E*TRADE's Monthly Sector Rotation report highlights investor movement across S&P 500 sectors. In August, Consumer Discretionary, Information Technology, and Consumer Staples saw positive inflows, while Communication Services, Health Care, and Financials faced outflows. Despite concerns about a tech sector rotation, IT continued its strength, driven by stocks like Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT). Meanwhile, Real Estate declined sharply amid rising interest rates and economic uncertainty. Historical trends suggest that top-performing sectors, like tech in 2023, often lose momentum the following year. This dynamic could impact sector performance in 2024.

Read More »$10,000 Gold May Be Too Conservative A Target

$10,000 may be too conservative of a price target for gold up ahead with a lot of pain before we get there, both in commodities and the broad market. A deflationary bust is coming that will wipe out most asset categories, before stagflation takes hold, the Fed intervenes, and commodities skyrocket to previously unimaginable levels.

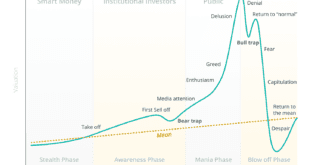

Read More »Bull Trend Continues: Are We In A Stock Market Bubble?

The bullish trend has remained firmly intact again this week, as the market tested the 20-DMA, the bottom of the trend channel, early in the week, which sparked buyers to push the index to all-time highs by the week’s end.

Read More »Bubble or Not Here’s How To Trade It

Whether you think the market is in a bubble or just forming a short-term top is mainly irrelevant but if you’re nearing retirement, or are a retiree, your investment horizon is shorter than that of much younger people it may be wise to consider the possibility.

Read More »Can the Super Bowl Winner Predict How Stocks Will Do This Year?

Some investors believe... the outcome of the Super Bowl could determine which direction the stock market will head. The thesis behind the Super Bowl stock indicator is this: If an AFC team [this year its the Kansas City Chiefs] wins the Super Bowl, a stock market decline or bear market can be expected by year-end. Conversely, if an NFC team [this year its the San Francisco 49ers] wins, it’s all roses ahead.

Read More »Ed Yardeni: S&P 500 Could Reach 5,400 By End Of 2024! Here’s Why

While Yardeni's forecast may seem outlandish given the economic and fundamental backdrop, the market cycle supports the claim.

Read More »SMART Stocks Are The New FANG (+28K Views)

I believe the SMART stocks should be cornerstones of a portfolio exposed to the rising digital economy we live in. An economy driven by data, digital payments, targeted advertising, streaming and new social interaction at your fingertips.

Read More »Bear Markets: 8 Facts You Need To Know

There are few things scarier than a bear market, but steep and sustained drawdowns in stocks are an absolute fact of investing life...so a familiarity with the basics of bear markets should help you better cope with the next one and, to that end, we've compiled the following eight facts you must know about bear markets.

Read More »Bull & Bear Markets: What You Need To Know

Bull and bear markets are a historical trend tool, but how should you read them and what can you expect from the current financial landscape?

Read More »Stock Market Pullbacks, Corrections & Crashes: How Do They Differ?

The nature of stocks, also known as equities, is that they often suffer declines and these market downdrafts - market pullbacks, corrections and crashes - have different characteristics. Here is the difference between a stock market pullback, correction and crash.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money