Automatically receive the internet’s most informative articles bi-weekly via our free bi-weekly Market Intelligence Report newsletter (sample here). Register in the top right hand corner of this page.

I am increasingly bullish on the prospects for silver, for the following three primary reasons:

1. Monetary Extravagance

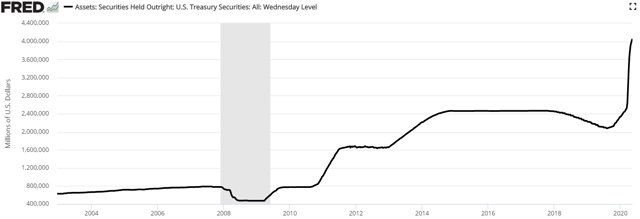

- Since the global financial crisis of 2008/2009, the Federal Reserve’s balance sheet has grown non-stop from about $400 billion to $2.4 trillion (see chart below) from the depths of the crisis to the middle of the expansion…

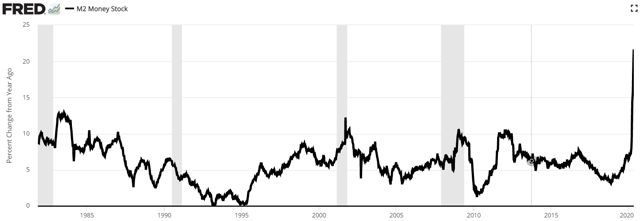

- Today, U.S. Treasury holdings have skyrocketed to about $4 trillion within a couple months and, consequently, to help fill this hole, the world has witnessed the fastest year-over-year growth of US money supply (M2) ever!

Source for both charts: St Louis Federal Reserve

Source for both charts: St Louis Federal Reserve

While much of this new money remains trapped in the banking system, a meaningful portion finds its way into the markets.

- Money supply has a strong correlation – likely causation – with asset prices. This likely explains the huge relief rally we’ve witnessed since the March 23rd lows for the S&P 500.

- Given the Great Depression-era economic fundamentals, it is likely the massive monetary expansion continues.

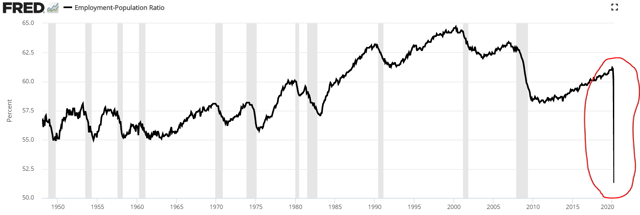

I could show dozens of graphs showing a collapse in GDP, industrial production, sentiment and economic activity. Instead, I’ll show just one: The Employment-Population Ratio.

Source: St Louis Federal Reserve

Source: St Louis Federal Reserve

While it has been deteriorating since its 2000 peak, the number of employed people as a percent of the total U.S. population has utterly collapsed almost overnight.

- In the middle of 2000, 65 people for every 100 were contributing to the economic pie. This number has dropped to 51.

- Said differently, in 2000, the productive activity of 65 people had to cover entitlements for 35 dependents.

Today, each working person must cover the entitlements of one non-working person and this results in enormous long-term shortfalls.

Since it is politically unpalatable to cut entitlements, it is very likely debt expansion – and thus the monetary expansion – continues unabated. It must, or the political and social system collapses under its own weight.

- America wants the champagne lifestyle but has a beer budget. The rest, therefore, needs to be subsidized with debt and a covert economic policy to suppress real yields. It has worked so far, but faith in central banking grows ever weary.

- As this continues, the opportunity cost of holding precious metals – gold and silver – shrinks. This provides a bullish long-term case for both metals.

2. Inflation on the Horizon

Currently, we are experiencing epic deflationary pressures:

- Corporate revenues have collapsed as consumption has imploded.

- Savings rates have jumped,

- and we are teetering at the edge of a catastrophic debt deflation.

The one card holding up the house is massive government and Fed intervention. In the end, perhaps CPI numbers might not show actual deflation. Nevertheless, the pressures are immense.

The world is in the early stages of a new experiment to help support the economy: helicopter money…and, given the poor history of reversing stimulus, it can reasonably be assumed that any form of helicopter money might never end, [after all,] which elected official will be the one to tell the voting public he’s taking away their monthly allowance? That doesn’t sound like a ticket to the White House…

Free money directly into the hands of Americans might create the inflation that central banks never could, because the middle man (i.e. banking system) is removed. Helicopter money is a direct infusion of money into the economy. This has inflationary implications, which is beneficial for real assets like silver.

Helicopter money isn’t the only potential inflationary force faced by America.

- Prior to the COVID-19 tragedy, America and China were in the midst of a trade war. Simply put, one superpower was trying to prevent the rise of another – a competition for power and control. Despite effectively making China what it is today, current American policy is looking to contain that growth.

- COVID-19 amplified that policy, as it underscored the risks involved with relying on China in the supply chain….

Previously, American companies off-shored and out-sourced production to China because it was far cheaper…[we are about to experience a long-term trend] in de-globalization…This means a return to more expensive American production and higher prices for consumer goods – in other words – inflation.

3. The Gold-to-Silver Ratio

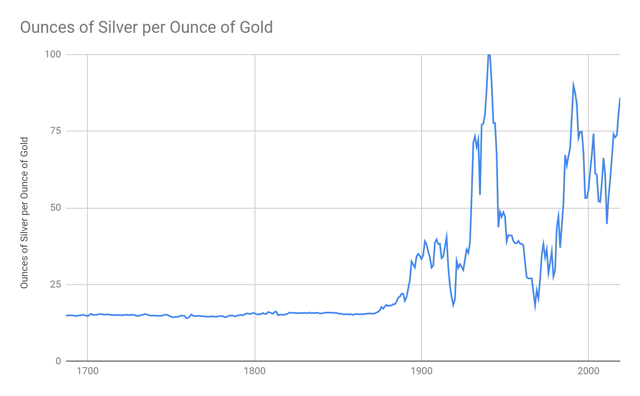

- Between 1687 and 2019, the gold-to-silver ratio has ranged from 14.14 to 99.76 (see chart below).

- Over this period, the average gold-to-silver ratio was 28.19.

- On May 15, 2020 (not shown in chart below), the gold-to-silver ratio was 102.84!

Data source: DumbWealth.com, Measuring Worth

Data source: DumbWealth.com, Measuring Worth

While it’s impossible to say that any ratio is ‘correct’, history does serve as a guide for what’s normal. Based on the simple historical average, the price of silver should be about $62 per ounce.

Another reference point for determining the relative value of something is how much of it exists.

- For every kilogram of Earth’s crust, there is 0.075mg of silver and 0.004mg of gold…[and] this implies there is 18.75 times more silver on the planet than gold.

- While this figure doesn’t consider mining costs, demand, or usage, the ratio is remarkably similar to the long-term average gold-to-silver ratio, both of which are vastly different from the current ratio…[which] provides a bullish impetus to silver vis-a-vis gold.

Final Thoughts

…With massive monetary expansion, potential for inflation and silver’s historical relationship to gold, I believe the upside for silver could be fantastic and is worth consideration. Given its recent under-performance relative to gold, now might be silver’s time.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money