…Market-related predictions have become a quadrennial tradition, but that doesn’t mean that they’re worth the ink that’s spilled on them. In terms of broader trends, politics in general – and elections in particular – have minimal predictive value with respect to subsequent market (and economic) activity. Nonetheless, we’ll take some time to consider what both the historical – and the more recent data might be telling us about this year’s election.

they’re worth the ink that’s spilled on them. In terms of broader trends, politics in general – and elections in particular – have minimal predictive value with respect to subsequent market (and economic) activity. Nonetheless, we’ll take some time to consider what both the historical – and the more recent data might be telling us about this year’s election.

The comments above and below are excerpts from an article by Evan Powers (myFinancialAnswers.com) which may have been enhanced – edited ([ ]) and abridged (…) – by munKNEE.com (Your Key to Making Money!)

to provide you with a faster & easier read. Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner.)

The historical data

As a general rule, the impact of presidential elections on market outcomes is statistically weak and unreliable, in large part…[due to the] small sample sizes: Since there is only one election every four years, we only have a couple of dozen useful data points to draw from, many of which are so old as to make extrapolation to the current environment problematic…

Nevertheless, if you study a data set long enough, a few trends are bound to pop out. One of the most commonly cited effects is the “previous 3 months” phenomenon. Over the last 22 elections, the direction of the stock market in the 3 months leading up to the election has correctly “predicted” the winner 19 times: When the market is positive in the pre-election period, the incumbent party tends to hold onto the White House; when the market is negative, the incumbent party loses. The three exceptions occurred in 1956, 1968, and 1980 – interestingly, all Republican wins. Of course, that phenomenon says nothing about subsequent market returns. If anything, the effect suggests that the stock market impacts the election, and not the other way around.

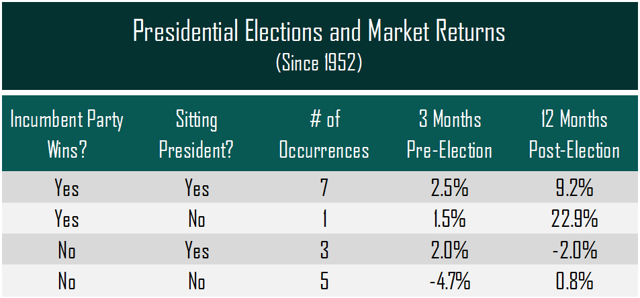

What happens…if we do attempt to study subsequent returns? [Well,] since the 1952 presidential election (we’re studying only the time period for which S&P 500 data is most reliable), 10 out of 16 elections have included a sitting president; of those 10, the incumbent president won re-election 7 times. In the 6 elections without a sitting president, the incumbent party only held onto the White House once. That last fact alone makes drawing historical conclusions about the election’s impact on the stock market difficult, because one data point cannot be trusted to indicate a trend.

That said, in the 8 elections where the incumbent party kept the presidency (7 of which were, of course, reelections of sitting presidents), the 12 months following Election Day saw an average gain of 10.88% but, when the incumbent party lost, the market was essentially flat over the next 12 months, with an average return of -0.23%. That difference may or may not indicate a causal link, but it would lend credence to the theory that markets dislike uncertainty, and therefore, perform best when there is a sense of continuity in the White House.

For what it’s worth, the one election in which the incumbent party held on to the presidency despite the absence of a sitting president (1988, George H.W. Bush over Michael Dukakis) saw one of the strongest subsequent rallies in our data set, with a 22.9% gain. That fact might get Clinton supporters excited, but remember, the predictive power of a single data point is minimal.

