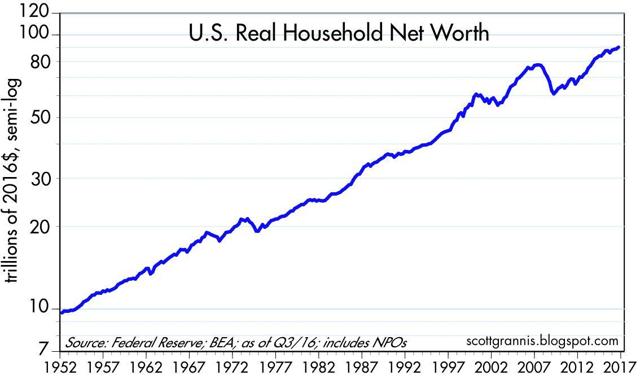

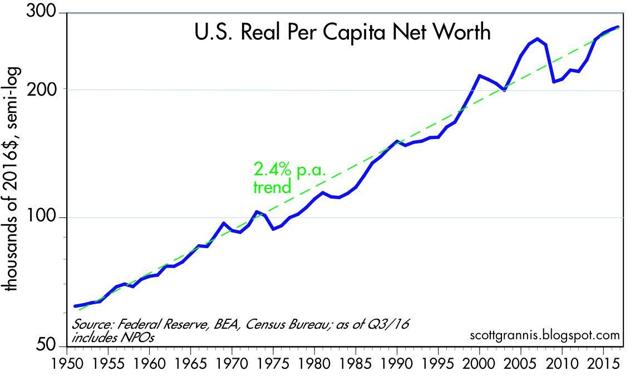

Collectively, our net worth reached a new high in nominal, real, and per capita terms according to the Fed’s Q3/16 estimate of the balance sheets of U.S. households released last Friday. While we are living in the weakest recovery ever, and things could and should be a lot better, it is still the case that today we are better off than ever before.

according to the Fed’s Q3/16 estimate of the balance sheets of U.S. households released last Friday. While we are living in the weakest recovery ever, and things could and should be a lot better, it is still the case that today we are better off than ever before.

The comments above and below are excerpts from an article by Scott Grannis (scottgrannis.blogspot.ca) which has been edited ([ ]) and abridged (…) to provide a fast & easy read.

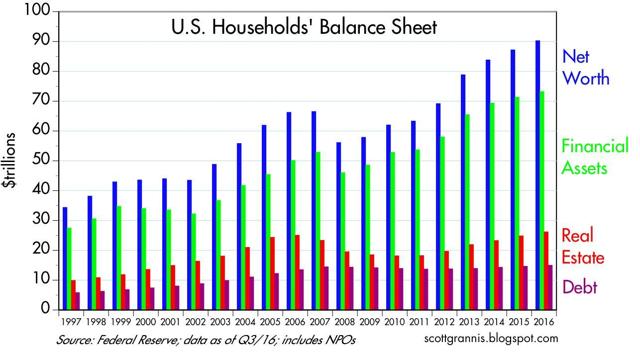

As of September 30, 2016, the net worth of U.S. households (including that of Non-Profit Organizations, which exist for the benefit of all) reached a staggering $90.2 trillion. To put that in perspective, it’s about one third more than the value of all global equity markets, which were worth $66 trillion at the end of September, according to Bloomberg.

I note that household liabilities have increased by only $300 billion since their 2008 peak; the value of real estate holdings is up about 5% from that of the “bubble” high of 2006 (10 years ago!); and financial asset holdings have soared since pre-crash levels, thanks to significant gains in savings deposits, bonds, and equities.

In real terms, household net worth has grown at a 3.6% annualized rate for the past 65 years.

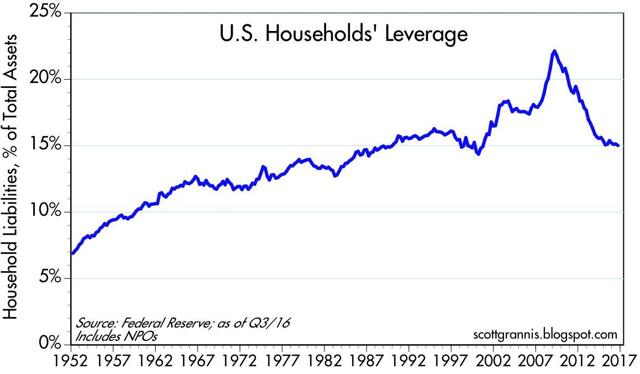

The ongoing accumulation of wealth is not a house of cards built on a bulging debt bubble either, regardless of what you might hear from the scaremongers. As the chart above shows, the typical household has cut its leverage by over 30% (from 22% to 15%) since early 2009. Households have been prudently and impressively strengthening their balance sheets over the past seven years by saving and investing more and by sharply reducing the use of debt financing.

Agree/disagree with the above article? Have your say in the Comment section at the bottom of the page. We want to hear from you!

Disclosure: The above article has been edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

If you want more articles like the one above: LIKE us on Facebook; “Follow the munKNEE” on Twitter or register to receive our FREE tri-weekly newsletter (see sample here , sign up in top right hand corner)

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money