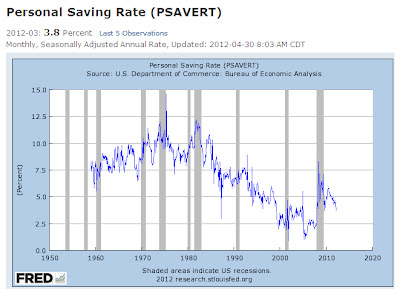

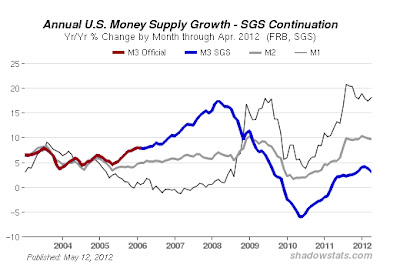

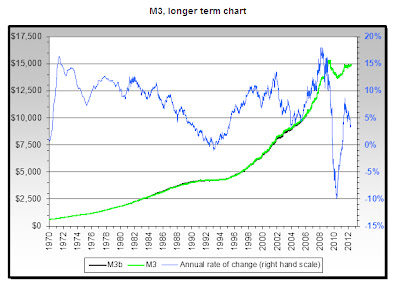

A look at the status of the economy, and in particular money supply, shows that deflation is starting to show up. Below are 7 charts that support that view. Words: 370

So says Katchum (http://katchum.blogspot.ca) in edited excerpts from his article* as posted on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Katchum goes on to say, in part:

1. Swiss government bonds (which are seen as a safe haven) are hitting new highs, with yields going as low as -0.1%. People are paying money to buy Swiss government bonds at 2 years (Chart 1).

*http://seekingalpha.com/article/614231-deflation-sets-in-hyperinflation-to-follow (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. It is VERY Important to Know Where the Inflation-Delation Pendulum Is to Invest Correctly – Do You?

Global investors are now being violently whipsawed by the decisions of central banks, as they switch between inflationary and deflationary policies. The choice governments now face is to allow a deflationary depression to finally purge the worldwide economy of its imbalances, or try to levitate real estate, equity and bond prices by printing massive quantities of their currencies.

2. Pento: Rampant Inflation Tomorrow Necessary to Avoid Deflationary Depression Today! Got Gold?

There is an all out assault on the part of global central banks to destroy their currencies in an effort to allow their respective governments to continue the practice of running humongous deficits. In fact, the developed world’s central bankers are faced with the choice of either massively monetizing Sovereign debt or to sit back and watch a deflationary depression crush global growth. Since they have so blatantly chosen to ignite inflation, it would be wise to own the correct hedges against your burning paper currencies.

3. An Inflation Inferno is Expected – but When?

Daniel Thornton, an economist at the Federal Reserve Bank of St. Louis, argues that the Fed’s policy of providing liquidity has “enormous potential to increase the money supply,” resulting in what The Wall Street Journal’s Real Time Economics blog calls “an inflation inferno.” [Personally,] I think it’s too soon to make significant changes to a portfolio based on inflation fears. Here’s why. Words: 550

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money