Long-term oriented investors and speculators should be aware of the near-term trends but they should also be aware of the conditions that will lead to a shift from a bear market to a bull market.

aware of the conditions that will lead to a shift from a bear market to a bull market.

This version of the original article, by Jordan Roy-Byrne, has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here)

This version of the original article, by Jordan Roy-Byrne, has been edited* here by munKNEE.com for length (…) and clarity ([ ]) to provide a fast & easy read. For the latest – and most informative – financial articles sign up (in the top right corner) for your FREE bi-weekly Market Intelligence Report newsletter (see sample here)

Here are the 5 factors that precede major bottoms in precious metals:

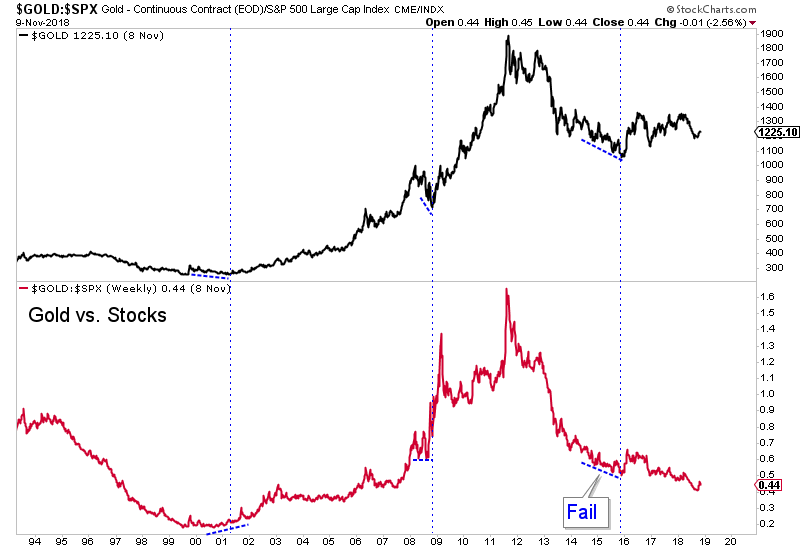

1. Gold Outperforms the Stock Market

Other than in 1985 through 1987, there has never been a real bull market in Gold without it outperforming the stock market. A weak stock market usually coincides with conditions that are favorable for precious metals. That’s either high inflation or economic weakness that induces policy that is usually bullish for precious metals. The 2016-2017 period failed to be a bull market because the equity market continued to outperform Gold.

Note that the Gold to Stocks ratio bottomed prior to the 2001 and 2008 bottoms. #munKNEE.com is being given away – check it out!

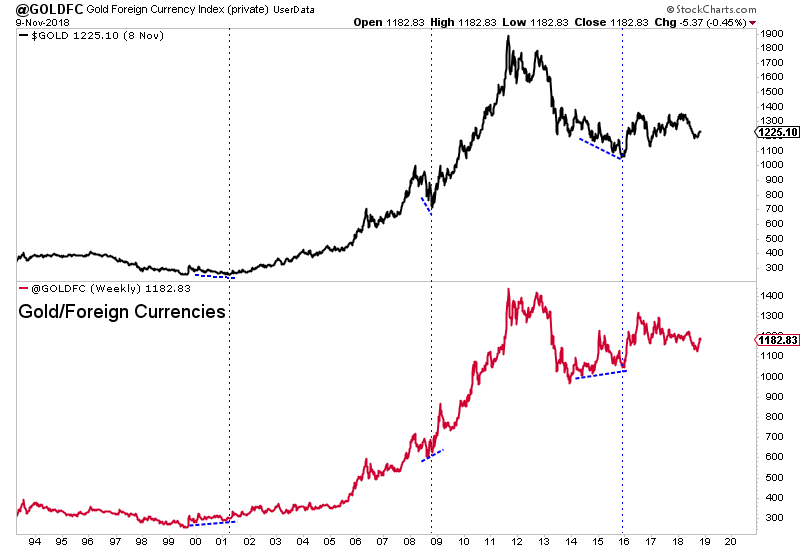

2. Gold Outperforms Foreign Currencies

Gold outperforming foreign currencies is important because this usually happens while the US Dollar remains in an uptrend. It signals relative strength in Gold and shows that Gold is not being held hostage by the strong dollar. It also can signal a coming peak in the dollar. Gold was outperforming foreign currencies prior to the 2001, 2008 and late 2015 bottoms. There are currently no positive divergences in place.

