development of new technologies, urbanization trends…is what Grantham called “the great paradigm shift” and they have equally dramatic effects on how we invest in commodities, change opportunities and adjust for risk.

Smart investors look past the rampant negativity in the media to see these patterns and anomalies to determine where the opportunities and threats lie. [For example,] Americans can see how shale gas technology has changed the dynamics of oil and natural gas.

The chart [below] from the U.S. Energy Information Administration’s Annual Energy Outlook 2012 shows how consumption of petroleum and other liquids in the U.S. have significantly changed while production has been rising.

- Consumption rose throughout the 1980s until about 2005, when it dropped off. Meanwhile domestic production was declining.

- Between 2005 and 2010, a significant change happened: consumption dropped, then leveled off and the rate of production shifted higher.

- The EIA estimates that because of these shifts, net imports will decrease to 36 percent in 2035 from about 49 percent today….

Similar to higher production in the U.S., Iraq production is on the rise, Libya supply is climbing and demand remains tepid. Morgan Stanley Commodity Research believes that the “path of least resistance for oil is down” estimating that OPEC spare capacity at the end of 2011 and into 2012 to be around 4 million barrels per day with a global consumption level estimated at 89 million barrels each day. This compares to today’s spare capacity of around 2 million barrels each day. “If OPEC production continues at today’s levels, stocks would build above normal through 3Q and supply would outstrip demand in 2012,” says Morgan Stanley.

This is why diversification among natural resources is vital. Because there’s always an ebb and flow of commodities, both seasonal and cyclical, it’s important to anticipate these global trends to know how to participate….The key is to adapt to external elements like the way oil production adapts to excess supply….

*http://www.usfunds.com/investor-resources/investor-alert/looking-past-negativity-to-see-opportunity/ (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money