This year’s data

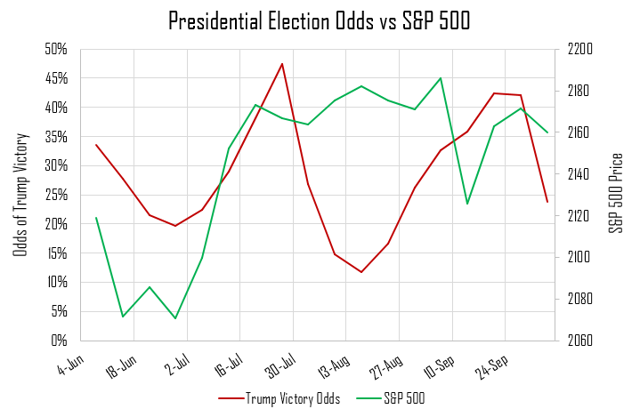

…By any reasonable quantitative definition, there is no meaningful relationship between election odds and stock market activity…[as the chart below clearly illustrates]:

…The data…notwithstanding, many voters remain convinced that the election outcome is pivotal. A recent CNBC poll found that 53% of those surveyed thought Clinton would be better for markets than Trump, while 26% thought Trump would yield higher returns (the remaining 21% were apparently either neutral or had no opinion).

Ultimately, we can slice and dice the data any number of ways and reach a variety of different (and likely contradictory) conclusions about how the election might impact markets but recent experience suggests that the market has a tendency to overreact to political news, both in magnitude and velocity. Furthermore, the election itself is but one data point in a sea of political data. Remember, we’ve said nothing here about the control of the House and Senate, the status of monetary policy, or anything whatsoever about international economic influences (think: China).

In Conclusion

In the final analysis, it’s generally best to leave politics out of your investment approach. More often than not, meaningful political change takes years to develop, and for the impacts of those changes to flow through to the broader economy. Even then, the market may respond to those changes in ways we didn’t anticipate…

We don’t know how this election will turn out, nor do we know with any certainty how the market will respond to the variety of different potential outcomes. What we do know is that having a coherent plan in place (and sticking to it) yields positive risk-adjusted returns over the long run. Don’t get caught overreacting with the crowd; remain flexible and nimble, take advantage of others’ lack of preparation, and you’ll almost always come out ahead.

Follow the munKNEE – Your Key to Making Money!

- “Like” this article on Facebook

- Have your say on Twitter

- Register to receive our bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

- Share your thoughts with us in the comments section below. We’d like to hear from you!

Related Articles From the munKNEE.com Vault:

1. Presidential Election Watch: Possible Impact On Markets

The outcome of the upcoming presidential election can impact the markets and this article outlines investor sentiment and what many investment managers are doing in preparation for the election results.

2. How Do Presidential Election Years Affect Annual Returns of Gold, Silver & Miners?

This article reveals how gold, silver, PM mining stocks and the S&P 500 performed each year of the 4-year presidential election cycle, on average, and suggests how one should invest in the various assets in the years to come.

3. McEwen: Trump or Clinton are “positive for gold” – Prices Could Rise to $1,700 – $1,900 By Year End

Canadian gold mining magnate Rob McEwen says either Trump or Clinton are “positive for gold” and that prices could rise to between $1,700 and $1,900 per troy ounce by year end as uncertainty builds around the stability of global currencies and sovereign debt.

4. Trump Would Elevate Gold’s Standing For Decades To Come

Mr. Trump is a presidential candidate unlike anything we have seen in modern times and his desire to jumpstart a currency war and willingness to think creatively may elevate gold’s standing domestically & internationally for decades to come. Let me explain.

5. Either Trump or Sanders Would Cause Stock Markets To Decline – Here’s Why

The anti-establishment Trump and Sanders might be from different parties, but they both should be of major concern to investors. Here’s why – and it is really scary!

6. What Impact Will the Upcoming U.S. Elections Have On Your Financial Future?

What impact will the elections have on your financial future? Well, frankly, regardless of which side of the political fence you stand on, the prospects of your retirement are much more likely to be impacted by your personal actions than by the actions of Washington politicians.

7. Who’s Better For the Stock Market – A Democrat Or A Republican President? (Part 2)

How would the stock market and the economy possibly be affected were a Democrat or Republican to become President?

8. Who’s Better For the Stock Market – A Democrat Or A Republican President? (Part 1)

In this 2-part series we analyze how the stock market has performed historically during Democratic & Republican administrations and then what sectors could outperform – and underperform with a Democratic president. Part 2 examines possible winners and losers if the Republican party takes over the White House in the upcoming election.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money