The structural slowdown in global economic growth and dramatic drop in bond yields represent a paradigm shift that is forcing a rethink of portfolio allocations.

bond yields represent a paradigm shift that is forcing a rethink of portfolio allocations.

The comments above and below are excerpts from an article by Jean Boivin, PhD (BlackRockBlog.com) which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

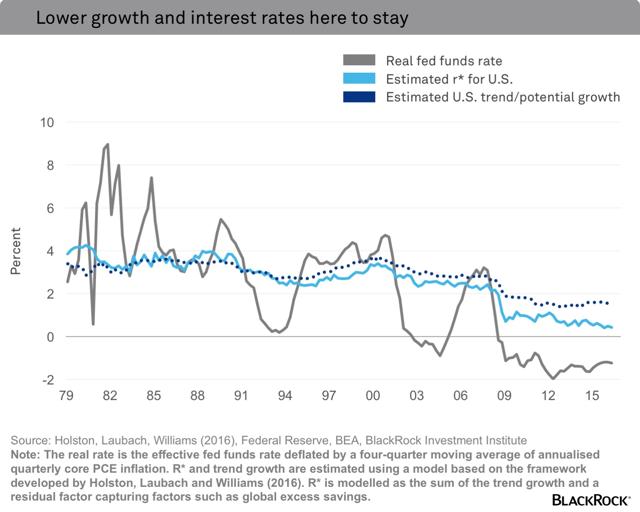

Aging societies, weaker business capital investment and slowing productivity growth have led to a persistent decline in economic growth. As a result, what is now considered a neutral policy rate for a central bank – one that neither stimulates nor restrains growth – has experienced a likely medium-term decline in the United States and other major economies.

Lower neutral rates have meant that central banks need to cut interest rates much lower, even negative, to be able to stimulate economic growth. Central banks in Japan and the eurozone have already done that.

Low neutral rates and large central bank ownership of government bonds are why we see long-term bond yields staying low on a five- to 10-year horizon.

This environment of low growth and low rates has three important portfolio allocation implications:

1. We believe investors are being fairly compensated to take risk in the low-return landscape

Investors should not expect bond yields to revert to historical averages, notwithstanding likely short-term swings. This view shapes our muted outlook for returns.

Low risk-free rates – the fundamental basis for gauging asset valuations – represent an under-appreciated sea change in assessing future returns, in our view. Prospective returns on equities and bonds have fallen across the board after the global financial crisis but this masks the reality that equities – and by extension, other risk assets – still look attractive taking into account that bond yields are likely to stay historically low.

It’s easy to assume that low returns imply little compensation for risk [but] we do not think this is the case. In fact, when looking at the earnings yield relative to real bond yields – the equity risk premium (ERP) – investors are still being well compensated for risk in many corners, we believe.

2. Investors need to reassess how to achieve return and diversification goals

Perceived “safe” assets are looking less safe due to a variety of near-term risks, including:

- elevated valuations and

- political and central bank policy uncertainties.

Meanwhile, equities can potentially generate more income than bonds in a diversified portfolio, since dividend yields in many markets exceed bond yields.

Government bonds will always be a core part of portfolios for some investors, of course but the potential for greater bond market volatility ahead associated with central bank policy uncertainties, and paltry expected returns, should make investors wanting to own government bonds for their perceived “safe” value think twice.

One of the biggest transformations in global financial markets is the drop in government bond yields – not only to historic lows, but into negative territory. About 30% of the development market government bond universe already carries a negative yield, according to the J.P. Morgan Global Developed Government Bond Index.

3. Relative valuations are key

Low discount rates suggest that asset valuations should not fall back to historical means. Thus, what matters are relative valuations across assets rather than putting too much emphasis on historical valuations that belonged to a very different economic environment.

Investors worried about valuations reverting to historical means are assuming that the global economy returns to a pre-crisis state – one that now looks confined to the history books, we believe. Low short-term interest rates and risk-free rates are likely an enduring feature.

The bottom line:

Investors are being offered better returns for taking risk in the low-return landscape, and a portfolio allocation to a broader, diversified mix of assets – including alternatives, global equities and emerging market (EM) assets – can potentially help improve returns, in our view.

Original Source: An unedited/unabridged version of the above post originally appeared on the BlackRock Blog.

Editor’s Note: Don’t bother “surfing the net” looking for the most informative financial articles available. My Facebook page has the BEST financial articles on the internet – bar none! Check it out. I guarantee you will not be disappointed – and don’t forget to “like” or “love” those articles of particular interest to you. I need the feedback.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money