Rising costs in the U.S. are driving more people to consider retirement in less expensive locales and the list of potential resting spots is long and varied. International Living compiles annual lists on the best places to retire based on things like cost of living, ease of entry, healthcare, insurance and access to amenities. [Below are their top 10.] Words: 950

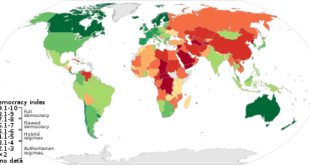

Read More »U.S. Designated A “Flawed” Democracy – Ranks 25th; Canada Ranks 7th – Here’s Why

The Democracy Index measures the state of democracy in 167 countries. The U.S. ranks 25 and is designated a Flawed Democracy. Here's why.

Read More »The American Dream Has Now Moved North to Canada! Here’s Why (+4K Views)

Whether it was due to geography or history or maybe even policy, we have arrived. Everything America once aspired to be, we now are. Not only have we achieved the fabled American Dream, we are arguably among the safest, healthiest, happiest human beings to have ever existed.

Read More »Consider Moving Abroad to Reduce Living Costs – Here’s Where (+5K Views)

Moving abroad may seem far-fetched, but it’s worthwhile to at least consider it as an option in your financial journey. A foreign country with a low cost of living could save you money while also providing fascinating cultural experiences and adventures...Let’s take a look at some of the differences in income and spending around the world.

Read More »Gold & Silver vs. Fiat: Do You Live In An Imaginary World Or In Reality? (+4K Views)

Make no mistake about it, it is the central bankers that are leading governments around by the nose, and by proxy, governments leading people around by the nose, and that “nose” is inhaling “lines” of fiat. Unless cured, all addictions end badly, and the only “cure” central bankers have for ever-increasing fiat is, ever-increasing it more. [You can protect yourself, however, by] demanding less of the valueless fiat and keeping, and growing, your wealth by buying and accumulating real value: physical gold and silver. Anything less, and you are still dealing in the imaginary world that is failing. [This article explains why that is the case.] Words: 834

Read More »Stock Market Seasonality: Be Careful This Summer!

The popular seasonal stock market saying "sell in May and go away" conveys that the stock market tends to under-perform in the six summer months compared to the six winter months but is this indeed the case?...Is this typical period of weakness in the summer months only seen in U.S. markets, or does it exist in other countries as well?

Read More »Grow Your Savings Slowly But Safely – Here’s How

Did your portfolio lose money over the past few years? Well, don't despair as there are many low-risk investment options that can help you grow your savings slowly - but safely. Here are ten safe and low-risk investment options to consider.

Read More »How Much Do You Pay in Taxes Compared to Residents of Other Countries? Take a Look (4K Views)

It seems that Americans (and particularly those who vote Republican) are always complaining about how much they pay in personal income taxes. Frankly, however, they have absolutely nothing to complain about when compared to what the citizens of Canada, Australia, the U.K., New Zealand, Germany, Belgium and almost all other countries pay. Here's a list of 20 countries of note showing what their effective tax rates are at the equivalent of USD100,000 and USD300,000 for comparative purposes. Words: 510

Read More »Home "Owners": Here Are 10 Advantages to Paying Off Your Mortgage Early (+5K Views)

Paying off the mortgage early is an idea with obvious appeal, but not one that many middle-class home "owners" pursue. If your interest rate is so good that the bank just made a bad bet in giving you that low rate, you might want to continue enjoying the benefits as long as possible. In many other circumstances, however, paying off the mortgage can be a fine money management move indeed. [Below are 10 sound reasons to do so.] Words: 1588

Read More »In Debt? Kick it to the Curb, Get Rich, and Start Living Life to the Fullest! Here’s How (+5K Views)

If you’re among those struggling with debt and just want to be rid of it and move on with your life, it can be helpful to find some information and inspiration from others who are financial experts or people working to pay off substantial amounts of debt. You’ll find all of that, and more, in these inspirational personal finance blogs that can offer you advice, motivation, and guidance in paying down your debts so you can start putting that money to other uses. Words: 1010

Read More » munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money