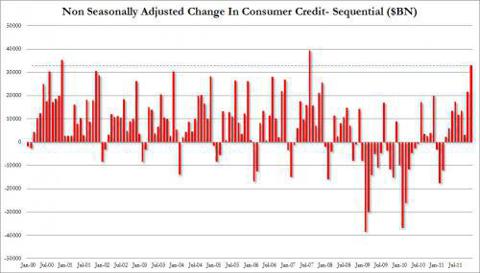

For the bulls yesterday’s news of a much higher-than-anticipated jump in consumer borrowing is yet more proof that the recovery is on track. [For the bears it is outright confirmation that America’s spending is setting it up for a major financial crash! Let me explain.] Words: 527

For the bulls yesterday’s news of a much higher-than-anticipated jump in consumer borrowing is yet more proof that the recovery is on track. [For the bears it is outright confirmation that America’s spending is setting it up for a major financial crash! Let me explain.] Words: 527

So says Michael J. Panzner (www.financialarmageddon.com) in edited excerpts from his original article* which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!) and www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) has edited ([ ]), abridged (…) and reformatted (some sub-titles and bold/italics emphases) below for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement.

Panzer goes on to say, in part:

Consumer Borrowing Increasing

[According to a recent report in Bloomberg] consumer borrowing in the U.S. rose more than forecast in December, driven by demand for auto and student loans. Consumers “are willing to take on this debt because there is some increasing degree of confidence in the economy,” said Ken Mayland, president of ClearView Economics LLC. “Consumers over the past several years have done a pretty good job of repairing their balance sheets.”Who in the world is currently reading this article along with you? Click here

An improving job market may be giving households the courage to take on more debt in order to sustain spending, which accounts for about 70 percent of the economy BUT increasing dependence on credit may be an indication the gains in employment have yet to push wages high enough to single- handedly give consumers the means to keep shopping.

Student Loan Debt Crisis Looming

[According to] the Rochester Democrat and Chronicle “Student Debt Could Be Next Economic Bomb” leading us to another train wreck.A report by the National Association of Consumer Bankruptcy Attorneys says that student debt is looming as a national problem that could have repercussions reminiscent of the mortgage crisis as what they are seeing at the ground level “feels too much like what they saw before the foreclosure crisis crashed onto the national scene.” In the survey:

- 81% of respondents said that potential clients with student loan debt have increased “significantly” or “somewhat” in the last four years and

- 95% of respondents reported that few student loan debtors have any chance of discharging what they owe through a bankruptcy proceeding because they have to prove “undue hardship” — a standard that is difficult to meet.

- total debt from student loans is about $1 trillion, about 14 times more than 15 years ago and well above the estimated total credit card debt of $798 billion.

The report urges a change in bankruptcy laws so that those burdened with student debt would be on the same footing as others in debt facing bankruptcy…William E. Brewer Jr., president of the National Association of Consumer Bankruptcy Attorneys, offered a warning, “Take it from those of us on the frontline of economic distress in America,” he said. “This could very well be the next debt bomb for the U.S. economy.”

Of course, Wall Street knows better — right? Otherwise, why would they keep buying stocks?

*http://www.financialarmageddon.com/2012/02/on-trackto-a-train-wreck.html

Why spend time surfing the internet looking for informative and well-written articles when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read. Sign-up for Automatic Receipt of Articles in your Inbox and follow us on

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet.

Wars and depressions largely characterize the periods of time where there have been significant run-ups in the level of the U.S. National Debt Burden per Capita [i.e. the U.S. National Debt Burden per Capita-to-income Index], with the debt taken on to support the costs of the U.S. Civil War and World War II being the most significant. Today… it is perhaps most comparable to the Great Depression. [Take a look.] Words: 326

2. 75% of Americans are in Deep _ _ _t!

Rising education and medical costs, on-going credit card interest payments, well used personal lines of credit and large mortgage debt and home equity loans – most a penchant for living beyond their means – is keeping 75% of American households in some degree of debt. Take a look and then pass it on to your friends, neighbors and co-workers.

3. In Debt? Here are 10 Ways Out

When people talk about getting their personal finances in order, they usually try to find relatively pain-free and low-cost ways to reduce debt and increase savings but this is a long-term approach which some people just cannot “afford”. [For them] …it may be worthwhile to consider taking the hard way out of debt. [Let me explain.] Words: 1370

4. American Grads: Here’s a Great Guide to Personal Finance

Graduating from college can be an exciting and stressful time. Suddenly you need to find a job, replay loans and make solid financial decisions. Fortunately, you don’t need to be unprepared. Below are some budgeting basics to keep your spending under control, some suggestions on how to set financial goals and a list of the top 10 American cities for starting out.

5. 2 Ways to Reduce Your Debts Using the “Snowball” Method

What is the best way to reduce debt? The most-efficient means is probably the snowball method. There are two main variations of the snowball method, but you must consider your personality to determine which of the two is right for you. [Let me explain.] Words: 1251

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money