Since Reagan came to power in 1981, the U.S. has had a total of five presidents who have spent ever increasing amounts of money to hang on to power and buy votes. This has resulted in the most extraordinary money printing venture in history…[and,] even worse than that, the U.S. government neither has the intention, nor the ability to ever repay the debt with real money…[As such,] the U.S. debt can only vaporise when the country defaults…[which] is guaranteed to take place in the coming years.

increasing amounts of money to hang on to power and buy votes. This has resulted in the most extraordinary money printing venture in history…[and,] even worse than that, the U.S. government neither has the intention, nor the ability to ever repay the debt with real money…[As such,] the U.S. debt can only vaporise when the country defaults…[which] is guaranteed to take place in the coming years.

The excerpts above and below, from an article by Egon von Greyerz (GoldSwitzerland.com), have been enhanced – edited ([ ]) & abridged (…) – by the editorial team at munKNEE.com (Your Key to Making Money!)

to provide a faster and easier read.

Before that, though, the Fed and the U.S. government will flood the market with jumbo jet money since helicopter money won’t suffice. Jumbo jet money will create hyperinflation but it will never repay the debt since all it does is to increase the amount of debt outstanding from trillions of dollars to quadrillions.

U.S. Debt will never be repaid

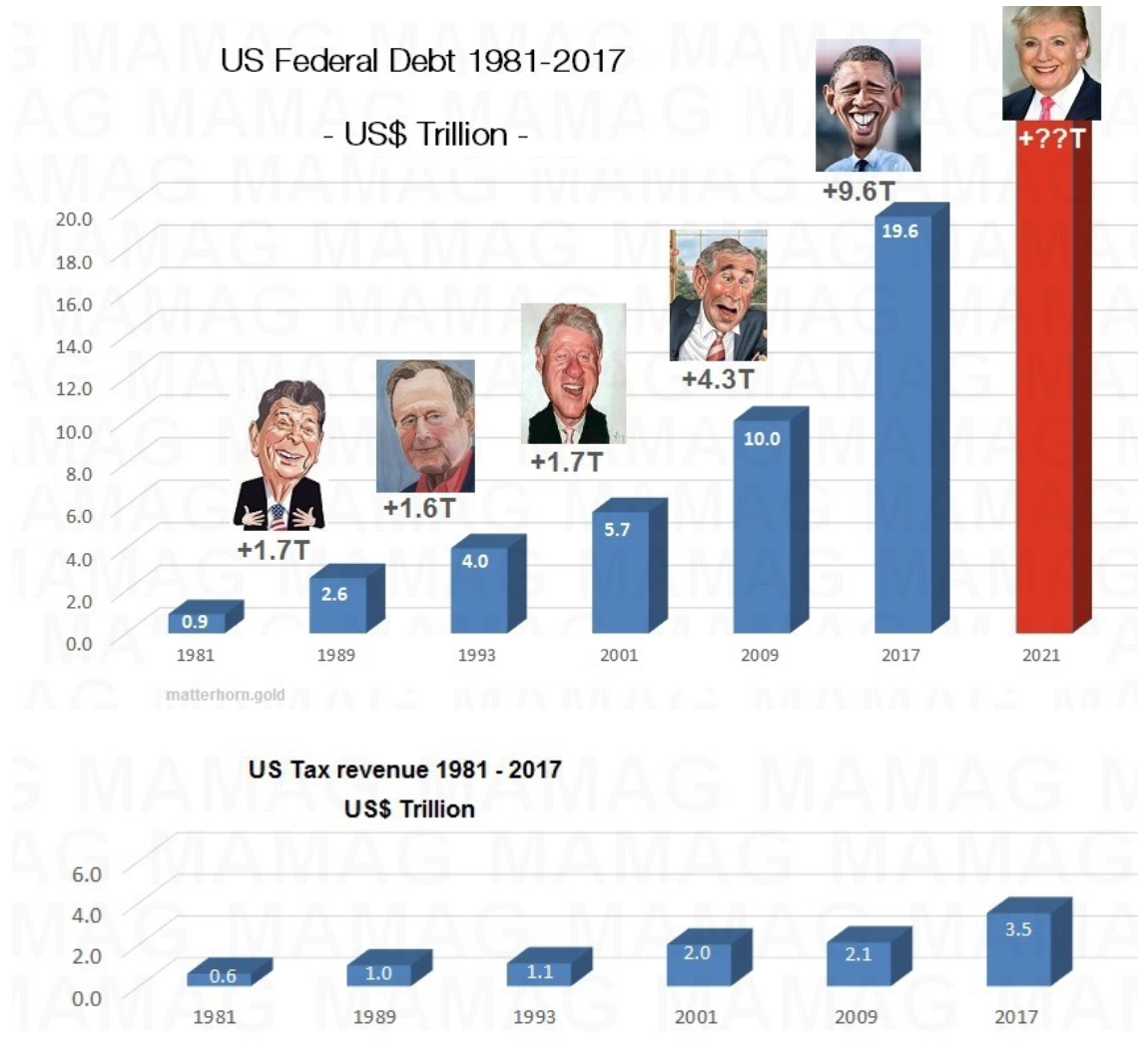

The first chart below shows how debt has gone from $900 billion in 1981 to $19.6 trillion currently. By the time Obama hands over to Clinton/Trump he will have doubled U.S. debt from $10T to $20T during his reign and he has also presided over a cumulative budget deficit of $7 trillion.

…The second chart above shows U.S. tax revenue from 1981 to date. Tax receipts have gone from $900 billion to $3.5 trillion, a 5.8 times increase…[As such,] it is totally clear that the U.S. debt can never be repaid with the only realistic solution being default and bankruptcy!

Neither presidential candidate will solve the U.S. debt catastrophe

It is just unbelievable that:

- the world’s biggest economy – with the world’s reserve currency – is being run into the abyss by a successive number of presidents with each one exacerbating the problem exponentially and

- even more astonishingly, in the current presidential election campaign, neither of the candidates devotes any serious campaign time to the most pressing of all problems which is “the economy stupid”! The reason for this is simple. They don’t dare to seriously discuss a problem that they know they can’t solve. To run for president at a time when it is almost guaranteed that the U.S. economy and the dollar will collapse in the next 4 years is certainly a daunting prospect.

