We are facing a crisis in Europe that is far, far worse than 2008. [It is so bad that,] before it ends, it is quite possible that we will see the entire western financial system collapse and a new system put into place. Words: 912

that,] before it ends, it is quite possible that we will see the entire western financial system collapse and a new system put into place. Words: 912

So says Graham Summers (www.gainspainscapital.com) in edited excerpts from his original article*.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Summers goes on to say, in part:

This will mean:

- Many major banks disappearing, as well as numerous, potentially lengthy, bank holidays...

- Multiple sovereign defaults, as well as broad economic contractions and their commensurate unemployment/ civil unrest/ erasure of retirement accounts/ pensions...

- New currencies or new denominations of currencies possibly being introduced…

- Massive wealth destruction to the tune of tens of trillions of dollars…

- The breakup of various countries/ unions and the implementation of new political/power structures.

- Very serious trade wars…and very possibly a real war.

If the above make you frightened, you’re not alone.

As I’ve dug deeper and deeper into the inner workings of the global financial system over the past months, the information I’ve come across has only gotten worse. I’ve been holding off writing all of this because up until roughly April/May it seemed possible that the world might veer towards another outcome. I no longer view this to be the case. I am almost certain that what I’ve written above will come to pass – so buckle up and let’s dive in.

How the Global Financial System Works

In order to understand why we’re at risk of the financial system collapsing, you first need to understand how the global banking system works. When you or I buy an asset (say a house, or shares in a company, or a Treasury bond), we do so because we’re looking to increase our wealth through either a capital gain or through the income that asset will pay us in exchange for us parking our capital there….

Banks, however, work differently. When a bank buys something, especially a bond, it parks that bond on its balance sheet as an “asset.” It then lends money out against that asset. This, in of itself, is not problematic except for the fact that the financial modeling of 99% of banks assume that sovereign bonds are “risk-free.” Put another way, their models assume that the banks will always get 100 cents on the dollar back.

Yes, you read that correctly, despite the fact that world history is replete with examples of sovereign defaults (in the last 20 years alone we’ve seen more than 15, including countries as significant as Russia, Argentina, and Brazil), most banks assume that the sovereign bonds sitting on their balance sheets are risk free. This phenomenon occurs worldwide, but given that it will be Europe, not the U.S. that takes the system down, I’m going to focus on European bank models/capital ratios.

The European Union (27 Countries) Model

You may or may not be familiar with EU banking law. EU banks are meant to comply with Basel II which is a series of capital requirements and other specifications meant to limit systemic risk.

In terms of capital ratios, Basel II requires that EU banks have equity and Tier 1 capital equal to 6% of risk weighted assets. On paper this idea was supposed to limit bank leverage to 16 to 1 (the bank has €1 in capital or equity for every €16 in loans). However, the term “risk weighted assets” destroys this premise because it means that the bank’s loan portfolio and ultimately its leverage ratio are based on the bank’s in house models/assumptions concerning the risk of its loans.

Let me give you an example. Let’s say XYZ Bank lends out €50 million to a corporation. The bank won’t necessarily claim that all €50 million is “at risk.” Instead, the bank will claim that only a percentage of this €50 million is “at risk” based on the company’s credit rating, financial records (debt to equity, etc), and the like. Thus, based on “in-house” risk modeling, European banks could, in fact, lend out much, much more than the Basel II requirements would imply.

Considering that both bank profits and executive compensation were/are closely tied to more lenient definitions of “risk-weighted,” (i.e. lend as much as you possibly can) it’s safe to assume that EU banks are in fact much, much more leveraged. Indeed, according to the IMF’s “official” analysis, EU banks as a whole are leveraged at 26 to 1. I would argue that in reality many of them are well north of 30 to 1 and possibly even up to 50 or 100 to 1.

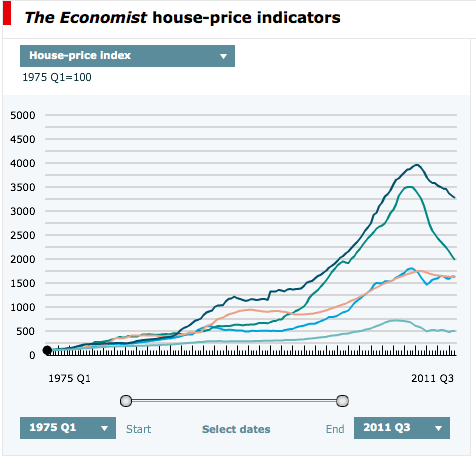

The reason I can claim this with relative certainty is because the EU housing bubbles dwarfed that of the U.S.. In the chart below the U.S. housing bubble is the lowest line. After it comes Britain (blue) and Italy (orange) then Ireland (green) and finally Spain (dark blue).

You can only get bubbles of this magnitude if you’re lending to literally anyone with a pulse – and you can only lend that much if your in-house risk models believe that the risk of lending to anyone with a pulse is much, much lower than reality.

Given the above, EU banks are likely leveraged at much, much more than 26 to 1. Indeed, considering how leveraged and toxic US banks’ – especially the investment banks’ – balance sheets became from the U.S. housing bubble, the above chart should give everyone pause when they consider the TRUE state of EU bank balance sheets.

This fact in of itself makes the possibility of a systemic collapse of the EU banking system relatively high.

HAVE YOU SIGNED UP YET?

Go here to receive Your Daily Intelligence Report with links to the latest articles posted on munKNEE.com.

It’s FREE and includes an “easy unsubscribe feature” should you decide to do so at any time.

SAVE TIME searching for today’s best articles. They are all here!

All articles are also available on TWITTER and FACEBOOK

*http://gainspainscapital.com/?p=1967 (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above posts may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. The $64 Trillion Question Is: “When and How Does the Debt Death Spiral End?”

