Buying silver now is like buying silver back in 2003 when it was under $5 per troy ounce. It’s the bargain of the century!

The U.S. monetary base basically reflects the total amount of US currency issued. Originally, the monetary base was supposed to be backed by gold available at the Treasury or Federal Reserve to redeem the said currency issued by the Federal Reserve. This is not the case any more, therefore, the amount of dollars have grown exponentially over the years.

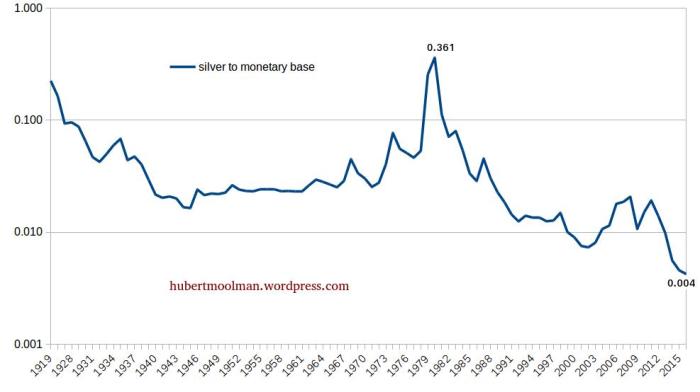

When you look at the silver price, relative to US currency (the amount of actual US dollars) in existence, then it is at its lowest value it has ever been (see chart below).

Below, is a long-term chart of the silver price relative to the US monetary base (in billions of dollars)

Note that the ratio – the price of silver in terms of U.S. dollars in existence – is at its all-time 100-year low. In 1980, the all-time high was 0.361, whereas the ratio is currently at around 0.004. The US monetary base is currently around 3.304 trillion dollars so, if silver was today at its 1980 value, relative to the monetary base, it would be around $1,193 ozt…[As such:]

- silver is trading at 1.24% (14.84/1,193) of its 1980 high.

- It is now like buying silver back in 2003 when it was under $5 per troy ounce.

Silver is the bargain of the century.

Editor’s Note: The above excerpts* from the original article have been edited ([ ]) and abridged (…) for the sake of clarity and brevity. Also note that this complete paragraph must be included in any re-posting to avoid copyright infringement.

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.)

Related Articles from the munKNEE Vault:

1. Gold: Monetary Base Ratio Suggests A Significant Monetary Event On the Horizon

We could be close to major financial/monetary crisis and it is most likely that it could happen during a major stock market crash and recession.

2. Silver Breakout To $22.50-$24.00 Coming In Next 2-4 Months – Then Quickly To +$85/ozt!

Silver has been in a descending triangle over the past 8 years but looks to be nearing completion. This suggests a large move in Silver is near.

4. Silver Will Soon Move Suddenly & Shockingly Higher – Here’s Why (+4K Views)

I am convinced that silver will soon explode in price in a manner of unprecedented proportions, both in terms of previous silver rallies and relative to all other commodities. By unprecedented, I mean that the price of silver will move suddenly and shockingly higher in a manner never witnessed previously, including the great price run ups in 1980 and 2011. The highest prior price level of $50 will quickly be exceeded.

5. Silver Prices Are Way Too Low Any Way You Look At It

The graphs below show that silver prices are too low based on five decades of history and via comparisons to national debt, the S&P 500 Index and gold. Expect silver prices to rise far higher in coming years as the over-leveraged financial system resets and rebalances.

6. This Opportunity Is Being Handed to You On A Silver Platter!

Talk about having an opportunity handed to you on a silver platter! Whether it’s buying shares of SLV or purchasing physical bullion, there really isn’t much of a downside at this point. If you haven’t staked your claim, now’s a good time to do it.

7. Analysis: Silver Prices Too Low – Could Rise Above $30 in 2019 – Here’s Why

It is time to assess risk versus reward and buy silver with currency units recycled from other assets.

8. Silver is Now Even More Precious Than Gold! Do You Own Any? (+5K Views)

Silver is now rarer than gold and will be for all of eternity. From this point forth we work from current silver production alone and, from this point forth, demand will outstrip production without exception. Can you imagine what that means for the future price of this, indeed, precious metal? Forget about the popular expression: ‘Got gold?’ The much more important – and potentially more profitable – question to ask these days is, ‘Got silver?

9. Buy Silver Instead of Gold! Here’s Why (+11K Views)

We are at the beginning of a major shift out of paper assets into real assets and the more I studied the merits of owning gold and silver the more I realized that silver was the smart decision. Let me explain.

10. Gold:Silver Ratio Suggests Much Higher Future Price for Silver – MUCH Higher! (+20K Views)

The majority of analysts maintain that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold and it is realistic to expect that silver will eventually escalate dramatically in price. How much? This article applies the historical gold:silver ratios to come up with a range of prices based on specific price levels for gold being reached.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money