We can make some inferences about how inflation is impacting our personal expenses depending on our relative exposure to the individual components [and any way you look at it inflation is on the rise – so let’s take a look at the particulars.] Words: 769

So says Doug Short (www.advisorperspectives.com) in an article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited ([ ]), abridged (…) and reformatted below for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Short goes on to say, in part:

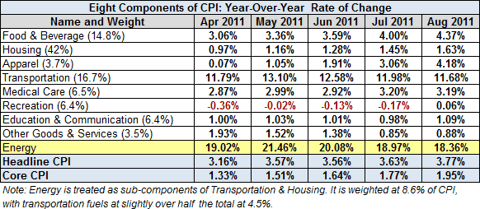

[Below] is a table showing the annualized change in Headline and Core CPI for each of the past five months. I’ve also included each of the eight components of Headline CPI and a separate entry for Energy, which is a collection of sub-indexes in Housing and Transportation.

The Trends in Headline and Core CPI

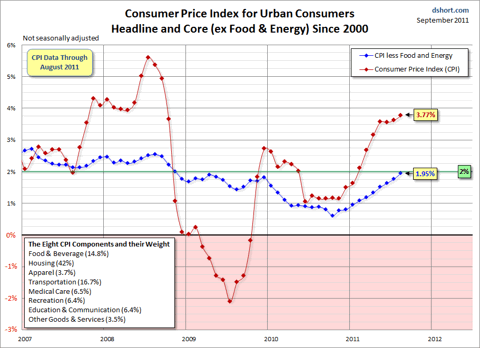

The chart below shows Headline and Core CPI for urban consumers since 2007. Core CPI excludes the two most volatile components, food and energy.

Core CPI has been on the rise but and is now at the Fed’s inflation target of 2% (1.95% at one decimal is 2%). However, the more attention-grabbing headline CPI has more than doubled since January.

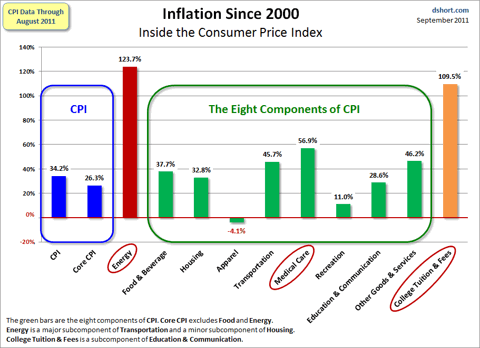

For a longer-term perspective, here is a column-style breakdown of the inflation categories showing the change since 2000.

*http://advisorperspectives.com/dshort/updates/Inflation-X-Ray-View.php

Related Articles:

1. Inside The Consumer Price Index: What Inflation Really Means To You

The Fed justified the last round of quantitative easing “to promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate”. In effect, the Fed is trying to increase inflation, operating at the macro level but what does an increase in inflation mean at the micro level — specifically to your household? [Let’s take a look.] Words: 1555

2. Higher Lumber Costs Today = Higher Housing Costs Tomorrow = Higher Inflation in 2012/13

Housing makes up 42% of the Consumer Price Index (CPI) with the rest of it – food, energy, clothing, recreation, education, transportation, toys, cosmetics, etc. – making up the other 58%. [The current] softness of housing prices is artificially suppressing the growth of the CPI inflation rate [but with the coming increase in lumber costs that is about to change. Let me explain] Words: 772

While it is true that the average consumer isn’t (and won’t soon be) spending as much as he used to, it’s not because he’s waiting for bargains. No, it’s because he’s out of credit, he’s unemployed, his house, car, motorcycle, boat, and plasma television have all either been repossessed or foreclosed upon, and his wife just left him. He’s not exactly in the mood for shopping. He’s not waiting for bargains. He’s waiting for a miracle – and I don’t think they sell those at the mall. Words: 1582

4. The CPI, TIPS and Protecting Yourself From Inflation: What You Need to Know

Many investors are worried about inflation and, as a result, are considering buying inflation indexed bonds and other inflation protected investment vehicles. They may be setting themselves up for significant losses, however, because of the way the government is now calculating the CPI, and the further changes being proposed. In the opinion of this writer, the CPI calculation appears to be inaccurate and, as a result, such investments may not be appropriate inflation hedges. [Let me explain.] Words: 1533

5. Real-time Inflation Data is Now Available – Finally

Inflation is a significant measurement for the economic health of countries around the world but rates are often reported weeks after data is collected. To address this problem, two professors at MIT Sloan School of Management have launched the Billion Prices Project which is the first website to publish daily price indexes and provide real-time inflation estimates around the world. Words: 825

6. These Indicators Say Inflation to Go to 4% Soon – and 6% by 2014

In response to the financial crisis of 2008, the Fed injected unprecedented levels of liquidity into the banking system. While inflation has been modest to date, an analysis of similar periods in history shows that it typically takes more than two years for the impact on consumer prices to be seen. Consequently, we are now at a pivotal point in the current cycle as Fed stimulus began more than two years ago. [Let me explain further.] Words: 2755

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money