…[What] evidence is there that the typical investor would be better suited sticking to a defined investment plan…[as opposed to employing] a performance chasing type strategy?

The original article has been edited here for length (…) and clarity ([ ]) by munKNEE.com – A Site For Sore Eyes & Inquisitive Minds – to provide a fast & easy read.

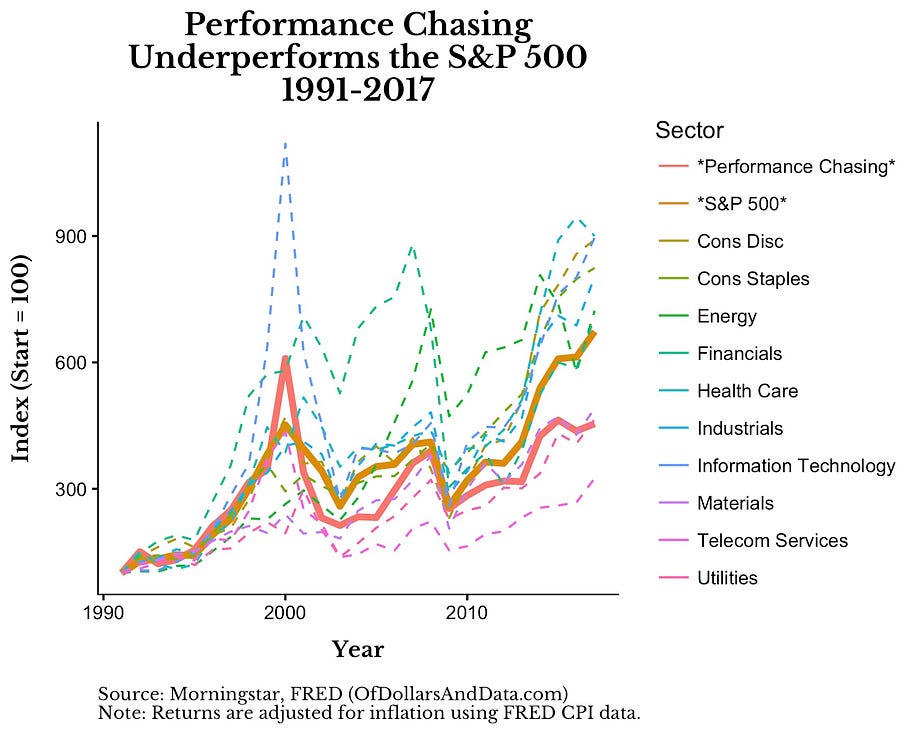

In the performance chasing strategy, you would find the best returning sector in the prior calendar year and invest in that sector in the current calendar year. For example, if “Healthcare” stocks did the best in 1990, you would put all of your money into them for 1991. If “Energy” stocks did the best in 1991, you would sell your “Healthcare” stocks and put all of your money into “Energy” stocks for 1992, and so forth.

After plotting the respective performance of each sector against the performance chasing strategy…[I determined] that the performance chasing strategy performs quite poorly.

- The strategy only beats two individual sectors from 1991–2017 and it does so with the second highest amount of risk (standard deviation) among all sectors.

(Note that the performance chasing strategy and the S&P 500 overall are plotted with larger solid lines to differentiate among the 10 dotted sector performance lines.)

As you can see [in the chart above], sticking to even one particular sector, though not ideal, would almost always have beaten out a strategy that constantly jumps around – and this is true before we take into account taxes and transaction costs, which make performance chasing even more undesirable….It is a perfect example of how investors can underperform as a result of performance chasing and not sticking to an investment plan…

The problem with sticking to most investment plans is that they are quite boring. There is no thrill in buy and holding 500+ stocks and waiting to retire. If you find this is a problem for you, I suggest taking a small percentage of your portfolio (~5%) and just betting it on the things you believe in. This will allow you to feed your “gambling instinct” without any worry of breaking the bank and ruining your future financial security.

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money