The current move up over the past 4 years is being driven by the Fed’s loose monetary policies (just as other global markets have been driven by their Central Banks). Most bulls believe the loose polices will stimulate enough consumer demand to lead to a significant U.S. economic recovery. We, however, continue to believe the debt – laden consumer, along with the still other unresolved debt burdens, will be a major drag on the U.S. economy, (we are convinced that the market will turn down and make a triple top at levels below the peaks made in 2000 and 2007 while we resume the secular bear market that started in 2000) and that will have negative affects on the global economy.

loose monetary policies (just as other global markets have been driven by their Central Banks). Most bulls believe the loose polices will stimulate enough consumer demand to lead to a significant U.S. economic recovery. We, however, continue to believe the debt – laden consumer, along with the still other unresolved debt burdens, will be a major drag on the U.S. economy, (we are convinced that the market will turn down and make a triple top at levels below the peaks made in 2000 and 2007 while we resume the secular bear market that started in 2000) and that will have negative affects on the global economy.

So say edited excerpts from the Comstock Special Report* (http://comstockfunds.com) entitled The Consumer, the Debt, and Competitive Devaluations.

This article is presented compliments of www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and www.munKNEE.com (Your Key to Making Money!) and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The report goes on to say in further edited excerpts:

The Influence of the Consumer

The consumer is the main driver of the U.S. economy, and there are many pundits who believe the consumer will significantly help the U.S. recovery. They believe that consumer spending has quite a few tail-winds that should help the recovery starting this year. [Read: We’ve Reached the Tipping Point: Are Consumers Prepared to Save the Day?] They cite:

- the turnaround in the automobile market ( up 19% in 2012) as well as the housing market (prices up 6% in 2012),

- the 4 year rally in the stock market which is up over 100% in all the major indices, and

- the recent decline in gasoline prices at the pump.

On the other hand, we believe that:

- the headwinds of the real wage decline of about 8% over the past 12 years,

- the enormous consumer debt that is in the process of being deleveraged, and

- the overall U.S. debt

will offset all of these consumer tail-winds.

The government debt of $16 trillion (tn) is just the beginning of our debt problems. The private debt of about $40 tn has to be added to the government debt to put a better perspective on the total debt but the total debt of $56 tn still understates the true debt of our country since we have promised so much to so many of our citizens. These promises have left us with unfunded liabilities from Medicare, Medicaid, Social Security, and government employee pensions which range from $70 tn to $122 tn depending upon the discount rate used and how far out we can assume that they won’t be addressed. Therefore, total debt is at least over $125 tn, and that has got to put a damper on this latest bull market that started in 2009.

We are convinced that the market will turn down and make a triple top at levels below the peaks made in 2000 and 2007 while we resume the secular bear market that started in 2000.

How will our country resolve the enormous amount of debt we’ve built up over the past 30 years?

The obvious answer is to drastically cut the spending and raise taxes enough to balance the budget or at least bring the deficit down to about 3% of GDP vs. the present 7-8%. However, the problem with raising taxes and cutting spending too drastically is that this will lead our country into a severe recession or even a depression….So what is the answer to this dilemma? [Read: The Captains of Monetary Policy Have Not Grasped These Priceless Lessons of History & At Our Expense!] There doesn’t seem to be a clear answer but [it has been suggested that the following changes be instituted]:

- …gradually raise the eligibility age to 70 years for both Social Security and Medicare….

- means test both Social Security and Medicare and phase this in over the next few decades.

The demographics have changed…[considerably] since these plans were established in 1965 (Social Security Act adjustment and start of Medicare)….[Then] the life expectancy was 67 for males and 74 for females , and now…[it] is close to 80…for males and …over 80 for females.

It is clear that even more adjustments have to be made to the cost of Medicare since the government outlays were $565 bn in 2011 and are projected to be over $1 tn in 2022 (if you add Medicaid and Social Security these entitlements will absorb much of the projected revenue).

The problem with relying on spending cuts and revenue generated from taxes raised are the unintended consequences of much lower growth, which could possibly drive us into a recession or even a depression.

The Cycle of Deflation

If we are correct in our assessment of the U.S. entering a recession in 2013, we expect the U.S. downturn to spread globally and probably lead to a global recession. It will…[force] the countries that will be most affected…to lower their currencies in order to export more goods and services to their trading partners…A chart we named the “Cycle of Deflation” shows…[that] “Competitive Devaluations” result from too much global debt. We have been in this segment of the “Cycle of Deflation” now for the past decade, but it will be most apparent next year if we enter the global recession we expect.

We have witnessed a tremendous central bank easing over the past few years, with virtually every country attempting to devalue its currency with a total of 335 central bank easings. Well, we also witnessed this when our Fed brought rates down to 1% in mid 2003 and started the wild housing bubble that almost brought us to our knees.

