Rather than taking a new position in gold at current levels…there are a variety of alternative investment ideas that are preferable and should be considered for your portfolio. [See below for details.]

variety of alternative investment ideas that are preferable and should be considered for your portfolio. [See below for details.]

By Douglas Ehrman

Silver

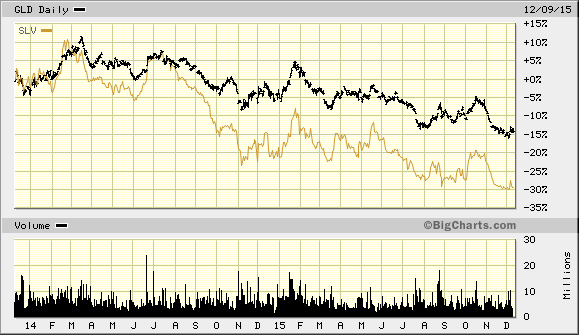

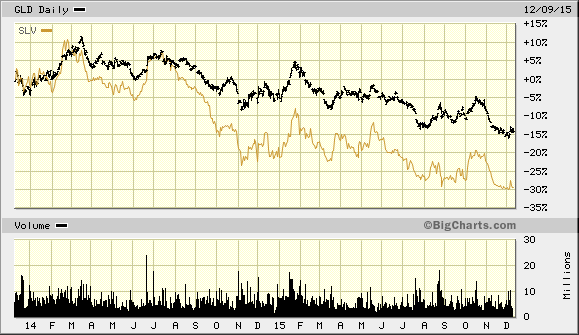

While many of the same factors that impact the price of gold (GLD) also drive the price of silver (SLV), over the past two years silver prices have dropped far more significantly than gold prices. That means that a reversal in precious metals [are more] likely to reward silver investors more generously than gold investors.

A study by Claude Erb and Campbell Harvey has calculated the fair value of gold at $825 per ounce, [while,] conversely, silver may have already experienced a fall to near fair value, making its risk profile and downside protection more attractive. Ultimately, silver remains a more attractive metals investment than gold.

Gold Miners

Similar to silver over the past two years, the stocks of gold mining companies (GDX) have fallen significantly more than the price of gold over the past year….During downturns in the price of the underlying commodity, the stock prices of those companies in the industry tend to fall more sharply. If and when the price of gold finally reverses, the price of the gold miners will reverse more rapidly…

Silver Wheaton

An alternative to buying silver directly through SLV is to take a long position in silver streaming company Silver Wheaton. Silver Wheaton makes money by entering into offtake agreements with various miners to purchase some or all of those miners production of silver and gold at a predetermined price. The company earns the spread between what they pay for these streams of precious metals and what they can sell them for in the open market. In order to enter into these streaming deals, Silver Wheaton often provides financing to miners as an inducement to enter some kind of arrangement.

The stock has been hit particularly hard as precious metals prices have fallen. When the ultimate reversal in prices occurs, Silver Wheaton should be expected to significantly outperform the commodities themselves. This offers plenty of upside for investors. In the interim, the stock offers a 1.43% dividend yield, meaning that an investment in shares of the stock will provide a modest return while you wait for a reversal.

The last argument for buying into Silver Wheaton at current levels is the structural position of the precious metals markets overall. With prices as depressed as they are, the company has a great opportunity to find attractive new streaming relationships under current conditions. The value of these will take time to materialize and be fully realized in the stock’s price, but the company has demonstrated significant expertise in this area over the years…

Read “Why Silver Wheaton Will Outperform Traditional Miners” for additional information.

Ultimately, the position for gold looks uncertain at current levels and any of the alternatives above should be considered more attractive by investors.

The original article was written by Douglas Ehrman and is presented here by the editorial team of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) in a slightly edited ([ ]) and abridged (…) format to provide a fast and easy read.]

Related Articles from the munKNEE Vault:

We are getting closer and closer to the bottom in gold and silver and many are wondering once we bottom what would be a better investment moving forward, silver or gold?

2. Once Silver Finds Bottom It Should Rebound By 350% – Here’s Why

Spectacular bull markets in silver are not a fantasy and are not anomalies. In the last 35 years, silver has had a perfect record of strong bull markets after a bear market. A 350% gain is what can be expected once silver finds a bottom. Here’s why.

3. Silver Will See Much Greater % Price Appreciation Than Gold – Here’s Why

The price of silver is going to go much, much higher – much higher – over the next decade relative to gold. Below are 5 solid reasons why I believe that is the case.

4. Availability Of, and Demand For, Silver vs. Gold Suggests MUCH Higher Future Prices for Silver

The current availability ratio of physical silver to gold for investment purposes is approximately 3:1. So, why is it that investors are allocating their dollars to silver at a much higher ratio? What is it that these “smart” investors understand? Let’s have a look at the numbers and see if it’s time for investors to do as a wise man once said and “follow the money.”

5. Why You Should Now Invest in Silver vs. Gold

The price of silver is going to go much, much higher – much higher – over the next decade [relative to gold according to Jim Rogers and I concur. Below are 5 solid reasons why I believe that is the case.]

6. Silver Is A Better Choice Than Gold! Here’s Why

We are at the beginning of a major shift out of paper assets into real assets and the more I studied the merits of owning gold and silver the more I realized that silver was the smart decision. Let me explain.

7. 20 Reasons Why a Significant % of Your Investment Portfolio Should Be In Silver

I also believe silver will be the best single investment of this decade. The following article is focused on why I think you should seriously consider having a significant percentage of your investment portfolio in silver.

8. I’m A Crazy Silver Bug…Why Aren’t You?!!

It’s true that there are “NO SURE THINGS” in life…but an investment in SILVER comes DARN CLOSE! Yes, you’ll have to ride the tidal wave of price manipulation but when the waves die down you will fully appreciate the power and value of SILVER. Let me explain.

9. Silver: Another Decade of 500% Returns is Very Possible – Here’s Why

Silver has given returns of 584% in the last ten years and this article discusses the reasons for believing that silver can produce another decade of over 500% returns.

10. Silver: The Price Could Easily Double or Triple – Here’s Why

Silver is selling at less than half its 2011 high. It is being ignored more than gold. It has explosive fundamentals. This article assesses silver’s potential by looking at the big-picture forces that could impact silver over the next several years – and point to a possible runaway price scenario.

11. Silver Has Bottomed & Is On Its Way To $35/oz

Silver looks like it has bottomed and will move substantially higher. Here’s why.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money