This article takes a look back at the history of gold’s performance as an investment over the years.

The edited excerpts above, and those below, are from an article* by Ben Carlson (awealthofcommonsense.com) entitled A History of Gold Returns which can be read in its entirety HERE.

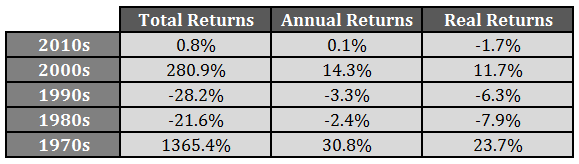

Returns By Decade

I broke down the returns into different time frames to give you a sense of how gold has performed over the different decades:

There’s still plenty of time remaining in the current decade, but if things continue as they have over the past few years, it’s possible that gold could have negative real returns in three out of the past five decades.

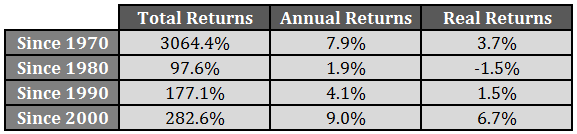

Returns By Starting Point

The starting point for the performance measurement also plays a large role in the total performance numbers:

Had you invested in 1980, following the huge surge in gold in the 1970s, you would have lost money to inflation over the ensuing 35 years. Since 2000, gold has actually outperformed the S&P 500. Both of these statements are true, but you’ll be hard pressed to hear both from gold’s most ardent supporters or detractors.

As with all investments, if you change the time frame, almost any argument can be made either for or against, depending on how the information is presented . Depending on your time frame gold has either been a terrible investment or a solid (no pun intended) diversifier…

The only thing I’m sure of after looking back on the history of the price of gold is that it’s extremely volatile and cyclical. I’ve seen some strong arguments that can be made for a relationship between gold and real interest rates, but that’s the kind of thing that can come and go as it pleases. Other than the aforementioned, I’m not sure I can deduce much from the yellow metal that seems to evoke such passion from certain corners.

*http://awealthofcommonsense.com/a-history-of-gold-returns/

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money