Just recently, the new prime minister in Japan made a clear move to “competitive devaluation.” The yen has been fluctuating during Japan’s deflation since 1989, but the trend has been up, and the new Prime Minister Sinzo Abe believes that the only way Japan will be able to extricate themselves from 23 years of deflation will be to get the yen down relative to their trading partners like China, the U.S. and Europe. Their goal is to stimulate now, but aggressively starting in 2014, until the inflation rate rises to their goal of 2%, from a slight deflation presently.

The Japanese stimulus may get the yen down relative to their trading partners, but with their heavy debt load (even more than the U.S.) and aging demographics, getting to their goal of 2% inflation will not be as easy to achieve as they hope. (The Fed’s balance sheet expansion has resulted in the U.S. dollar declining about 11% against a basket of world currencies since Quantitative Easing (QE) started in 2009. [Read: Peter Schiff: The Federal Reserve is Now 100% Committed to the Destruction of the Dollar] Stocks, bonds, and commodities have also risen, but the recovery has been very sluggish and inflation has remained tame.) Japan has been using different forms of QE for many years, and in fact, they even bought Japanese stocks to reverse the deflation to no avail. We believe the new Prime Minister’s…significant stimulus plan will fail again.

The U.S. and Europe will do whatever they can to…[offset Japan’s actions] and that is why we call this “competitive devaluation”! [Read: This Chart Proves That Your Currency Is Being Debauched At An Accelerating (Parabolic) Rate! Got Gold?] If we continue along the path of “Competitive Devaluations” the next step is “Beggar-thy-Neighbor”, which is the next stage of the Cycle of Deflation. It is similar to competitive devaluation, but is just more severe since it essentially means that in order to keep plants and businesses from closing down, exports are sold below cost to their trading partners.

Japan has been in the same “liquidity trap” as the U.S. They can print money and drive interest rates down (and boost stocks, bonds, and commodities), but real inflation only comes about by borrowing and spending. Neither the U.S. nor Japan can lower rates enough to encourage its citizens to borrow and spend. As the saying goes, “You can lead a horse to water, but you can’t make it drink.” [Read: US “Recovery” Needs More Fiat Money Steriods to Continue! Here’s Why]

In summary, because the U.S. consumer is over burdened with debt we don’t believe there will be enough consumer demand to spark business spending or hiring.

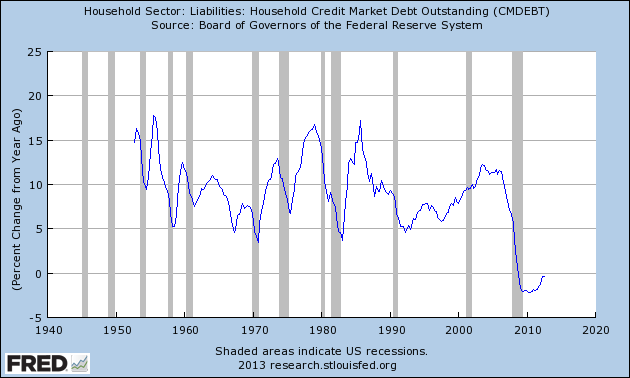

The consumer had increased household (H/H) debt every single quarter since World War II (including the severe recessions of the early 1970s and 1980s) averaging around 65% of Personal Disposable Income (PDI) and 50% of GDP for decades (50s, 60s, 70s and 80s) before taking off in the 1990s to double this average by 2008 (130% and 100%).

In 2008, when the Great Recession hit the U.S. and because H/H debt rose so much, H/H debt declined for 15 out of the last 17 quarters. Some would think this deleveraging would be a positive for the U.S. economy and stock market, but because the H/H debt to PDI is still 110% and 100% of GDP, the total H/H debt is still close to $13 tn and would have to drop by another $3 tn or so to get back to the normal relationships to PDI and GDP (see Ned Davis charts here and here).

[Says Cullen Roche of the Pragmatic Capitalist: Richard Koo, who coined the term “balance sheet recession” to describe the de-leveraging cycle, isn’t buying it. In his latest note he describes why the USA has years left to go. He says:“If people who had been paying down debt to repair their balance sheets had actually resumed borrowing, it would mean that balance sheet problems were behind us. However, the fact that the latest colored bar in Figure 1 is above zero indicates that US households are still paying down debt.

Inasmuch as this act of reducing financial liabilities in spite of zero interest rates runs counter to the principle of maximizing profits, it suggests that US households continue to undertake balance sheet adjustments.”

