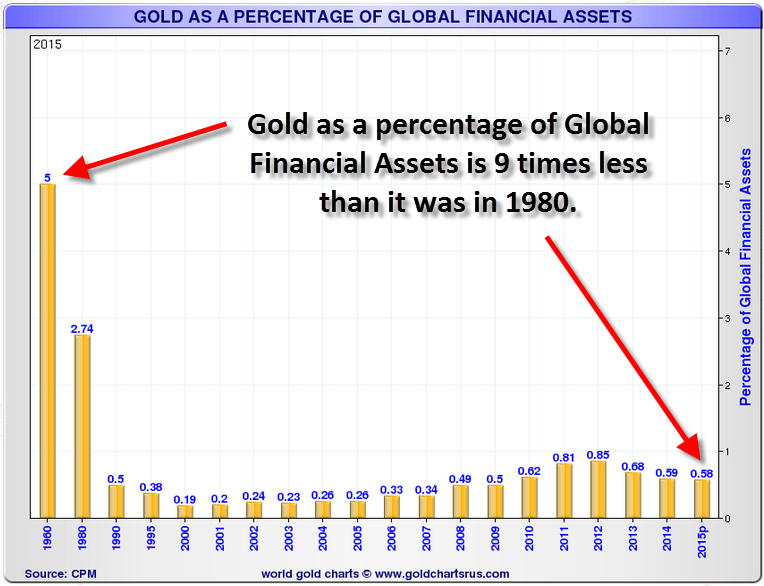

…The price of gold soared from about $160 in 1976 to a little over $800 in early 1980…[at which time] gold investments, as a percentage of Total Global Financial Assets, had reached 5.0%…[By 2000, however,] gold investments as a percentage of Global Financial Assets had bottomed at 0.19%. [What would the price of gold rise to were gold investments to reach 5.0% in the future? The answer: it boggles the mind!]

which time] gold investments, as a percentage of Total Global Financial Assets, had reached 5.0%…[By 2000, however,] gold investments as a percentage of Global Financial Assets had bottomed at 0.19%. [What would the price of gold rise to were gold investments to reach 5.0% in the future? The answer: it boggles the mind!]

The comments above and below are excerpts from an article by I.M. Vronsky (Gold-Eagle.com) which has been edited ([ ]) and abridged (…) to provide a fast & easy read.

By 2001 gold investments as a percentage of Global Financial Assets began a slow methodical climb until the 2011-2012 period when [the price of] gold again made an all-time peak at over $1,900. Understandably, the price of gold then slowly began to decline in concert with the diminishing gold investments as a percentage of Global Financial Assets (which dropped from 0.85% to last year’s 0.58%.

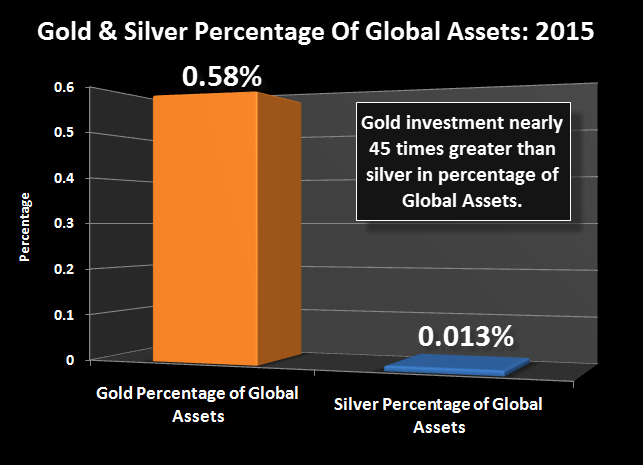

Think about it: Gold investment as a percentage of Global Financial Assets was nearly 9 times greater in 1980 than it is today. To be sure the implications and ramifications of the above are mine-boggling. Here is another chart that focuses on how minuscule recent gold investment is as a percentage of Global Financial Assets:

(Chart Source: SRSrocco Report: https://srsroccoreport.com)

Gold Forecast: In the event gold investments as a percentage of Global Financial Assets again rises to 5.0%, it means 0.05 X 105,000,000,000,000 = $5.25 Trillion ($5.250,000,000,000) will flood into gold. This begs the question: What might be the impact of a tsunami of increased gold investments hitting world markets?…This analyst does not dare try to predict how high the gold price will be turbocharged as a result when this happens…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money