You may think you’ve missed the AI boom but, if you take a long-term view, it could be another life-changing moment in the market just it was with electricity, the automobile, computers and the internet. Here’s why; here’s where; and here’s how.

An original article by Lorimer Wilson, Managing Editor of munKNEE.com – Your KEY To Making Money!

Large investors and corporations are investing massive sums to get a leg up on AI. It wasn’t until the mid-2010s that venture capital and other institutional investors started funding more and more AI projects betting that AI’s time was finally around the corner.

(Click on image to enlarge)

Back in 2015, AI investment was just $12.7 billion, but by last year it had hit $91.9 billion – a 32% growth in AI funding per year.

According to:

- Goldman Sachs:

- investment in AI is set to grow 25% per year over the next two years to more than $150 billion and

- advancements in generative AI could significantly impact the world economy, leading to a 7% rise in global GDP (equivalent to nearly $7 trillion) and a 1.5% increase in productivity growth over a decade

- McKinsey & Co.:

- AI has 63 uses across 16 business functions, and if applied, they could create between $2.6T and $4.4T in economic benefits on an annual basis. This would add 15% to 40% to the current $11T to $17.7T potential value from non-generative AI and analytics

- Accenture:

- AI will nearly double global GDP in the next 20 years and

- 98% of corporate executives reported that they believed AI will play an important role in their business in the next 3-5 years knowing that they need to adopt AI systems in the coming years, or they could lose market share

- International Data Corporation:

- AI applications are on track to reach $192.6B by 2025 – a compound growth of 31.2% and, by 2026, 75% of large organizations will rely on AI for this compared to just 45% today

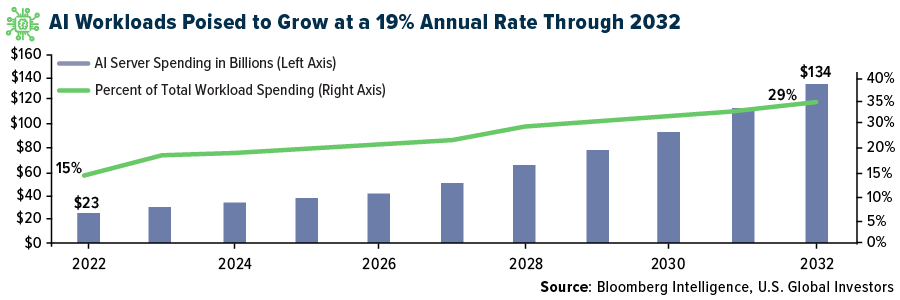

- Bloomberg Intelligence:

- AI server spending could account for nearly 30% of total workload expenditures by 2032, a significant increase from approximately 15% in 2022(Click on image to enlarge)

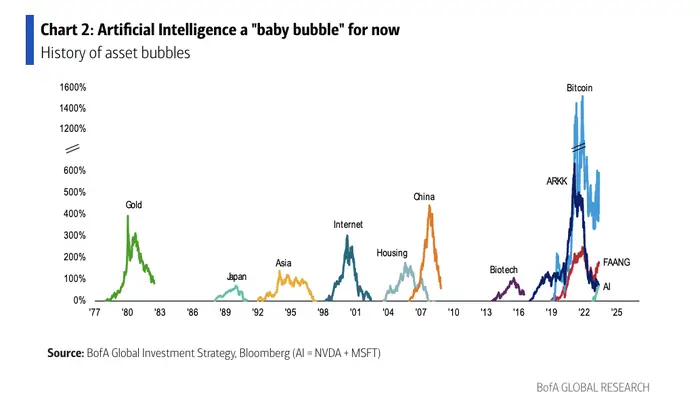

- Bank of America:

- AI is currently just a “baby bubble” with huge upside potential. If past bubbles are any indication the bubble should continue until such time as the Fed pauses their rate hikes and then starts to raise rates again.(Click on image to enlarge)

- AI is currently just a “baby bubble” with huge upside potential. If past bubbles are any indication the bubble should continue until such time as the Fed pauses their rate hikes and then starts to raise rates again.(Click on image to enlarge)

Nomi Prins makes the point (see here) that, In technology, new and disruptive ideas don’t catch on overnight stating, for example, that:

- the first car was invented in 1886 but the technology didn’t take off until Henry Ford’s Model T took over streets 25 years later,

- personal computers (PCs) popped up in the 1970s but weren’t common in households until the ‘90s – two decades later,

- Apple’s first portable “smart device” came out in 1993 but it wasn’t until the iPhone was launched 14 years later that everyone wanted one,

- early in the 1990s internet stocks started outperforming all other sectors in the market and they didn’t stop outperforming for a whole decade soaring more than 1,100% while consumer staples stocks rose just 200%, energy stocks gained less than 140%, and utility stocks added just 50%.