I think Koo’s view is confirmed by the NY Fed’s latest data on quarterly household debt trends. They showed another quarter of de-leveraging but the balance sheet recession isn’t an event – it’s a process – and the process is very clearly moving in the right direction. For instance, see the improvement in consumer borrowing year over year:

We’re obviously digging out of a deep hole there, but we’re digging. Household debt is on the verge of turning positive. There’s still a lot of work to be done here and the recovery remains fragile, but we’re moving in the right direction ~ Source]

Conclusion

The [current and] continuing deleveraging will dampen consumer borrowing and spending which, in turn, will effect business spending and hiring not only in the U.S. but globally. [As such,] if we are correct, the U.S. and global economies will contract and there will be a race to the bottom with “competitive devaluations” rampant. All the countries that need exports for economic growth will be very aggressive in the race to the bottom, as the global economy struggles, and drives these same countries into the next stage of the “Cycle of Deflation”, that is, “Beggar-thy-Neighbor”.

Register to “Follow the munKNEE“ and automatically receive all articles posted

*http://comstockfunds.com/default.aspx?act=Newsletter.aspx&category=SpecialReport&newsletterid=1696&menugroup=Home

Editor’s Note: The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

Related Articles:

1. We’ve Reached the Tipping Point: Are Consumers Prepared to Save the Day?

Injecting massive amounts of liquidity into the banking system can spur dramatic economic growth if that liquidity is used. On the other hand, if public perception is negative and fearful, that liquidity remains untapped and no growth occurs. We are in a new earnings season and for the most part – based on lowered expectations – the numbers are looking OK so what should we expect based on these modestly improving numbers? Words: 2176

2. Mohamed A. El-Erian: Bad Economics Led to Bad Politics and Will Further Undermine Economy Unless….

The warning bells are ringing, and they are ringing loudly. We’ve already allowed bad economics to lead to bad politics. Now, it’s high time to put a stop to the cycle where bad politics undermines an already fragile economy. [Let me explain.] Words: 1085

3. US “Recovery” Needs More Fiat Money Steriods to Continue! Here’s Why

This time is far worse than any other modern recession. What we are seeing now is a depression, despite what the NBER would have you believe. If you are still looking for the “Big One” to happen, you are too late. It happened here and it is still happening here and in Europe. They, like us, have tried to paper over most of the effects of the boom-bust business cycle malinvestment, and they have failed and the piper is at their door [as it is here in the U.S.]. The current economic “good news”, this supposed “recovery”, is largely based on fiat money steroids and will not last without continuous injections of new fiat money into the economy. [Let me explain.] Words: 2300

4. “Liquidity Trap” is Fast Approaching

When velocity is low the nation essentially winds up in a “liquidity trap” which is a situation where monetary policy is unable to stimulate the economy either through lowering interest rates or increasing the money supply. This was the condition that Japan found itself enveloped in from 1989 to present. We expect the same problem in this country and hope (really hope) to be wrong. Words: 672

If you are clearly watching, listening and paying attention to what is going on around you, and not what the press ‘conjures up’ and the political apparatus ‘spins’, then the following lessons, in the following sequence, should resonate with you. [Unfortunately, however,] the captains of world monetary policy have not and, as such, they have put the world on a course that history has warned us against [and we will eventually pay the price of their ignorance and ineptitude. Take a look. These words of wisdom (lessons) are as timely today as when first spoken/written.] Words: 865

6. Peter Schiff: The Federal Reserve is Now 100% Committed to the Destruction of the Dollar

In order to generate phony economic growth and to “pay” our country’s debts in the most dishonest manner possible, the Federal Reserve is 100% committed to the destruction of the dollar. Anyone with wealth in the U.S. dollar should be concerned that economic leadership is firmly in the hands of irresponsible bureaucrats who are committed to an ivory tower version of reality that bears no resemblance to the world as it really is. By upping the ante once again in its gamble to revive the lethargic economy through monetary action, the Federal Reserve’s Open Market Committee is now compelling the rest of us to buy into a game that we may not be able to afford. Words: 1410

[According to the chart in this article,] all currencies are being debauched. The price of gold in each currency approximates a parabola, meaning the use of printing presses is accelerating. Each unit of currency is losing purchasing power at an increasing rate. The trend points to a worldwide currency collapse unless the creation of money stops. [Take a look!]. Words: 282I keep wondering to myself, do our money-printing central banks and their cheerleaders understand the full consequences of the monetary debasement they continue to engineer? [Below is what I think awaits us.] Words: 1013

9. World’s Largest Economies Have NO Choice But to Engage in Massive Money Printing – Here’s Why

The choice facing the leaders of the world’s largest economies is a simple one: Either they engage in massive money printing, or they let the world slip into another great depression. This article examines why they have no choice but to print money, something which will have significant consequences for everyone. Words: 560

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money