The next time someone says, “The U.S. is the richest country on Earth”…[correct them and] state that “The U.S. is the most bankrupt and indebted country in the history of the world” [because that’s reality. Let me explain.]

them and] state that “The U.S. is the most bankrupt and indebted country in the history of the world” [because that’s reality. Let me explain.]

The above introductory comments are edited excerpts from an article by Jeff Berwick (dollarvigilante.com) entitled The US Government Has Nearly As Much Debt As The World Has Wealth.

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Berwick goes on to say in further edited excerpts:

According to a study by the Boston Consulting Group, privately held wealth increased to $152 trillion globally in 2013. When that is compared to estimates putting the U.S. federal government’s total debts and liabilities alone at anywhere from $78 trillion to $200 trillion you can see just how untenable the U.S. government’s debt is. The U.S. government is nearly indebted to the equivalent of all the privately held wealth in the world and possibly more!

Tallying Up The Total

We are dealing with massive, incalculable numbers here.

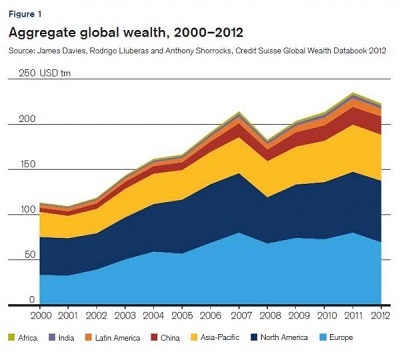

Total Global Wealth

While it is impossible to calculate the value of all wealth in the world the Boston Consulting Group’s number of $152 trillion seems reasonable. Zero Hedge calculated the total amount of global wealth at $223 trillion [as illustrated in the chart below].

Total U.S. Government Debt & Liabilities

[One would think that it would]…be much easier to calculate the total debt and liabilities of the U.S. government but even this is mostly a guessing game – even the U.S. government’s own Government (Un)Accountability Office (GAO), which is slated with the task of trying to find out where all the money in the government is going, has said that it is impossible to fully audit the government... [That being said,] however, there have been some estimates of the total debt and liabilities of the U.S. government.- Former US Comptroller General David M Walker argues total U.S. government debt is $73 trillion.

- The Washington Post…[suggests that] the U.S. has $128 trillion in unfunded liabilities – funds that have been extorted in the past for programs such as Medicare, Medicaid and Socialist Insecurity that are theoretically supposed to be paid back..

The above numbers mean the U.S. government is nearly as indebted as the world is wealthy, if not more. Put in other words, all the wealth in the world – every stock, bond, bar of gold, piece of real estate – couldn’t even pay off the U.S. debt and liabilities at this point.

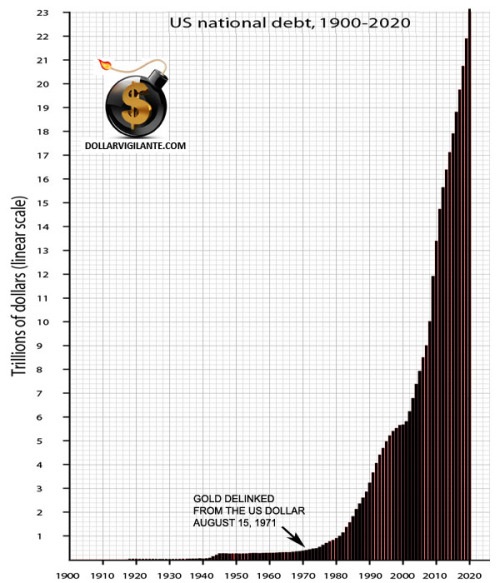

U.S. Government Budget Deficit

Actual debt owed via Treasury bonds currently stands over $17 trillion and, as can be seen in the following chart, has gone fully parabolic.

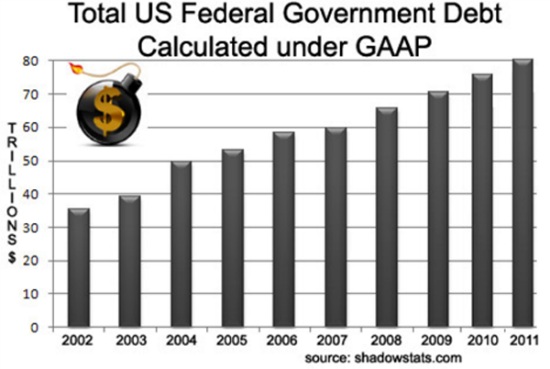

Total U.S. Federal Government Debt Calculated Under GAAP

If accounted for under Generally Accepted Accounting Principles (GAAP), like every other company in the U.S. does, total U.S. government debt and liabilities stands above $90 trillion and is rising at about $5 trillion per year.

