…The markets have recovered since the stock market correction in December 2018, and it seems nobody is worried anymore, …[but] the numbers are not looking good, so caution is advised if you decide to jump into the stock market.

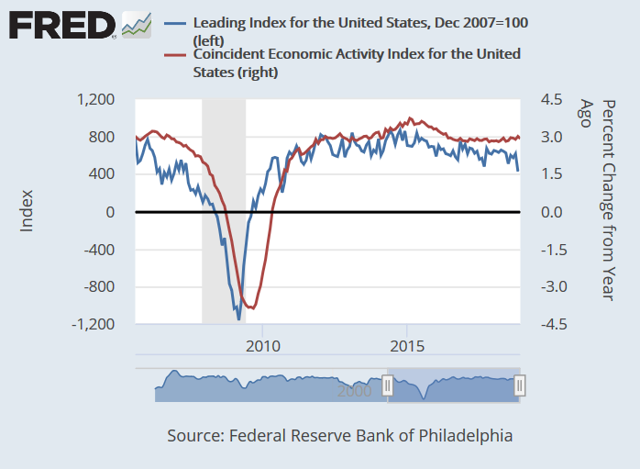

1. Leading Economic Indicator Has Hit A New Low

…We haven’t seen such a bad number since 2010 so I expect that the coincident “soft” indicator will follow soon.

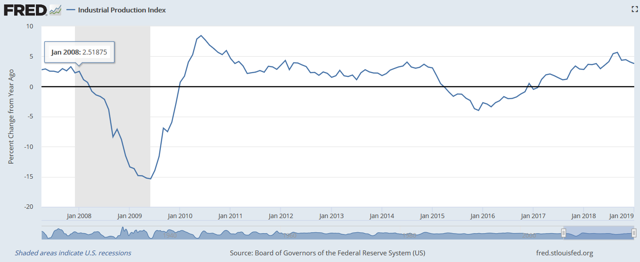

Let’s go over the deteriorating “hard” indicator numbers:

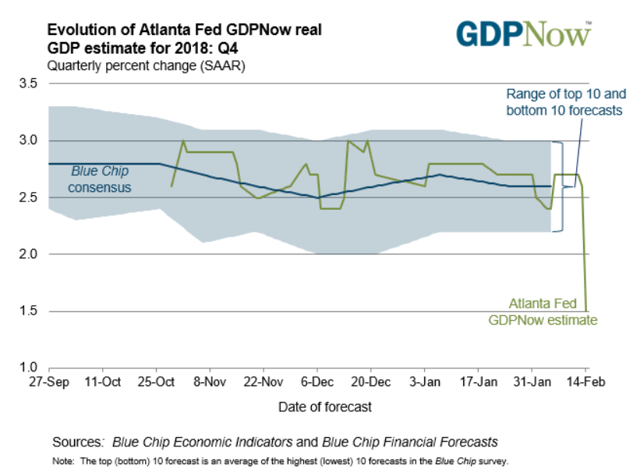

2. The latest GDP numbers were abysmal

The Atlanta Fed slashed its GDP forecasts for Q4 in half to 1.5% so we are really approaching a recessionary period here.

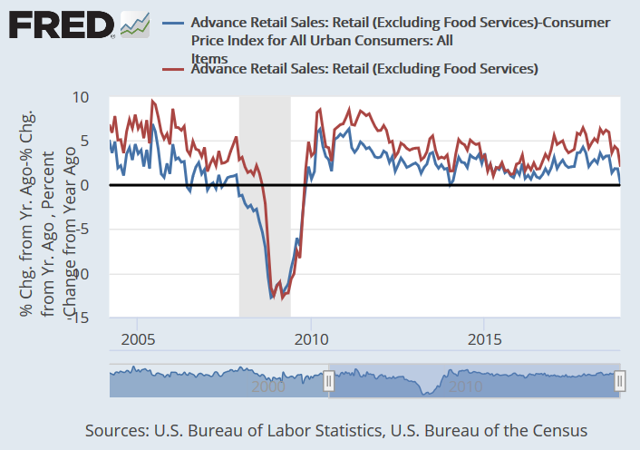

3. Inflation-adjusted retail sales are now negative year over year

…Retailers like J.C. Penney (NYSE:JCP), Macy’s (NYSE:M) and Nordstrom (NYSE:JWN) have been underperforming.