- A $10,000 investment in Oracle (ORCL) in 1991, for example, would have turned into $900,000 by 1999,

- a $10,000 stake in Cisco (CSCO) would’ve turned into $1.4 million and

- a $10,000 stake in Qualcomm (QCOM) would’ve grown to over $1.5 million.

Companies that make, sell, and use AI effectively are going to eat up entire industries and become titans of business. They’ll destroy those companies that don’t do the same and the result will be that stocks on the right side of the AI divide will soar – not just this year but for the next 10 years – and stocks on the wrong side will crash. Companies that fall behind in the race to develop AI are at risk of being left behind but for companies that move early to adapt the fruits of AI’s advantages could deliver windfall profits and, with windfall profits come major appreciation in stock prices.

Again, according tp Prins (see here) a great example of that is what happened to Sears when they didn’t embrace the advent of the internet while Amazon did. Sears was a powerhouse, but it failed to adapt and went out of business. Amazon made a bet on the right trend at the right time, and it is now a $1.4 trillion business. An investment of $1,000 in Amazon at its 1997 initial public offering price, for example, would have returned an unbelievable gain of 179,900% but an investment of $1,000 in Sears would have lost 95% of such any investment.

This predictable pattern of initial interest and then widespread acceptance is known as the “adoption” curve and it looks like this:

(Click on image to enlarge)

- If you invest too early – in the “innovation” phase, when the technology is being developed – you’ll have to wait years, perhaps decades to see returns, if any, BUT,

- if you invest too late – in the “saturation” phase, when everyone knows about it – you’ll miss all the biggest gains SO

- if you invest at just the right time – in the “take-off” phase – in the right AI companies you will have the chance to get extremely rich just as early investors in Amazon and Apple did, and that “take-off” phase is where we are with AI today.

There’s a huge opportunity for companies at the forefront of AI and that means huge profit potential for you.

(Click on image to enlarge)

We know AI is in the “take-off” phase because:

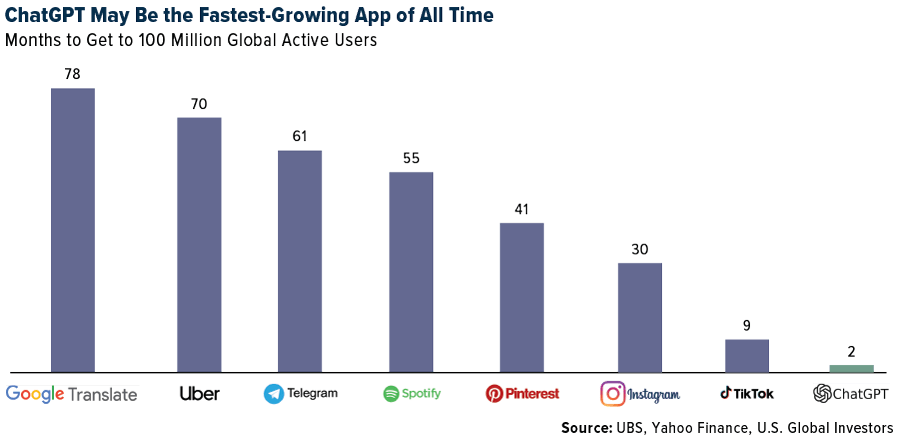

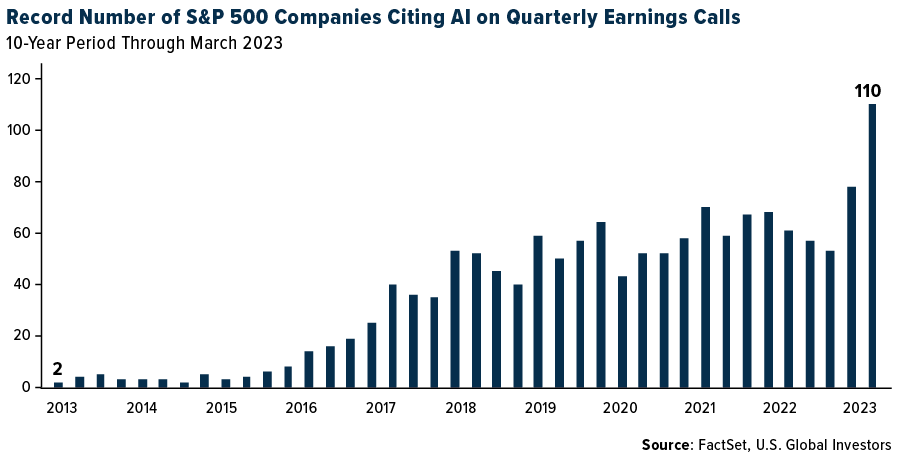

- usage is spiking: according to research firm McKinsey, as mentioned above, AI adoption is up 2.5x over the past five years alone – and that’s only going to accelerate. User growth of Chat GPT, the popular AI-enabled chatbot became the fastest-growing consumer application in history, according to a study from UBS, going from zero to 100 million users in only two months and, as a result of Chat GPT’s success,(Click on image to enlarge)