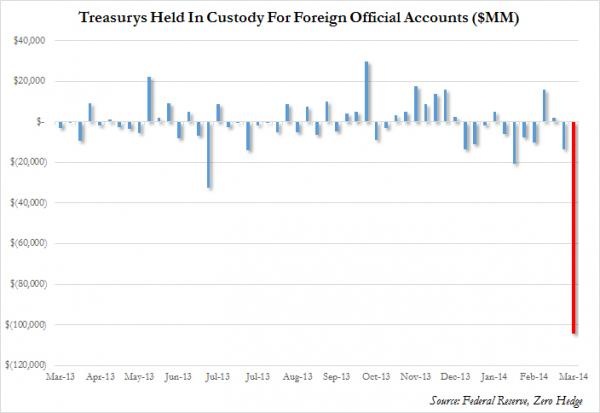

U.S. Treasury Bonds Held In Custody for Foreigners

…The only thing keeping this system alive is the never-ending printing of money of the Federal Reserve and the continued acceptance of dollars by foreigners in the form of Treasury bonds. In March of this year, however, Treasuries held by the Federal Reserve on the behalf of foreigners recorded the biggest drop in history.

Conclusion

In other words, this game is coming to an end – and all the wealth in the world couldn’t even pay off the debt and liabilities of the U.S. government at this point.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://dollarvigilante.com/blog/2014/6/10/the-us-government-has-nearly-as-much-debt-as-the-world-has-w.html (The Dollar Vigilante 2013)

Stay connected!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

Related Articles:

1. What Could – What Will – Pop This “Money Bubble”?

There is too much debt. Debt works the same way for a country as it works for an individual or a family, which is to say if you borrow too much, then your life basically craters. Everything gets harder to do, and you end up doing things in order to deal with your past mistakes that you would never do normally. You start trying absolutely crazy things, and that’s where the world’s governments are right now. We are doing all these things that are essentially con games and getting away with it so far, because a printing press is a great tool for fooling people. I don’t see how we can get away with it too much longer. Read More »

2. Monetary System Collapse Guaranteed – Here’s Why & How to Invest & Insure Your Wealth Accordingly

Our monetary system is guaranteed to collapse. The central banks prints money like there is no tomorrow. The governments spends like a drunken sailor and yet inflation is benign and interest rates sit at generational lows. Banks are gaining in profitability while their bad debts are being erased by rising asset prices. What’s not to like? Plenty! This article goes into the details of the money creation process to understand how and why this is happening, what the future implications will be and how to best invest to protect oneself from these eventualities. Read More »

3. U.S. Dollar Collapse Will Be Cataclysmic Endgame of Current Fiscal Policy

Government fiscal policy – profligate spending, leading to debt crisis, leading to currency crisis, leading to…the fall of the U.S. dollar – is the major cataclysmic endgame that is going to befall the U.S. Read More »

4. Which of These 6 Actions Will U.S. Gov’t Take to Resolve Country’s Debt Problems?

The U.S. is in a financial debt spiral. What’s the Administration to do? This article analyzes 6 alternative courses of action available, presents the consensus view of each, comes to a conclusion as to what will unfold and suggests what the implications are for one’s investment portfolio. Let’s take a look. Read More »

5. $17+ Trillion U.S. National Debt Adversely Affects Every American – Here’s Why & How

For the first time in U.S. history, the national debt has risen past $17 trillion. That number is a bit hard to comprehend and means little to Americans when not applied to their everyday lives. So just how does the national debt affect consumers, and why should the average American care about how much this country owes? Here’s why and how. Read More »

6. Debt Default or Hyperinflation? Which Will It Be?

The Fed, together with other central banks from around the world, have created the perfect crescendo of worldwide credit bubbles and asset bubbles leading to the excesses and decadence which are the normal finale to a secular trend. They have totally destroyed all major world currencies and left the world with debts that cannot and will not be repaid with normal money. As such, there are only two alternative outcomes, debt default or hyperinflation. Both will have disastrous consequences for the world economy. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

no worries, we’ll just print more.