With the holidays right around the corner, now is the perfect time to set your sights on one or more of these 6 financial gifts that will help your kids learn about, respect, and appreciate money.

Read More »Understanding Money: 5 Great Books For Christmas

There are plenty of brilliant books that break down money in a digestible and clear way and here are a few of our favorite recommendations.

Read More »Under 30? My Christmas Gift Could Make You Happier, Freer & More Financially Secure – Interested? (+2K Views)

If you’re reading this and under 30, let me be absolutely clear about one indubitable point: your government is going to sacrifice your future in order to pay for its own mistakes from the past. [If that kind of future does not sit well with you] then get out of Dodge. Stop playing by the same rules of the game that used to work in the past because the old playbook of “go to school, get a good job, work your way up the ladder” simply doesn’t apply anymore. [This article outlines what is being laid out as your future unless you take independent action and, in conclusion, outlines suggestions on how to make a better life for yourself. Feel free to share this article with one and all!] Words: 1058

Read More »Consider Giving Your Child/Grandchild Some Gold or Gold Stocks This Christmas

Your young children or grandkids will probably say they'd like a toy or bicycle this holiday season, but their adult selves might prefer a financial gift with a long-term payoff. Here's why and the best way to do that.

Read More »Investors Eye a Soft Landing After Fed’s Big Rate Cut, But Caution Remains

The Federal Reserve's recent 50-basis point rate cut has bolstered optimism for a "soft landing," pushing the Dow, S&P 500, and NASDAQ to new highs. While the move has alleviated uncertainty, investors remain wary of potential economic risks, including a slowing labor market and lingering inflation concerns. Despite the positive market reaction, some experts warn that market volatility could resurface if inflation picks up or the labor market weakens further. With the Fed expected to announce more rate cuts later this year, all eyes are on the November meeting for clues on future economic policy.

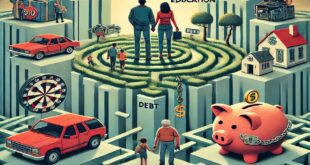

Read More »The Waning North American Dream

The traditional aspirations of leisurely vacations, quality education, and a secure retirement are becoming increasingly unattainable for many middle-class families. Rising costs and financial pressures have made it more difficult to save for these goals, with inflation, student debt, and inadequate retirement savings posing significant challenges. The interconnectedness of these financial struggles, compounded by political gridlock and societal behaviors, underscores the complexity of the problem. Achieving these dreams now requires both individual planning and systemic reforms to create a more sustainable economic environment for future generations.

Read More »What Is A Universal Basic Income? Why Is It Flawed?

A Universal Basic Income (UBI) sounds great in theory. According to a previous study by the Roosevelt Institute, it could permanently increase the U.S. economy by trillions of dollars. While such socialistic policies sound great in theory, history, and data, they aren’t the economic saviors they are touted to be.

Read More »Donald Trump’s Cryptocurrency Strategy and Its Impact on Gold & Silver Investing

Donald Trump has outlined a series of cryptocurrency policy proposals aimed at positioning the United States as a global leader in the digital asset space. Trump's cryptocurrency policies, particularly his proposal to establish a strategic Bitcoin stockpile, could have significant implications for the gold and silver markets.

Read More »Can Silver Get You Through a Stock Market Crisis

On Monday, major U.S. stock indexes experienced their most significant decline since 2022. The S&P 500 fell by approximately 3%, while the NASDAQ dropped over 6%. As investors navigate through the current financial turbulence, attention is increasingly turning towards assets that can provide stability amidst uncertainty. Silver, historically known as a safe haven during economic downturns, is garnering interest due to its potential to hedge against market volatility.

Read More »Founding Fathers’ Financial Advice Stand the Test of Time

To help you in your personal finances, consider what 6 of the founders of the United States of America - Benjamin Franklin, Thomas Jefferson, Alexander Hamilton, John Hancock, John Adams and George Washington had to say on the subject. They definitely stand the test of time.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money