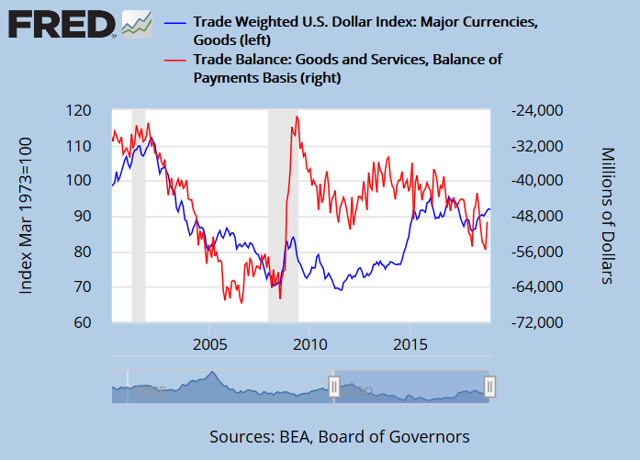

5. The U.S. trade deficit improved in November 2018, but it is still pointing down

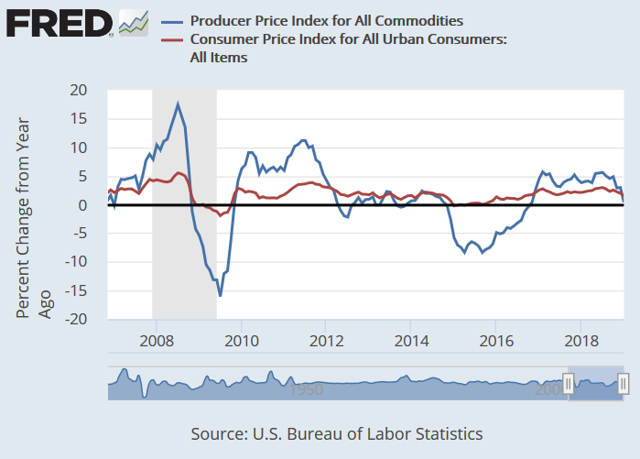

6. Producer prices are crashing down

This suggests that consumer prices will follow the same path.

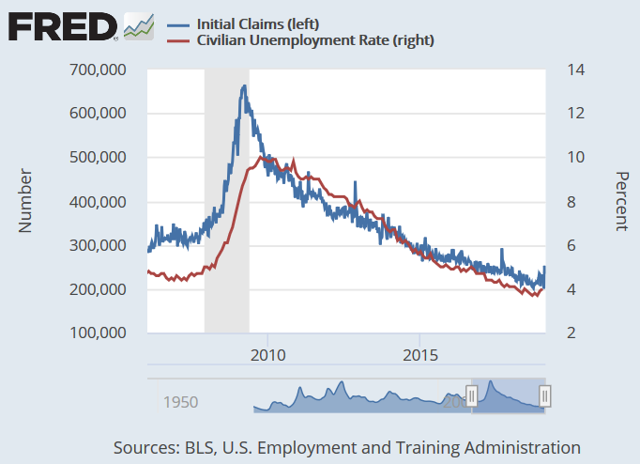

7. Initial jobless claims are now starting to move higher, because real GDP growth is weak

The conclusion is that there are multiple signs that the economy is cooling down:

- GDP growth is weak,

- inflation is low,

- and jobless claims moving higher.

All the ingredients for a recession are present. With this in mind, I also suspect that the Federal Reserve will end QE this year.

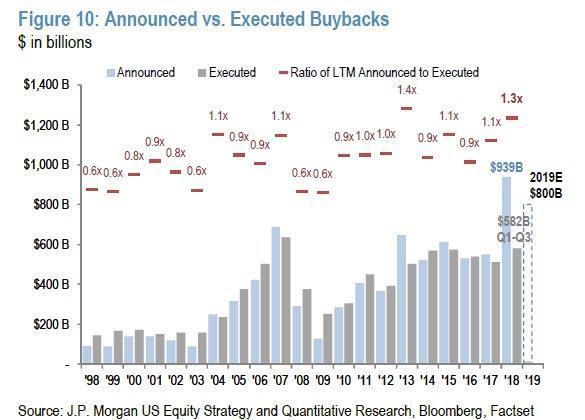

You might wonder why the stock market is up for the year then? The answer lies in stock buybacks.

- All the money that was being repatriated back into the U.S. and

- all the money from tax cuts

have been flowing into stock buybacks since the start of 2018, and this will continue until the end of 2019. We are now halfway.

If you’re smart, you’ll take this opportunity to reduce your risk.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money