Gold is in a long-term downtrend and could drop as low as $250 by 2020. Here’s why that is likely the case.

Here’s why that is likely the case.

The commentary above & below consists of edited excerpts from an article* by Anthony Lerner as posted on SeekingAlpha.com.

Gold In A 10-yr Bear Market

Gold just finished the fourth year of what I believe will be a ten year bear market. By the year 2020 or so gold has a very good chance of revisiting its 2001 low of $250 dollars. Over the next twelve months gold might go down to $850 or so, maybe lower. If you still hold physical gold outright, gold ETF’s or gold mining stocks take advantage of this rally and sell.

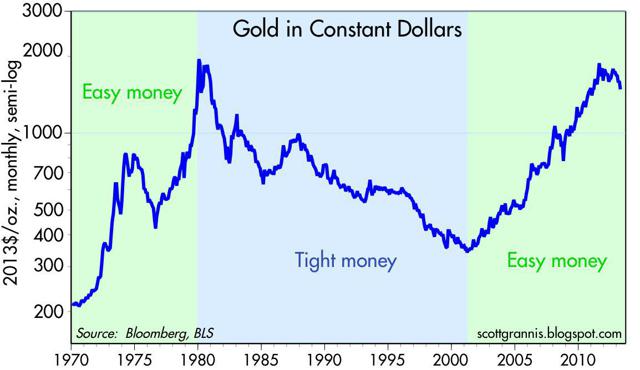

The two charts above tell the long term story of gold. In 50 years gold has had 3 major trends.

- There was a massive uptrend in the 1970’s.

- This was followed by 20 years of sideways to down between 1981 and 2002.

- Gold rallied steadily and strongly from 2002 to 2011 as part of the great commodity supercycle.

I believe another great gold trend has already begun.

Fed Monetary Policy

…The long term macro economic trends in gold prices are determined by monetary policy at the U.S. central bank in much the same way as the U.S. dollar. (The history of gold over the last 50 years can be described in 3 great trends driven by 3 great changes in Fed policy). [See HERE for details from the original article.]…

The history of gold as shown in the two charts above shows that we are in an extended bear market for gold. There won’t be a Volcker like squeeze on monetary policy. Yellen and the other governors are being ultra cautious. Expect a long, slow careful tightening of monetary policy. Expect a long, slow painful grind lower in gold prices with plenty of counter-trend bear traps along the way. Like now for instance…

Gold is a currency. Like the U.S. Dollar, its long term price movements are directly correlated to U.S. Federal Reserve monetary policy…The depth of the Great Recession has made the Fed ultra careful but, nonetheless, a new era of tighter U.S. Fed monetary policy is upon us.

Conclusion

Gold at $1200 is well below its high from 4 years ago, but it is still closer to the top than its ultimate bottom. If you are long gold in any form, physical, ETF or equities you should sell them now.

*http://seekingalpha.com/article/3580526-gold-is-in-a-long-term-downtrend-driven-by-fed-monetary-policy?ifp=0

Related Articles from the munKNEE Vault:

-

Gold Price Forecasters Always Get It Wrong – Here’s Why

When it comes to market sentiment, gold is at the bottom of the barrel as almost everyone is predicting a complete collapse in the gold price and is falling all over each other to predict the new and lowest price for gold. Why is that so? What does it all mean? Read on!

2. Gold Will Soon Revert To Bear Mode Trading On Way To $880/ozt.

If gold were to start moving appreciably higher it would damn all paper currencies…and given the current fragile state of the global economic landscape…governments around the world simply cannot, and will not, allow that to happen. They sit on big stocks of gold and, if necessary, they will use those reserves as a tool to crush rallies. I believe, therefore, that gold will soon revert to bear mode trading. My price target remains at the $880 level.

3. I See Gold Dipping To – Dare I Say – $880ozt. Here’s Why

Several signs have been flashing for the past year that gold has become too big for its britches and will eventually adjust to a lower price which could push the yellow metal off the edge of a cliff to – dare I say – not just below $1100 or $1000 per troy ounce, but to $880ozt.

4. Gold ‘s Price Is Mostly Affected By These Macroeconomic Factors

For relevant analysis of gold prices, the so-called “fundamentals” provide scant help. What is required is an understanding of the macroeconomic drivers at play. This article addresses 9 such factors.

5. Gold Won’t Shine In the Near Term – Here’s Why

Our analysis reveals a bearish outlook for gold over the next 3 months based on the following fundamental and technical factors:

6. Analysts: Gold Will Bottom Somewhere Between $725 & $1,000/ozt.

Much has been written over the past few months as to just where gold (and silver) is headed. In light of the recent significant drop in price below is substantiation for such a decline and several projections as to where the price correction will bottom out and the timeframe for such price action.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

this guy who is very accurate => http://www.bit.ly/1S7sxxs

he says market may have cycle bottom, but crude will go down some more.

I think with QE crack on toast, europe might be a good place to invest at the moment. Italy, spain, france, eurostoxx50