This article identifies the top 10 most owned stocks by the 49 value-oriented “super investors” as tracked by Dataroma.com and those stocks that are most popular with said 49 investors. Take a look! Words: 947

So says Ultralong (www.thoughtsofaprivateinvestor.blogspot.com) in an article* written for SeekingAlpha.com which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

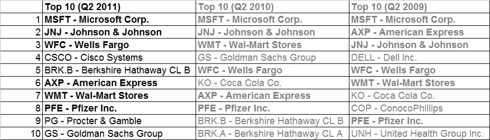

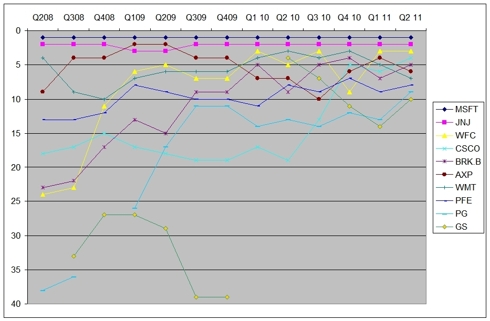

Microsoft (MSFT) is the most owned stock currently (24 out of 49 investors holding it). Goldman Sachs (GS) is the 10th most owned stock (13 out of 49 investors holding it). As you can see from the table below, the Top 10 has changed relatively little in two years. Apart from Cisco Systems (CSCO), Berkshire Hathaway B (BRK.B), Procter & Gamble (PG) and Goldman Sachs, all others have been in the top 10 in the second quarter of 2009, 2010 and 2011:

A closer look at history reveals that Microsoft and Johnson & Johnson (JNJ) have been in the top three every quarter for the last four years. Wal-Mart Stores (WMT) and American Express (AXP) have been in the top 10 every quarter for the last four years.Pfizer (PFE), Wells Fargo (WFC) and Berkshire Hathaway have been clearly also long time favorites of the famous value investors. Cisco Systems and Procter & Gamble…made a steady rise…[into] the top 10 during the last four years.

1. Which Investments Are the Best Safe Havens In A Financial Crisis?

As investors look for safe havens in a potential market panic, I am reminded of the adage, “In the land of the blind, the one-eyed man is king.” Today, I see several metaphorical one-eyed men in this land of the blind that could serve as safe havens were there to be a market panic. All of them have significant flaws. In this post I would like to discuss them one by one. Words: 780

In response to a recent request to identify the best one investment that provides acceptable growth without incurring unreasonable risk we applied our proprietary algorithms based on our unique ZYX Change Method and came up with a relatively unknown equity that warrants serious consideration for inclusion in your portfolio. Words: 454

Benjamin Graham, known as the father of value investment, is famous for his simple, yet powerful, valuation method as first explained in his 1973 book, Intelligent Investor, and later updated in his book entitled Renaissance of Value. His “Graham Number” approach has been adapted and applied to all 30 stocks listed on the Dow Jones Industrial Index to determine which of the stocks have above average safety factors – of which only 10 do. Below is an explaination of the approach, the formula and the results for all 30 stocks. Words: 1220

Recent stock market action has brought the major indexes into at least a correction zone, if not an outright new bear market. So, if this is a new bear market, how can you dodge another bear bite? [I have 4 suggestions on how to do just that. Read on!] Words: 746

5. Which Stocks Trade at a Discount to the “Graham Number”?

Benjamin Graham, the “godfather of value investing” created an equation to calculate the maximum fair value for a stock, referred to as the Graham Number and any stock trading at a significant discount to this number would appear undervalued. [Here are the names of 18 such stocks.] Words: 1707

6. Now’s the Time to Buy Quality Dividend Stocks – Consider These 11

The decrease in stock prices over the past weeks has many investors scared that the market is forecasting a dip in the economy. This panic has started to create an environment where enterprising dividend investors could start adding to their positions at cheaper prices. In fact, if stocks keep going lower this would create tremendous opportunities for enterprising dividend investors to scoop up some of the best dividend stocks in the world at fire sale prices. In this article I will explain why the market dip has created a perfect opportunity for dividend investors and specify 11 stocks worth considering. Words: 819

7. Don’t Fight the Fed: Buy Some of These 20 Blue Chip Stocks Instead!

The herd continues to stampede into U.S. Treasury debt of every possible maturity to, theoretically, avoid risk. Yields on AA+ 10-yr bonds can be locked in to yield 2.11% per year and you get your principal back in 10 years. [As we see it, though] the only justification for [such a meagre] return on invested capital must be tied to the belief that a return is better than nothing given the prospects of a future depression. We believe, however, that fighting the Fed and investing like a depression is coming is not the right way to position your portfolio. [Below are 20 suggestions on how to generate in excess of 2.11% returns plus strong appreciation potential with modest risk.] Words: 657

8. These are the Top 10 Stocks Based on Yield and Payout Ratio

I have identified 248 stocks with histories of 10+ years of raising dividends…and ranked the yields and payout ratios of each…to create an average overall rank for each stock. Here are the top 10 on the list. Words: 325

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money