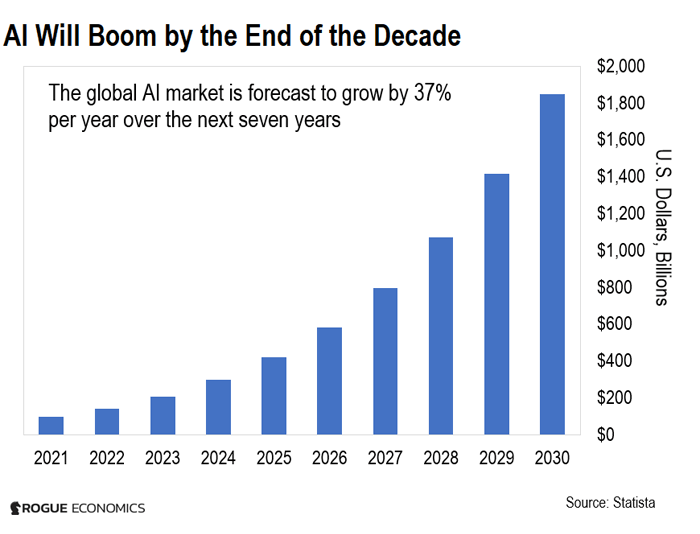

- growth is exploding: according to statista.com, the market for AI is set to explode to nearly $2 trillion before the end of the decade, up 20x from $95.6 billion in 2021.

- Microsoft has poured $10 billion into OpenAI, the parent company of the Chat GPT program,

- AI data architecture company Databricks has raised $1.3 billion from major investors like BlackRock and Fidelity, and

- AI startup Anduril, has raised $1.48 billion from several venture capital powerhouses.(Click on image to enlarge)

(Click on image to enlarge)

Given the above, NOW is the time to act. We weren’t there six months ago – and we may be past it in six months – so, I repeat, NOW is the time to act. You may have missed the first AI boom but there are many more to come. Certain categories will reap more benefits than others so the impact will be lopsided – and so will the coming profit distribution.

- AI’s low-hanging fruit has already been picked from the technology sector. Semiconductor companies are profiting from the need for massive amounts of computing power to create and train AI models.

- Many companies are already incorporating AI into things like spreadsheet apps and search engines. and their stock prices have jumped this year as a result.

- According to Clint Brewer (see here) the next big winners from the impact of AI are where AI stands to make the biggest impact on productivity and assist in revolutionary new products and those areas are:

- the banking industry which is plagued by redundant tasks, like processing loan applications and other back-office operations. One estimate puts the AI-driven productivity gain of the global bank industry at over $200 billion;

- the pharmaceutical sector where AI is creating new ways to quickly model new drugs and other treatments for various diseases cutting down on the time and cost for new drug discovery by modeling molecules for new treatments, which is a process that can traditionally take a decade and billions of dollars in research and development costs. Indeed, the next new blockbuster drug could well be discovered with the assistance of AI; and

- the energy sector where, by predicting energy usage, AI can optimize the power grid to save costs and prevent power outages and be used to extract more from existing energy deposits while poring over mountains of geological data to spot promising locations for new sources. By some estimates, AI will have a $14.5 billion impact on the energy sector in five years.

Not every AI investment will be a winner, so it is imperative that you:

- do your own research,

- review the AI and related stocks with the best performances since the beginning of 2023,

- read up on all the analyses and commentaries that are available on AI and

- seriously consider investing in a number of sector ETFs – as opposed to choosing individual stocks – that invest in the areas of interest to you, such as:

- iShares Global Financials ETF (IXG),

- VanEck Pharmaceutical ETF (PPH),

- iShares Global Energy ETF (IXC),

- iShares Semiconductor ETF (SOXX), and

- Global X Artificial Intelligence & Technology ETF (AIQ):

Conclusion

As I said in the opening paragraph, you are mistaken to think you’ve missed the AI boom. Investors who bet on the right AI stocks now – at the dawn of AI in the early 2020s – are giving themselves the chance to turn thousands into millions.

I hope this article has given you the incentive to get ready NOW and some information that will help you with that.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money