Sell your Tesla shares, Amazons , Facebooks and your government bonds and buy gold and then wait. The next 5-10 years will give us opportunities that only happen once every few hundred years and, due to the massive debt and asset bubbles we are in today, this time the bargains are likely to be greater than any time in history. Sadly, only a fraction of 1% of the investment population can see this opportunity but remember the Golden Rule: “Whoever holds the gold makes the rules.”

then wait. The next 5-10 years will give us opportunities that only happen once every few hundred years and, due to the massive debt and asset bubbles we are in today, this time the bargains are likely to be greater than any time in history. Sadly, only a fraction of 1% of the investment population can see this opportunity but remember the Golden Rule: “Whoever holds the gold makes the rules.”

The original article has been edited here for length (…) and clarity ([ ])

THIS TIME IT WILL BE DIFFERENT

Most investors will hold on to their bubble assets until they have declined by 85-100%. They will again believe that central banks will save them but this time it will really be different although nobody will see that – until it is too late. The transfer of wealth in coming years will be of a magnitude that few can realise today. Most billionaires will disappear and not understand what has happened. They all thought it it was their own ability that created their wealth. They will soon become aware that their wealth was based on the central bank money printing bonanza that favoured a few and impoverished not just the poor but also the middle classes but, when bubbles burst, debts implode and so do asset values…

GOLD HAS BROKEN OUT IN MANY CURRENCIES

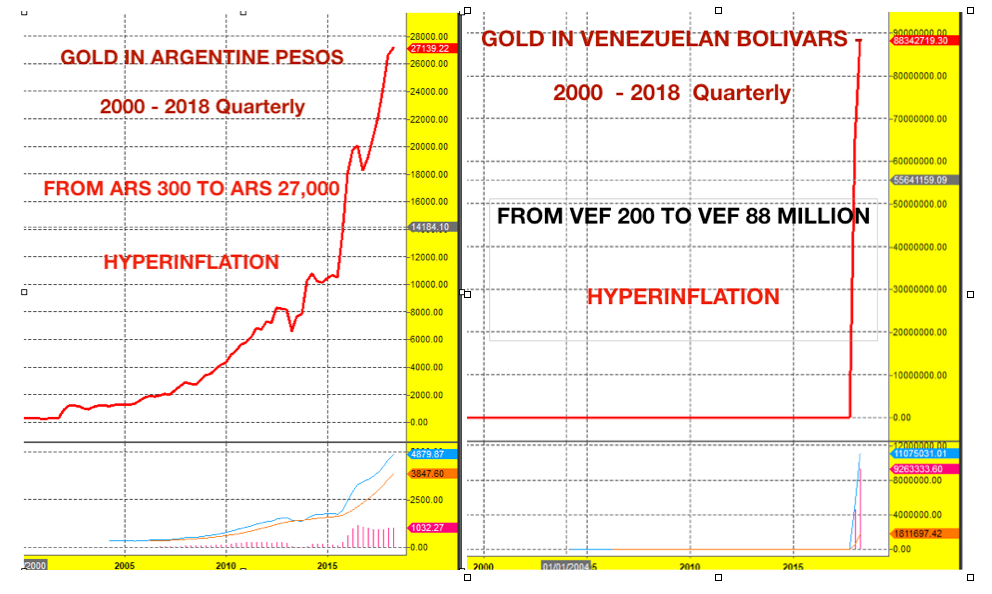

…The problem with looking at gold in just US dollars is that it doesn’t give the full picture. Gold must be measured in the home currency of the holder. Just look at the charts below.

Gold in Swiss francs has broken out and is in a clear uptrend to new highs and gold in Swedish kronor is near the 2012 highs.

Gold in Swiss francs has broken out and is in a clear uptrend to new highs and gold in Swedish kronor is near the 2012 highs.

Looking at gold in the weak South American economies, we can see the effect of collapsing currencies and the resulting hyperinflation.

The gold charts for Dollars, Euros, Pounds and Yen will look the same as the two charts above, in a few years time. Take my word for it. All these countries will have unlimited money printing and hyperinflation.

Don’t ignore the risks and don’t ignore history. Physical gold and silver will be your saviour.

Related Articles From the munKNEE Vault:

1. Hyperinflation: Venezuela Has Experienced 8,900% Inflation In the Last 12 Months!

Venezuelans can no longer afford the most basic necessities. During the first quarter of 2018, consumer prices rose again, this time by 454%. Hyperinflation has made the bolivar essentially worthless. The country experienced 8,900% inflation in just 12 months.

2. 28 Countries Have Experienced Hyperinflation In the Last 25 Years

Hyperinflation is not an unusual phenomenon. 33 countries have experienced hyperinflation over the last 100 years of which no less than 22 have experienced it in the past 25 years and 4 in the past 10 years. The United States is one of the few countries to have experienced two currency collapses during its history (1812-1814 and 1861-1865). Could it happen again?

3. These 5 Currencies Experienced Hyperinflation – Here’s Why

In the following infographic we look at 5 occasions when currencies crashed in a big way.

4. What Would It Take For Hyperinflation To Occur in the U.S.?

There is a difference between inflation and hyperinflation…and there is no gradual path from one to the other. To wind up with true hyperinflation, some very bad things have to happen. The government has to completely lose control… the populace has to completely lose faith in the system… or both at the same time. [Are we there yet? Let’s take a look.]

5. Hyperinflation In The U.S. — A Real Or Imagined Threat?

After seeing the latest string of events unfold right before our eyes, many are openly pondering whether we may see hyperinflation hit the US shores. Rather than ponder Trump’s latest executive orders or over the top pronouncements, let us first look at what hyperinflation is and how it works.

7. Hyperinflation Highly Unlikely In U.S. & U.K. – Here’s Why

Without pricing power or a large fiscal deficit and large foreign currency demands, it simply isn’t credible to claim that hyperinflation in the U.S. or the U.K. is in the offing now or anytime in the immediate future.

8. What’s Coming: A Hyperinflationary or Deflationary Depression?

While I believe that the U.S. is heading towards a Weimar style hyperinflationary depression there are several developments that point to the possibility of another deflationary depression, similar to the 1930’s. Let me explain.

9. A Perspective On the World’s Most Famous Hyperinflation Even

The Great War ended on November 11th, 1918, when the signed armistice came into effect, but the peace agreement lead to additional destruction – the destruction of wealth and savings – in the form of an hyperinflation event in Germany from 1921 and 1924 that caused millions of people to have their savings erased.

10. Finally: A Clear Understanding of Hyperinflation, Money Demand & the “Crack-Up Boom”

Hyperinflation is perhaps the darkest side of a government fiat money regime. Among mainstream economists, hyperinflation typically denotes a period of exceptionally strong increases in overall prices of goods and services, thus denoting a period of exceptionally strong erosion in the exchange value of money.

11. Stages of Hyperinflation & Death of a Fiat Currency

There is a general pattern for the stages of hyperinflation – the stages of the “death of a fiat currency”. Here they are.

12. Debt Default or Hyperinflation? Which Will It Be?

The Fed, together with other central banks from around the world, have created the perfect crescendo of worldwide credit bubbles and asset bubbles leading to the excesses and decadence which are the normal finale to a secular trend. They have totally destroyed all major world currencies and left the world with debts that cannot and will not be repaid with normal money. As such, there are only two alternative outcomes, debt default or hyperinflation. Both will have disastrous consequences for the world economy.

For all the latest – and best – financial articles sign up (in the top right corner) for your free bi-weekly Market Intelligence Report newsletter (see sample here) or visit our Facebook page.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money