Even under normal circumstances and without major recessions, the U.S. deficit is forecast to grow substantially in coming years…Add to that:

- the cost of the promises of Clinton/Trump,

- a serious recession,

- increasing interest rates,

- and a derivative debacle,

and we will see deficits…in the hundreds of trillions. Thus Clinton/Trump are likely to preside over a U.S. default.

…It is only a matter of time before the U.S. economy implodes and, as the country implodes, so will the US dollar. A currency that is just supported by worthless debt and by a weakening military power, does not qualify for the role as reserve currency. That is why the hegemony of the U.S. and the dollar is now coming to an end. The country will clearly not give up this role without putting up a massive fight. This could sadly involve starting major military conflicts even of nuclear proportions. It is also guaranteed to involve money printing of a magnitude never seen before in history.

It is not only the U.S. which will experience escalating deficits, massive money printing and a collapsing currency. Virtually every major economy including Japan, China, EU and Emerging Markets will go through the same thing. The big difference is that the U.S. has the biggest debt and deficits as well as bigger bubbles in stocks, bonds, property, car loans, student loans etc. than any other country.

There will be dark clouds around the world in coming months

Dark clouds are now moving in fast across the world and this coming autumn could be very troublesome both for the world economy as well as geopolitically and socially. The combined risks are now higher than at any time in world history. When risks are high, it is advisable to stay away from bubble markets but, sadly, the investment world loves owning things that are priced high, totally ignoring the massive loss potential.

Gold – the only money which will survive

The best insurance against financial or economic risk are real assets such as gold and silver as long as they are held safely outside the financial system. Precious metals will reflect the unending destruction of paper money.

Before the coming crisis is over, gold is likely to reach at least $10,000 in today’s money and silver $500 [and,] in hyperinflationary terms, we could see multiples of these targets…Compared to holding…cash, the gain in the gold price becomes very real and will be actual life insurance. At $1,350 per ounce, there is no better insurance to own.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money