We are in the latter stages of the debt death spiral where debt and interest payments can only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends. [Let me put forth just how serious the problem is.] Words: 431

2. What Will the Outcome of All the QE Mean for the U.S. (and the World)?

At the risk of looking/sounding like some crazed religious fanatic usually seen carrying a sign or proclaiming: “Repent, the end is near,” I shall avoid the word “repent”. To me, the rest of that proclamation appears accurate and reasonable, at least with regard to our economic condition. [Let me explain:] Words: 1896

This short video – on the unsustainability of government spending – should be watched by everyone, including those not yet old enough to vote. It should be shown in every high school and college classroom. Anyone that cannot understand this presentation should not be allowed out without a guardian.

4. Richard Duncan: IF Credit Bubble Pops Civilization Won’t Survive the Depression that Follows

Our civilization would not be able to handle such a transition from an expansionary credit based economy where goods and services were readily available into a paradigm of credit contraction, supply shortages and destitution and this is what is coming. There is no way to prevent it – only to defer it until a later date – and that day will soon be upon us. Words: 590

The outcome of the election of 2012 will [only] determine the rate of speed at which we approach the [financial] cliff [because] neither political alternative is willing to change course, to steer away from the cliff. The cliff is so high that whether we go over it at 200 mph (Obama) or whether we merely slip over the edge (Romney), the end result is the same — fatal for the economy and perhaps our entire political system. It is the fall that will kill us. [This article explains why that is going to be the case.] Words: 1135

6. U.S Likely to Hit the Financial Wall by 2017! Here’s Why

The deficits aren’t going to stop anytime soon. The debt mountain will keep growing…Obviously, the debt can’t keep growing faster than the economy forever, but the people in charge do seem determined to find out just how far they can push things….The only way for the politicians to buy time will be through price inflation, to reduce the real burden of the debt, and whether they admit it or not, inflation is what they will be praying for….[and] the Federal Reserve will hear their prayer. When will the economy reach the wall toward which it is headed? Not soon, I believe, but in the meantime there will be plenty of excitement. [Let me explain what I expect to unfold.] Words: 1833

7. This Will NOT End Well – Enjoy It While It Lasts – Here’s Why

…The US Government and its catastrophic fiscal morass are now viewed by the world as a ‘safe haven’. This would easily qualify for a comedy shtick if it weren’t so serious….[but] the establishment is thrilled with these developments because it helps maintain the status quo of the dollar standard era. However, there are some serious ramifications that few are paying attention to and are getting almost zero coverage from traditional media. [Let me explain what they are.] Words: 1150

8. Events Accelerating Towards an Ultimate Dollar Catastrophe! Here’s Why

With the U.S. election just months off, political pressures will mount to favor fiscal stimulus measures instead of restraint. Such action can only accelerate higher domestic inflation and intensified dollar debasement culminating in a Great Collapse – a hyperinflationary great depression – by 2014. [Let me explain why that is the inevitable outcome.] Words: 2766

9. Major Inflation is Inescapable and the Forerunner of an Unavoidable Depression – Here’s Why

Whether our current economic crisis will end with massive inflation or in a deflationary spiral (ultimately, either one results in a Depression) is more than an academic one. It is the single most important variable for near and intermediate term investing success. It is also important in regard to taking actions which can prepare and protect you and your family. [Here is my assessment of what the future outcome will likely be and why.] Words: 1441

10. An Inflation Inferno is Expected – but When?

Daniel Thornton, an economist at the Federal Reserve Bank of St. Louis, argues that the Fed’s policy of providing liquidity has “enormous potential to increase the money supply,” resulting in what The Wall Street Journal’s Real Time Economics blog calls “an inflation inferno.” [Personally,] I think it’s too soon to make significant changes to a portfolio based on inflation fears. Here’s why. Words: 550

11. Major Price Inflation Is Coming – It’s Just a Matter of Time! Here’s Why

The developed economies of the world have opened the money spigots…[and this] massive money and credit creation is sitting in the banking system like dry tinder just waiting for a spark to set it ablaze. How quickly it happens is anyone’s guess, but once it does we are likely to be enveloped in a worldwide inflation unlike anything before ever witnessed. [Let me explain further.] Words: 625

Evidence shows that the U.S. money supply trend is in the early stages of hyperbolic growth coupled with a similar move in the price of gold. All sign point to a further escalation of money-printing in 2012…followed by unexpected and accelerating price inflation, followed by a rise in nominal interest rates that will bring a sovereign debt crisis for the U. S. dollar with it as the cost of borrowing for the government escalates…[Let me show you the evidence.] Words: 660

13. Current Distortion of Interest Rates is Unsustainable & Will Have Dire Consequences

Interest rates have been manipulated to keep them extremely low in an attempt to stimulate the economy but…unless deficits are dramatically reduced…. interest rates will eventually rise and government interest expense will double or triple from the amounts being paid today. That potentially triggers a debt death spiral, where government has to borrow more than otherwise expected. It also raises the credit risk and could ratchet interest rates up again. It has happened to Greece, Portugal, Spain and other European countries already this year and could well happen in the U.S. too. Words: 595

14. Eventual Rise in Interest Rates Will Be Downfall of U.S. – Here’s Why

Everyone who purchases a Treasury bond is purchasing a depreciating asset. Moreover, the capital risk of investing in Treasuries is very high. The low interest rate means that the price paid for the bond is very high. A rise in interest rates, which must come sooner or later, will collapse the price of the bonds and inflict capital losses on bond holders, both domestic and foreign. The question is: when is sooner or later? The purpose of this article is to examine that question. Words: 2600

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money