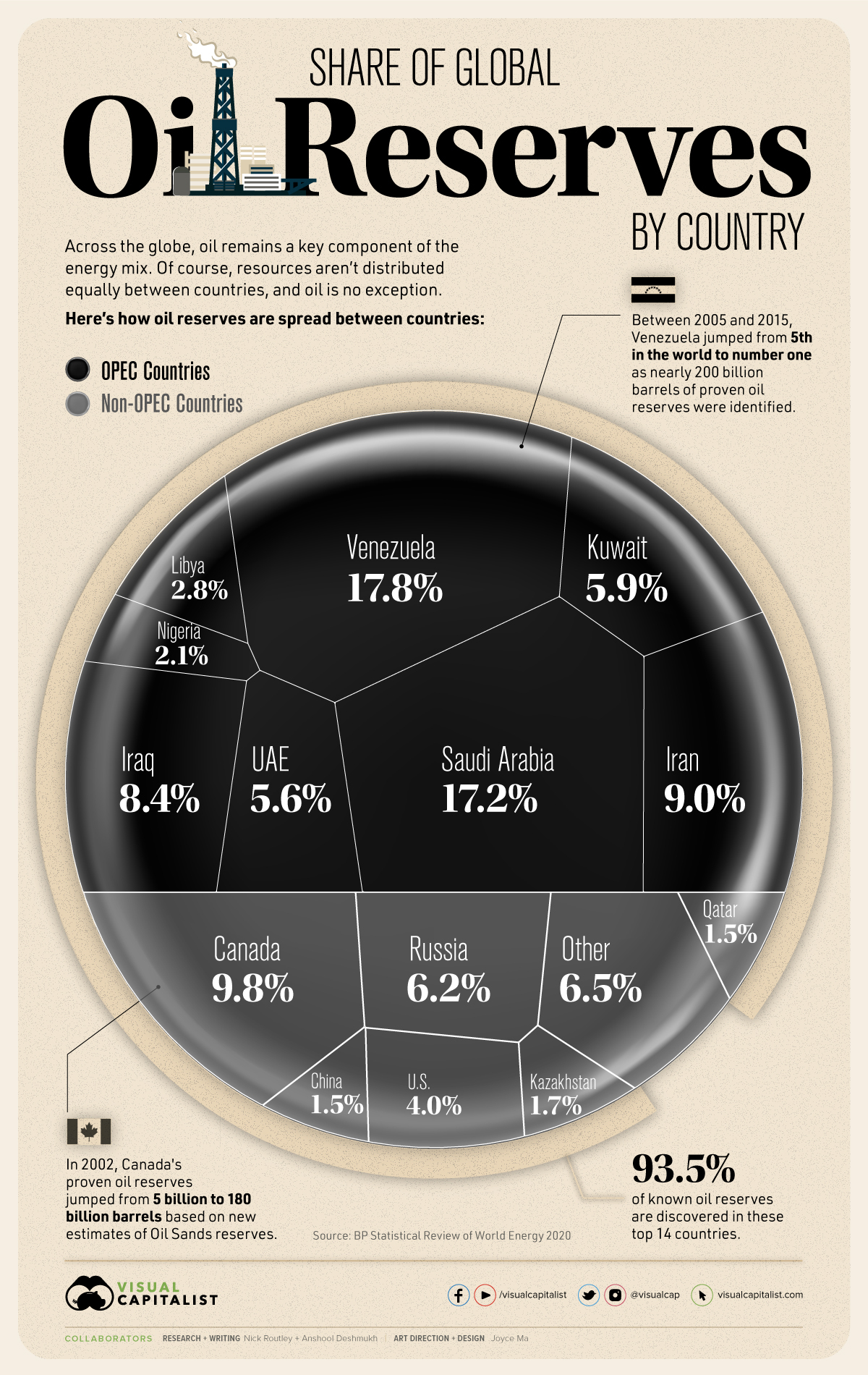

…The world derives over a third of its total energy production from oil, more than any other source by far. As a result, the countries that control the world’s oil reserves often have disproportionate geopolitical and economic power…[and,] according to the BP Statistical Review of World Energy 2020, 14 countries make up 93.5% of the proven oil reserves globally…Here are the 14 countries with at least a 1% share of global proven oil reserves:

Oil Sands Contributing to Growing Reserves

Venezuela has long been an oil-producing country with heavy economic reliance on oil exports. However, in 2011, Venezuela’s energy and oil ministry announced an unprecedented increase in proven oil reserves as oil sands in the Orinoco Belt territory were certified…[and is now] the number…[country in] proven oil reserves…

In 2002, Canada’s proven oil reserves jumped from 5 billion to 180 billion barrels based on new oil sands estimates…[and now] accounts for almost 10% of the world’s proven oil reserves at 170 billion barrels, with an estimated 166.3 billion located in Alberta’s oil sands, and the rest found in conventional, offshore, and tight oil formations.

Large Reserves in OPEC Nations

The majority of countries with the largest oil reserves in the world are the 14 members of OPEC…[and they hold] nearly 70% of crude oil reserves worldwide.

Regional Shifts

…In the past three decades the Middle East share of global oil reserves has dropped, from over 60% in 1992 to about 48% in 2019…[as a result of] constant oil production and greater reserves discovered in the Americas. By 2012, Central and South America’s share had more than doubled and has remained just under 20% in the years since.

Conclusion

…As the world shifts away from oil consumption and towards green energy and electrification, these reserves might not matter as much in the future as they once did.

Editor’s Note: The original article by has been edited ([ ]) and abridged (…) above for the sake of clarity and brevity to ensure a fast and easy read. The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

Related Articles From the munKNEE Vault

1. 10 Questions You Need Answers to Before Investing in Oil & Gas Stocks (+2K Views)

10 questions to ask before deciding whether or not to invest in an oil or gas company. Words: 820

2. More of What You Need to Know Before Investing in Oil & Gas Stocks (+2K Views)

Here are 10 more questions potential investors should be asking oil and gas company management teams or searching for on the company website. Words: 1046

3. How ‘Crude’ are Canada’s Oil Sands? (+2K Views)

The carbon footprint left by Canada’s oil sands has been a target of criticism for years with many environmentalists suggesting that the extraction and processing of bitumen from Alberta’s northern oil sands is “two to three times worse” for the environment than any other supply of oil on the planet. Is that legitimate criticism? Words: 692

4. Crude Oil: How ‘Sweet’ it can be! (+2K Views)

Some people arbitrarily speak about oil as if it is a single, indistinguishably homogenous substance without any unique differentiation, but this is actually not the case at all! In fact, there are many different kinds of oil. Words: 1007

5. Why & How Oil Prices Fluctuate

To understand why and how oil prices fluctuate take a look at today’s infographic from which illustrates the many different issues – supply and demand, weather, technology, geopolitics, as well as other factors – that make oil prices fluctuate.

A Few Last Words:

- Click the “Like” button at the top of the page if you found this article a worthwhile read as this will help us build a bigger audience.

- Comment below if you want to share your opinion or perspective with other readers and possibly exchange views with them.

- Register to receive our free Market Intelligence Report newsletter (sample here) in the top right hand corner of this page.

- Join us on Facebook to be automatically advised of the latest articles posted and to comment on any of them.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money