We’ve reached a point in which the odds for further gains in the stock market are smaller than the odds to start losing money. Here are 10 warning signs why I believe that currently the risk is (far) greater than the reward!

The above edited excerpts and the copy below comes from an article* by The Fortune Teller originally entitled 10 Warning Signs Regarding Equities That Investors Shouldn’t Ignore which can be read in its entirety HERE.

While equities may keep going higher my claim is very simple: We’ve reached a point in which the odds for further gains are smaller than the odds to start losing money. I see 10 warning signs that I believe currently suggest that the risk is (far) greater than the reward!

- The current valuation of the S&P500 index points to a circa 70% (!) probability for a minimum 10% correction soon enough.

- The S&P500 index hasn’t gone through a 10% correction since 3rd October, 2011. This is the third longest-ever period in the index history without experiencing such a correction.

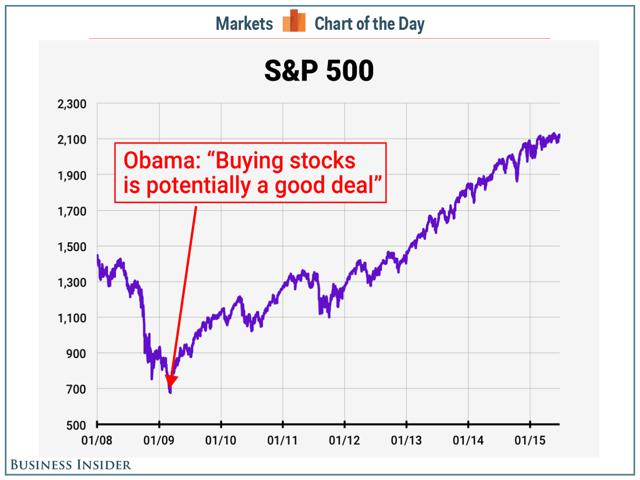

- Since the trough (9th March 2009) to the recent peak, the S&P500 has gained 220%. That’s over six years of almost non-stop increase, or about 21.4% compound per annum.

- It’s been 9 consecutive weeks for the S&P500 not moving (on an end-of-week pricing basis) more than 1%, up or down. This hasn’t happened for 21 years (!) until last (short due to July 4th) week…

- The S&P500 index is trading within a range of 2040-2135 over the past five months. Until this week, volatility has been shrinking steadily and set at record lows last week. Eventually, we will see a breakthrough – up (over 2135) or down (sub 2040). All technical accepted indicators point out that the “sub” is more likely than the “over”.

- It’s been 23 consecutive weeks that money goes out of domestic equity mutual funds.

- The S&P500 hasn’t made a daily move (on an end-of-day pricing basis) of more than 2% for 144 days, something that hasn’t happened at all (anytime) since February 2007 and during the first half of any year since the first half of 2005.

- In order not to lose what is left (if anything) of its credibility, the Federal Reserve will most probably raise interest rates at its September meeting. How much it will be (the first hike) and at what pace (after that) won’t change the fact that the “zero interest rate” era is coming to an end. That’s never good for stock markets and the higher the cost of money – the worse.

- Looking at the S&P500 price graph over the past two years, it’s clear that the index is running out of “fuel” (in spite of energy prices trading at record lows). Not only is that index (technically) “stuck” but it has already tried twice to break through the resistance level lying at 2135 with no success. On the other hand, should the supporting level of 2040 break down, we would most probably test the resilience of the ultimate psychological level at 2000.

- I don’t like politics and I don’t like to write about it. Nonetheless, if history taught us anything it’s that if President Obama is pointing at a certain direction – it’s safe to say that it would be wise to take the exact opposite direction at some point.

The time has come, folks, the time has come!

To conclude, it may take days, weeks, months, possibly even years, but I dare say that:

- the peak is closer than the trough (9 March 2009);

- we’re closer to the finish line (of the rally) than to the starting point.

*http://seekingalpha.com/article/3315135-10-warning-signs-regarding-equities-that-investors-shouldnt-ignore?ifp=0

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money