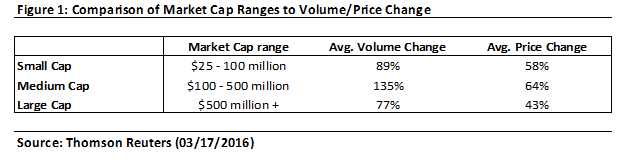

…While gold has increased 19% year-to-date, mining stocks are up 56% on average over the same time [but, interestingly, the extent of the average increase in price] depends on the market cap of the stock.

[As can be seen in the table below] there seems to be a heavier preference amongst investors towards the mid-cap range ($100mm – $500mm Market Cap), as seen by the large volume increase, relative to the other two brackets. (Volume change was calculated using the last 30 days of average daily traded volume, as a percentage increase over the last 200-day average daily traded volume.)

…Some of the companies that fit within the mid-cap range level, but which have not received the same type of volume gains, are: [… continue reading here and go here to see SmallCapPower’s interview with the CEO of one of those companies to learn more].

Disclosure: The original article, by SmallCapPower.com, was edited ([ ]) and abridged (…) by the editorial team at  munKNEE.com (Your Key to Making Money!)

munKNEE.com (Your Key to Making Money!)  to provide a fast and easy read.

to provide a fast and easy read.

“Follow the munKNEE” on Facebook, on Twitter or via our FREE bi-weekly Market Intelligence Report newsletter (see sample here , sign up in top right hand corner)

Links to More Sites With Great Financial Commentary & Analyses:

ChartRamblings; WolfStreet; MishTalk; SgtReport; FinancialArticleSummariesToday; FollowTheMunKNEE; ZeroHedge; Alt-Market; BulletsBeansAndBullion; LawrieOnGold; PermaBearDoomster; ZenTrader; CreditWriteDowns;

Related Articles from the munKNEE Vault:

1. Any 1 Of These 20 Stocks Could Be A 10-Bagger At Higher Gold & Silver Prices

The list of stocks provided in this post are what I consider “must own”stocks if you want big returns. Why? Because most of them are potential 10-baggers at higher gold & silver prices. These are the cream of crop when it comes to risk/reward for large returns. They all have solid projects and growth potential. They all have the “goods” and are extremely undervalued. Take a look.

2. The 10 Best Resource Stocks To Invest In At This Time

Resource stock returns during the past few years have been downright lousy but that’s not to say investors should neglect the sector. It offers tremendous value currently and has historically produced some eye-popping gains. Here is a portfolio of 10 stocks we think will outperform long-term during both good and not-so-good times.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money