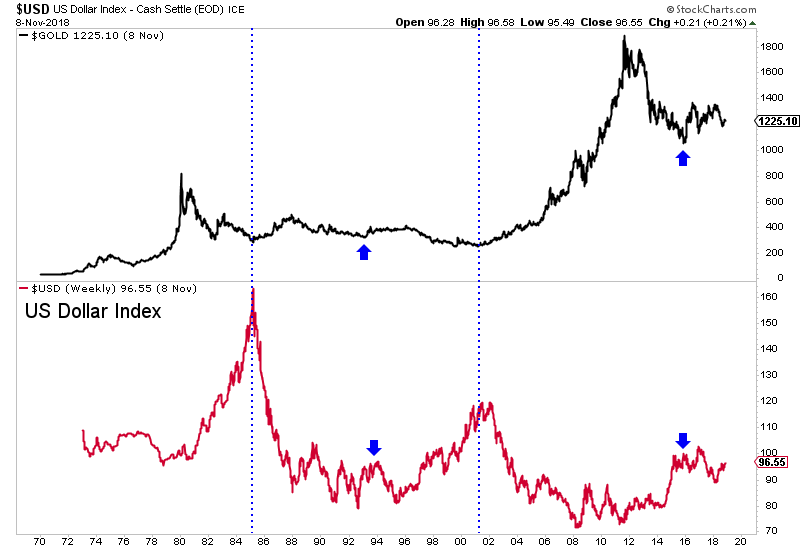

3. Major Peak in the US Dollar

…Gold is not going to embark on a major, long-lasting bull market without a corresponding peak in the US Dollar. Sure, they can rise at the same time and for months on end however, it’s difficult to imagine a multi-year bull market in Gold without a corresponding peak in the dollar. Peaks in 1993 and 2016 led to brief runs in Gold but those were nothing like the 1985 and 2001 peaks.

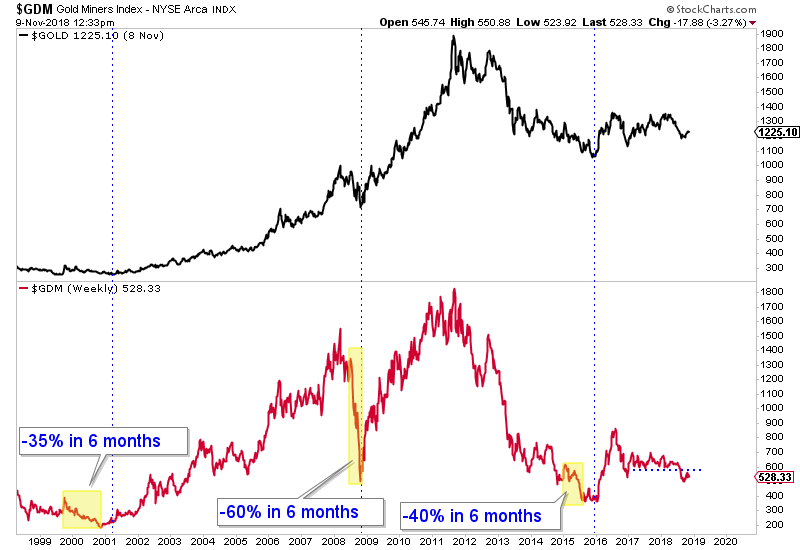

4. Gold Mining Stocks Crash

This is not a mandatory component of major bottoms but definitely is something that can occur before a major bottom. Below we plot GDM, which is the forerunner to GDX. Note that gold stocks essentially crashed into their late 2000 and late 2008 lows. They also crashed into their summer 2015 low which wasn’t the final low for the sector but was for the senior miners. The main point is that if gold mining stocks fall apart again it could very well be a sign that a bottom is almost imminent.

5. Fed Policy Change

Over the past 60 years, gold stocks have often bottomed almost immediately after the peak in the Fed Funds rate (FFR). In 10 of 12 rate cut cycles, gold stocks bottomed a median of one month and an average of two months after the peak in the FFR. The average gain of gold stocks following that low was 185%. There are also points where the gold stocks declined during a period of rate cuts or no Fed activity. Bottoms then were sometimes followed by the start of Fed hikes. However, given the current conditions, we are quite confident that gold stocks will bottom immediately after the Fed’s final rate hike.

Now you know what to look for to signal that a major bottom is imminent.

(*The author’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.}

Thank you for taking the time to read the article. If you enjoyed reading it please hit the “Like” button, and if you’d like to be notified of new articles, hit that “Follow” link.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money