Most investors do not have sufficient exposure to equities outside the United States in their portfolios (a phenomenon known as home country bias), even though investing internationally is another way of introducing diversification in a portfolio. Investors interested in looking abroad may wish to look to the Far East – specifically, Japan.

Read More »A Look At “Safe” Investments: Just How Safe Are They? (+2K Views)

Is there such a thing as a truly "safe" investment? The short answer is that no investment is 100% safe, but there are certainly some investments that are better than others at protecting your hard-earned savings. Let's examine some of the most common "safe" investments and learn how good they actually are at shielding you from financial losses.

Read More »Short Selling Stocks: The Long & the Short of It (+2K Views)

You can make money short selling a stock if its price goes down – but if its price goes up, your losses could be unlimited. [This short article outlines the theory behind short selling and what you need to know before doing so.] Words: 333

Read More »Time the Market Using Momentum Indicators (+3K Views)

Never again will you have to rely totally on the ‘advise’ of your broker. With what happened last year to most portfolios it is imperative to do ones own analysis and be in a position to become better informed. If ever there was a “cut and save” investment advisory this article is it. Read More »

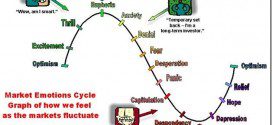

Recognize These 6 Emotions Before You Buy or Sell an Investment (+3K Views)

Since there is such a wide range of emotions, it might be helpful for you to do a 'gut-check' before you actually buy or sell any type of security. Knowing how you "feel" about investing might turn out to be just as important as knowing what you "know." Words: 737

Read More »5 Investment Tips to Riches

We often get questions from readers about the criteria we use when considering positions in a market. Because of that, we decided to release our best insights in this article in line with what we believe are actual market conditions. To illustrate that, we have included recent charts and data points. Read on!

Read More »Invest With An Edge: The Wonderful World Of Fractals (+2K Views)

What are fractals, what causes them, and how we can use them to improve our trading? It's a subject worthy of a lengthy research paper, but hopefully this article and the following excerpts to whet your appetite to read the full article will be a good introduction.

Read More »Elliott Waves Warn You About Trend Changes Before the News – Here’s Why

What gives Elliott waves the ability to warn you about trend changes before the news? Here's the answer.

Read More »You May Be Smart – But Are You An Intelligent Investor?

One of the most dangerous places to be as an investor is when you’re the smartest person in the room and don't have a heavy dose of humility. That can get you into trouble because it can lead to overconfidence which can lead to overthinking which can be a deadly combination when managing money. Intelligence becomes wisdom with the recognition that no matter how certain you are in your market views, no one really knows how things will play out. This is why it’s so important to fight to...

Read More »Investing: Being Right All the Time Is More About Ego Than Making Money (2K Views)

Most investors assume that the only thing that matters is whether they’re right or wrong...[but] being right or wrong all the time is more about ego than making money. Risk only matters when there are consequences attached to your actions. To understand true risk, investors need to ask themselves: “What are the consequences if I am right or wrong?” Word count: 674

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money