An investment advisor friend of mine recently asked me to summarize for him the criteria I would use if I were looking to identify an investment advisor to work with and I came up with 15 characteristics I would look for in what for me would be an 'ideal investment advisor' which I would like to share with you. Words: 679

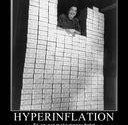

Read More »Will Hyperinflation Happen in America? Here Are Economic & Political Worst Case Scenarios (+8K Views)

I have been reading a lot lately about the coming hyperinflation in America... [and while] I respect many of the writers [who express that opinion] I think they are jumping the gun. At this point none of the economic or political factors required to set off hyperinflation are present - and a careful analysis of theory, fact, and history leads me to conclude that inflation/stagflation is our future. It is quite a leap of fancy to say we are certain to have hyperinflation. Words: 2780

Read More »6 Arguments For Maxing Out Your 401(k) Contribution (+3K Views)

Maxing out your 401(k) is often the best way to accumulate a healthy sum for retirement, and there are great tax benefits as well...Consider these 6 arguments.

Read More »History Says Global Debt Levels Will Lead to Another Crisis (+2K Views)

Analysts at Deutsche Bank recently released an extensive study that demonstrates the link between debt and crisis. One chart in particular screamed for attention.

Read More »The Gap Between the Retirement ‘haves’ & ‘have-nots’ Continues To Grow

The gap between the retirement ‘haves’ and ‘have-nots’ has grown since the recession ended and it is only going to continue growing unless people are provided with enough financial guidance so they can plan accordingly.

Read More »The Silver Setup Is Stunning – Absolutely Stunning! (+3K Views)

A major new silver bull market looks imminent and is expected to kick off with a dramatic spike.

Read More »Welcome to the New Retirement Model – NO Retirement! Here’s Why (+4K Views)

Welcome to the new model of retirement. No retirement. In 1983 sixty two percent (62%) of American workers had some kind of defined-benefit plan. Today less than 20% have access to a plan. The majority of retired Americans largely rely on Social Security as their de facto retirement plan [and the 35 and younger cohort are not able to save, or save enough, to eventually retire. True retirement is now a thing of the past except for a privileged few. Let me support this claim.] Words: 1091

Read More »The Financial Crisis “Nobody Saw Coming” IS Coming (+3K Views)

Almost every financial crisis is presented in the mainstream media as one that "nobody saw coming" yet, as the 4 charts show below, the next one is foreseeable - "the writing is already on the wall".

Read More »Silver Trend Is Inevitable In Its Outcome – Here’s Why (+3K Views)

Supply and demand trends are clearly poised to continue tightening the silver market and when the next crisis hits the silver price will be significantly impacted by this trend. It may not happen this year, but the 20,000-foot view of this market says a crunch is on the way. It’s supply/demand 101.

Read More »Frustrated By the Comatose Silver Price? Don’t Be. Here’s Why (+3K Views)

Frustrated by the comatose silver price? Tired of it going nowhere and being held down? Well, history has a message for you: This trading behavior is normal. Furthermore, similar scenarios from the past say the next price explosion is on the way.

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money