Retirement years can be plagued by financial uncertainty what with not having a steady paycheck coming in. Fortunately, common sense money saving opportunities as presented in this article furnish relief for seniors.

Read More »Almost Anyone Can Afford to Retire in Mexico – Here’s Why (+3K Views)

Only 4% of Americans who start working at age 25 are expected to have saved enough for retirement at age 65 yet, while this number may seem surprisingly low, retiring doesn't have to be as expensive as you may think. One easy way to do this: retire abroad. For many Americans, Mexico is a top choice. It's not only geographically close, it's also very affordable...

Read More »Interested in Buying Gold or Silver Mining Company Warrants? Here’s How (8K Views)

Buying and selling warrants associated with commodity-related companies (including those of gold and silver miners) can be very confusing if you are not aware of the unique information required to do so and understand just how to go about it. Below you will find all the information you need to know on the subject.

Read More »Derivatives: Their Origin, Evolvement and Eventual Corruption – Got Gold! (+5K Views)

The term “derivative” has become a dirty, if not evil word. So much of what ails our global financial system has been laid-at-the-feet of this misunderstood, mischaracterized term – derivatives. The purpose of this paper is to outline the origin, growth and ultimately the corruption of the derivatives market – and explain how something originally designed to provide economic utility has morphed into a tool of abusive, manipulative economic tyranny. Words: 3355

Read More »Here’s the Timetable For the Upcoming Explosion Of the U.S. Debt Bomb (+3K Views)

the U.S. national debt is not a problem, says Gary Shilling, until we either see "a tremendous amount of inflation or a complete breakdown in confidence in US Treasury obligations." Once that happens, the world's largest economy is at risk of an exploding 'debt bomb.'

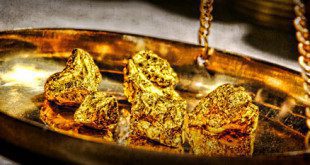

Read More »A “Troy” Ounce of Gold is 10% Greater Than a Regular Ounce – True or False? (+4K Views)

When the price of gold is mentioned as costing “x dollars per troy ounce” do you fully appreciate the signifance of the term "troy"? When looking to buy gold jewellery do you fully understand what the difference is between an item that is 10 "karat" gold and another item stamped 18 "karat" gold (other than that it is much more expensive)? Let me explain. Words: 587

Read More »Gold Will Go Parabolic When This Event Happens – But We’re Not There – YET! (+3K Views)

One of gold's allures is its use as a hedge against negative economic outcomes: inflation, deflation, general economic collapse and even war [with] investors and speculators enter[ing] the market based on their guesstimate of how bad things might get. [An analysis of] how gold performs during inflation and deflation [suggests, however, that there has to be some another] market force - some secret force - that has driven gold prices by +370% over the last 10 years. Words: 734

Read More »What’s a “Goldbug”? Why It’s Critical To Understand the Purpose & Reasons For Owning Physical Gold (+3K Views)

This article defines the term "goldbug", identifies the real purpose of holding gold and provides 9 reasons why we should own some physical gold.

Read More »James Turk Interviews Robert Prechter: Which Will It Be – Hyperinflation or Massive Deflation? (+5K Views)

James Turk believes hyperinflation is ahead. Bob Prechter believes massive deflation is coming. An interesting discussion between the two takes place in this audio. Ultimately, both lead to Depression. Only the route taken differs, but that is important.

Read More »Saving For Retirement Today Will Compound Your Returns Tomorrow (+3K Views)

When should you start saving for retirement? Financial advisors say it is never too early to drop a chunk of your monthly paycheck into a retirement account – and ideally in your 20s when you start earning a steady paycheck. The compounding effect of money can be very powerful especially over a long period

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money