The current volatility in the precious metals market doesn’t necessarily indicate a change in secular direction. [In fact,] if today’s gold price was to rise by the same degree over the next 14 months [as it did from the beginning of 1979 into 1980, it would hit $4294/ozt. by Jan 2013! Let me explain.] Words: 420

So says Plan B Economics (www.planbeconomics.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) the article below for the sake of clarity and brevity to ensure a fast and easy read. The report’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

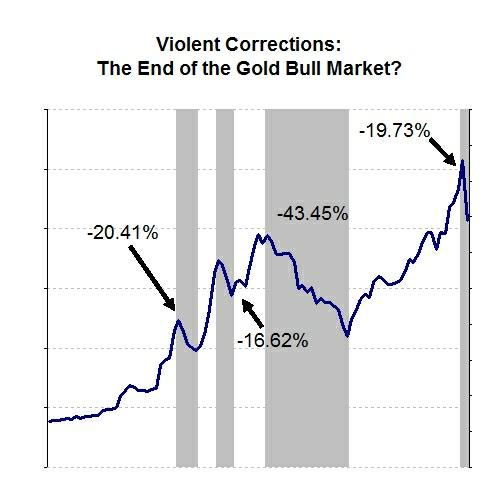

The following chart is a snapshot of gold prices during the 1970s. Between January 1971 and November 1978, gold experienced a number of whopping corrections that sent the weak hands scrambling to cash. Many levered players saw their margins decimated and called it quits…

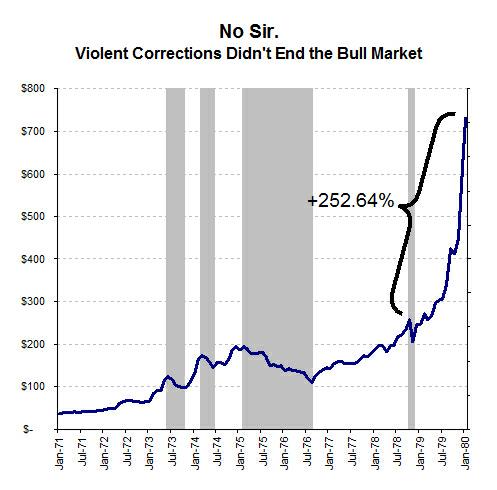

What many at the time failed to realize was that the great bull market in gold had only just begun. Below, I have extended the above chart by only 14 months to include the full extent of the 1970’s bull market (shaded correction periods remain the same to provide context). The additional data encompasses one of the greatest performances gold has ever seen (intra-month data would have yielded even better results, as it would have included the full extent of gold’s rise). The final 14 month 252% rise was the epitome of a parabolic frenzy that every investor dreams of exploiting.

Investors that bailed during one of gold’s many heart-pounding corrections entirely missed the biggest leg of the 1970’s bull market. To put this into perspective, if gold were to rise by the same degree over the next 14 months [from its recent low of $1,700/ozt.] , it would hit [$4,294/ozt.] by Jan 2013. [Using a base price of $1,750 would equate to a future parabolic peak of $4,421/ozt.]

I’m not making a prediction but what I am saying is that heightened volatility and steep corrections don’t necessarily indicate the end of a bull market. In fact, some might argue that scary volatility, by shaking out the weak longs, helps form a base from which a big bull market can rise.

*http://en-gb.facebook.com/note.php?note_id=10150383015290814

www.munKNEE.com

is for sale!

Become the editor/publisher of your very own financial site quickly, easily and inexpensively

Contact: Editor [at] munKNEE.com for details

Related Articles:

1. Gold Tsunami: on the Cusp of $3,000+?

Early this year we suggested a 50% rise in Gold to $1860 – $1,920 into mid-year. Now, we see the Gold tsunami realizing an approximate 100% rise that will crest at $3,000+ into the middle of 2012, drowning any doubters in its wake. Below are a number of factors that support that view. Words: 1250

From questions whether gold is in a bubble to predictions that soaring prices are just around the corner, one thing is clear: a new phase of awareness for gold is upon us. How far might it move before these troubling times are over? [Let’s take a close look at a variety of factors and scenarios before coming to a conclusion.] Words: 5717

3. Update of Alf Field’s Elliott Wave Theory Based Analysis of the Future Price of Gold

The Elliott Wave Theory (EW) gives superb results in predicting the gold price. [While] it is a complicated system with many difficult rules [which] I explain in simple terms in this article, [I have determined that] once this present correction in gold has been completed it should [undergo] the largest and strongest wave in the entire gold bull market. The target for this wave should be around $4,500 with only two 13% corrections on the way. [Let me explain how I came to that conclusion.] Words: 1924

4. Jeffrey Nichols: Gold to Reach $1,850 – Perhaps Even $1,923 – by Early 2012!

Since the fundamentals still point to gold’s long-term viability… why [are] investors responding by selling gold…? I was always told not to look a gift horse in the mouth… [so] take advantage of the dip. Words: 880

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money