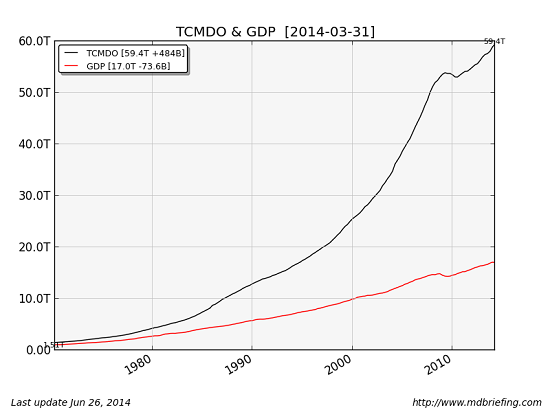

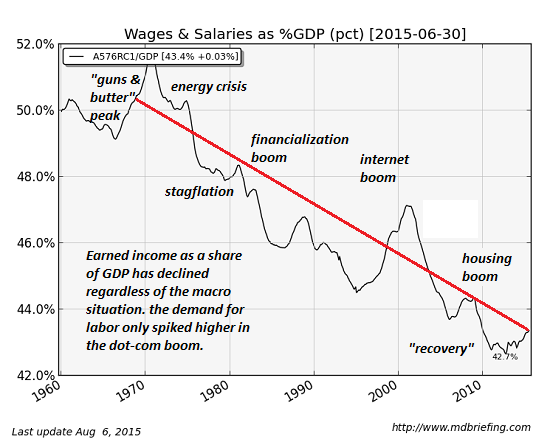

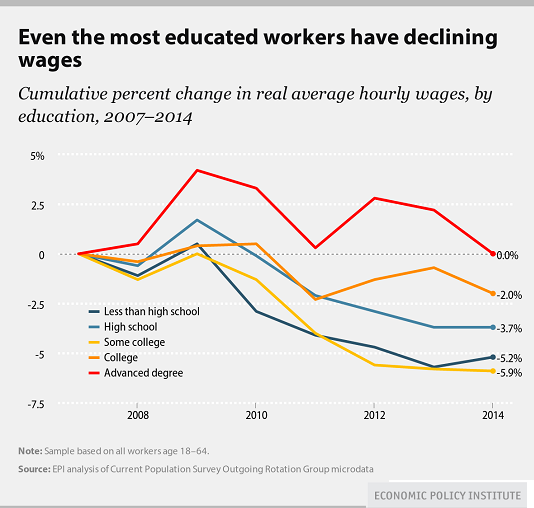

…The American Dream–characterized by plentiful jobs offering living  wages, security and opportunities to get ahead–is over…. Piling on debt is not a solution; it’s simply a politically expedient method to forestall the crisis, while guaranteeing the eventual repricing will be even more severe because the debt load is then so much larger. [If you think otherwise,] I strongly recommend that you reduce your dosage of Delusionol.

wages, security and opportunities to get ahead–is over…. Piling on debt is not a solution; it’s simply a politically expedient method to forestall the crisis, while guaranteeing the eventual repricing will be even more severe because the debt load is then so much larger. [If you think otherwise,] I strongly recommend that you reduce your dosage of Delusionol.

The original article was written by Charles Hugh Smith (oftwominds.com) and is presented here by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) in a slightly edited ([ ]) and abridged (…) format to provide a fast and easy read.]

Want more such articles? Just “follow the munKNEE” on Twitter; visit our Facebook page and “like” an article; or subscribe to our free newsletter – see sample here.

Related Articles from the munKNEE Vault:

Majority of Americans Are Willfully Ignorant Delusional Consumers – Here’s Why

A lack of discipline, inability to delay gratification, failure to understand basic mathematical concepts, materialistic envy, absence of critical thinking skills, and a delusionary view of the world have left the majority of Americans broke and in debt. Let me explain further.

