Comparing silver’s current price of $14.98/ozt silver has tumbled:

- by 70% from its intraday peak price of $49.82/ozt 8 years ago this month and

- by 90% from its intraday peak of just over $50/ozt 39 years ago in 1980 (inflation-adjusted price $160.00.ozt).

[Given the above,] some say that $15/ozt silver is a bargain – “a screaming buy!”- but what are the fundamentals and/or technical factors to support such claims?…

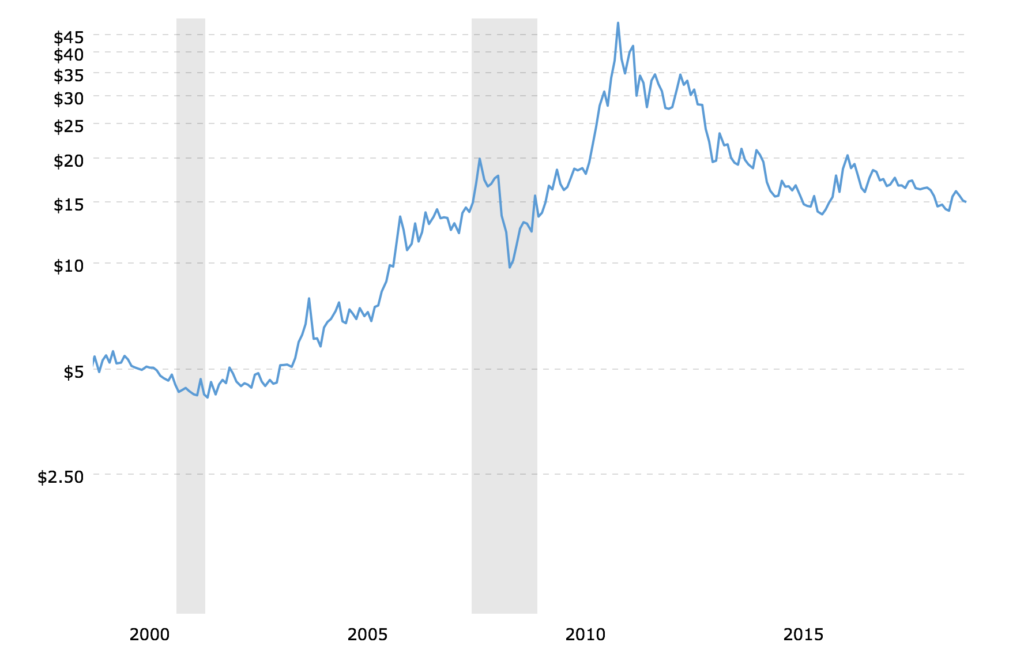

See the chart of the ten-year history of silver prices below.

In order to put things in perspective, however, we need to go further back in time. Below is another chart…[that] shows the silver price for the past twenty years:

The chart…[above shows] that the current 70% decline in silver’s price came on the heels of a 1,150% increase beginning in late 2001 and ending with the price spike we mentioned earlier that took silver to $49.82/ozt. While I haven’t drawn it in, there is a long-term uptrend line dating back to November 2001 that is still intact. Silver could actually fall back to somewhere close to $10.00/ozt in the near term without breaking the trend line…

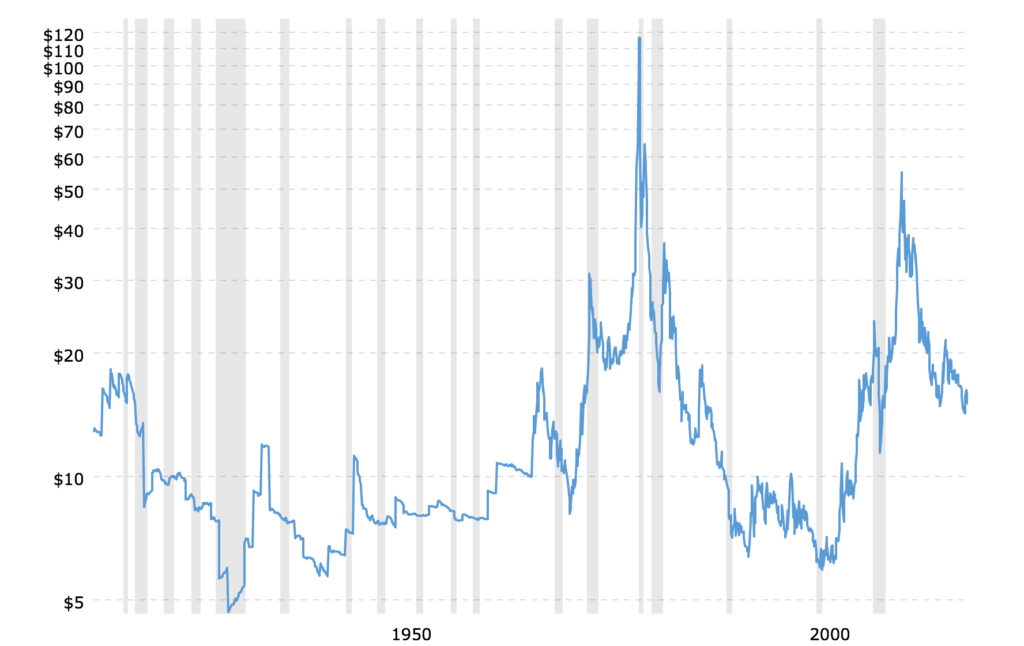

We still need to know more, though, before we can proclaim that all is well with silver. Below is a third chart of silver, which shows a one hundred year history of the white metal:

In this chart, there is also a long-term uptrend line. This one dates back to December 1941. It, too, provides a possible floor under silver’s price of somewhere close to $10.00/ozt…

Here is a fourth chart which plots the price of silver over the past one hundred years on an inflation-adjusted basis:

…Some say that silver at $15.00/ozt is a bargain – “a screaming buy!” but there are NO fundamentals or technical factors to support such claims…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Looking only at the history of silver prices, as this piece does, makes the stated conclusion inevitable. However, the silver market fifty years ago had none of today’s economic, banking, dollar, inflation, debt, balance of payment, government-controlled markets, and cost- escalating recovery issues…plus the fact that above-ground silver was much more plentiful then, and that today’s technology is creating new and expanded uses for silver. When these points are factored in, the problem I see with $15 silver is that it is the means by which the 3-cent dollar continues to masquerade as money.