Would gold really rocket or are there other solutions available should we encounter such a disaster, negating the need for gold?

Read More »4 Ways To Add Defensive Exposure To Your Investing

As investors adjust to a lower growth paradigm, investors may want to consider exposures that either offer limited downside protection such as minimum volatility strategies or that move less in sync with equity and bonds such as in commodities. This article identifies 4 ways investors can add targeted defensives exposures to their portfolios.

Read More »“Rent” Silver For Pennies-on-the-Dollar! Here’s How

Investors owning a substantial amount of physical silver not only pay storage costs, they are missing out on interest. This report shows you how it’s possible to “rent” silver for pennies-on-the-dollar, freeing up capital to earn virtually risk-free interest elsewhere.

Read More »Short Selling A Stock Is Not As Difficult Or Risky As You Might Think

Learning how to short sell a stock takes practice, but it’s not as difficult (or as risky) as many people believe.

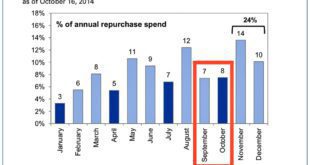

Read More »Stock Buybacks/Share Repurchases: Their Pros & Cons & How They Impact Dividend Investors (+3K Views)

Stock buybacks are a pretty common mechanism nowadays to provide value to shareholders so it is important to familiarize yourself with the terminology and understand the impact it may potentially have on your investments - especially if you are a dividend investor.

Read More »3 Elements to Better Understand Health & Direction of Economy & Markets

While the economy is a vastly complex and difficult thing to grasp, you can simplify the many moving parts by boiling it down to three basic elements, or touch points, which give you a brief understanding of the health and general direction of where and how things are going.

Read More »“Dogs of the Dow” Investment Strategy: Higher Yields & Above Average Stock Price Gains

Dogs of the Dow is an investment strategy that targets the 10 top-yielding stocks in the Dow Jones Industrial Average (DJIA) for investment each year. Investors following this strategy should reap the benefits of higher yields and above-average stock-price gains.

Read More »The More You Know the Better: The Stock Market Is NOT the Economy

The more you know, the better. The stock market is only one indicator of economic health; it is not the economy,

Read More »5 Tips For Successful Cannabis Stock Investing

Recent regulatory changes that have made recreational use of cannabis among adults legal in Canada and the manufacture and sale of CBD legal in the United States...have led to the emergence of an entirely new market that is bound to make plenty of millionaires in spite of the risks associated with doing so. Here are a few tips to help you make the right choices.

Read More »“All Weather” Investment Strategy Lives Up To Its Name!

Ray Dalio’s All Weather Portfolio is a diversified asset mix designed to weather through any financial climate be it a bull market, bear market, recession, or whatever and, based on its historical performance thus far, it holds up to the name.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money