2. World’s Biggest Debtor & Creditor Economies: Where Does Your Country Rank?

In absolute size of net foreign liabilities the U.S. leads the way but, as a share of GDP, its position is much less than that of Spain & Poland who exceed the acceptable level of 60%. Where does your country rank?

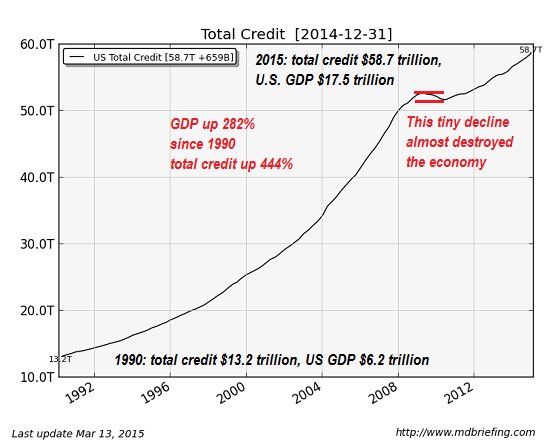

3. Perpetual Debt Provides NO Free Lunch!

For a couple of years the world’s central banks fooled the public into believing that perpetual debt was a good way to rejuvenate the markets but, alas, there will be no free lunch. Having a system addicted to perpetual debt is NOT a solution as the following 9 indicators clearly suggest. Again, nothing comes for free in this world.

4. You Should Be Terrified! U.S. Is In A Debt Trap & Oblivious to the Consequences

There exists in the Congress, in the Obama administration, in the media and on Wall Street, a national belief that America can print paper money and grow its economy as its route map out of debt. With annual GDP growth expectations of 2% to 3% over the next several years, this is a completely false hope!

5. These 23 Countries (+ Greece) Are Also Facing a Full-blown Debt Crisis

An unprecedented global debt bomb threatens to explode at any moment. 24 nations are currently facing a full-blown debt crisis, and there are 14 more that are rapidly heading toward one. The only “solution” under our current system is to kick the can down the road for as long as we can until this colossal debt pyramid finally collapses in upon itself and when it does it will be unlike anything that we have ever seen before.

6. World Debt ($59.7 Trillion) By Country

Today’s infographic visualization breaks down $59.7 trillion of world debt by country, as well as highlighting each country’s debt-to-GDP ratio using colour.

7. Which Countries Have the Most Debt? Here’s a Ranking

Even if all federal tax revenue was applied to pay down U.S. sovereign debt, it would take 10 years (not including any interest) to do so! This infographic shows how other countries like Canada, UK, Australia and Germany, among others, rank in comparison.es like Canada, UK, Australia and Germany, among others, rank in comparison.

8. Crushing Debt Cannot – & Will Not – Be Repaid! Here’s Why

The central bankers of the world have painted themselves into corner. Growing mountain of debt makes it harder for economies to grow at higher interest rates, hence forcing central banks into a downward spiral of record low rates and monetary stimulus that simply encourages more borrowing and worsening the underlying problem – what the BIS calls “a debt trap”.

9. What Could – What Will – Pop This “Money Bubble”?

There is too much debt. Debt works the same way for a country as it works for an individual or a family, which is to say if you borrow too much, then your life basically craters. Everything gets harder to do, and you end up doing things in order to deal with your past mistakes that you would never do normally. You start trying absolutely crazy things, and that’s where the world’s governments are right now. We are doing all these things that are essentially con games and getting away with it so far, because a printing press is a great tool for fooling people. I don’t see how we can get away with it too much longer.

10. How Much Time Before “The 7 Bubbles of America” Start to Burst?

History has shown us that all financial bubbles eventually burst. It is not a question of “if” they will burst. It is only a question of “when” and when the 7 current financial bubbles in America burst, the pain is going to be absolutely enormous. That being said, how much time do you believe that we have before these bubbles start to burst?

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money