New changes in the Federal Reserve’s discount rate will reverberate through global markets and more than likely increase the price of gold. Here’s why.

The above comments, and those below, have been edited by Lorimer Wilson, editor of munKNEE.com (Your Key to Making Money!) and the FREE Market Intelligence Report newsletter (see sample here – register here) for the sake of clarity ([ ]) and brevity (…) to provide a fast and easy read. The contents of this post have been excerpted from an article* by QuandaryFX originally posted on SeekingAlpha.com under the title What You Need To Know About Gold and which can be read in its unabridged format HERE. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

The discount rate is essentially the true risk-free rate of return for the United States economy. Nearly all other interest rates are based on a proxy to this rate. As the discount rate increases, so increases the rates of almost everything else in the economy. In other words, the discount rate is very important.

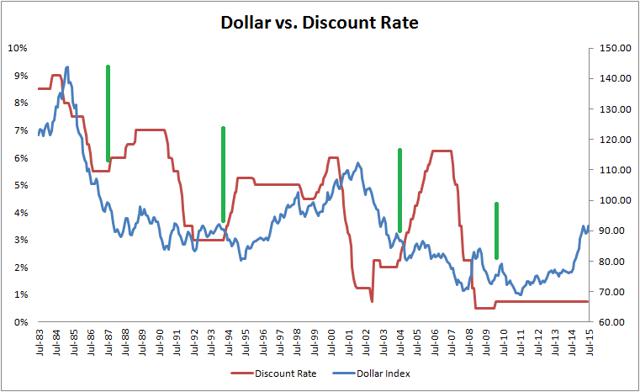

What has most been overlooked in the recent financial media is the clear relationship between the discount rate and the U.S. Dollar Index.

When the Federal Reserve increases the discount rate, the dollar tends to decline in value. This is an important concept to grasp. Since the discount rate is the bedrock of interest rates, all projects and investments which corporations pursue will be evaluated against this rate.

- When the discount rate is low, companies are able to pursue projects which offer relatively small return, provided the return is greater than the discount rate.

- However, when the rate increases, companies are forced to trim back investments and only focus on projects which offer higher returns.

- When companies pursue fewer projects, there is less demand for dollars, and the currency weakens.

In today’s capital markets, everything is interconnected.

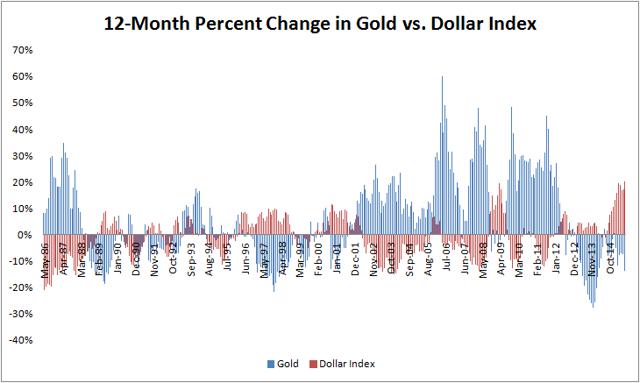

- As the dollar falls, basic economic theory says that it will take more dollars to purchase the same basket of goods.

- In other words, as the dollar weakens, it will take more dollars to purchase the same ounce of gold, and the price of gold will rise.

As the chart below shows, this is simple, logical, and gives an investment edge.

Every time in the past that the Federal Reserve has increased the discount rate, the dollar has proceeded to decline by 8-12% and, when the dollar weakens, the price of gold has risen.

Conclusion

The Federal Reserve is about to increase the discount rate for the first time in several years so profit from it by buying gold.

*http://seekingalpha.com/article/3476846-what-you-need-to-know-about-gold?ifp=0

Related Articles from the munKNEE Vault:

1. True or False: Inflation Makes Gold & Silver Go Up

This one seems like a no-brainer. The government or the central bank prints more bonds, notes and bills, and prices for things go up in response. Gold is real money, so it must fluctuate along with the inflation rate. It’s basic physics but it doesn’t happen that way. Let’s examine the history of inflation and the precious metals since the low of the Great Depression.

2. Future Gold Movement: Are Ups/Downs In Interest Rates the Best Predictor?

Many investors believe that the rise of the federal funds rate is detrimental for gold prices but, although this relationship may often hold, investors should be skeptical about this rule of thumb. This article explains why that is the case.

3. To What Extent Is Price of Gold Affected By Changes In U.S. Monetary Policy?

This article presents a historical analysis of the impact of U.S. monetary policy announcements on the price of gold in U.S. dollars over subsequent 3-month periods beginning with the Federal Reserve’s extra-ordinary 75 basis point Fed Funds rate cut in January 2008 and the most significant central bank policy announcements since. The findings are very interesting, indeed.

4. Gold Price Dependent on Extent of Money Supply NOT Direction of US Dollar Index – Here’s Why

…When the USD starts to rise many assume that this is negative for paper gold ETFs such as GLD as well as physical gold. I’m sure you have heard it before, if the USD goes up then gold goes down, and vice versa…but, in reality, this “rule of thumb” isn’t the case and, in actuality, it would be impossible for the USD and gold to trade inversely with each other. Let me explain.

5. What Do Current Low Interest Rates Mean For the Future Price of Gold?

Investors commonly assume that rising interest rates adversely impact the gold price, and vice versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income but this intuition is unfounded. Let me explain why that is the case ans why, as such, gold investors shouldn’t fear rising interest rates.

6. What Affect Will Rising Interest Rates Have On Inflation & the Future Price of Gold?

Though the stock, bond and currency markets, at the moment, are preoccupied with the question of when the first interest-rate increase will happen, the real story lies in where interest rates are ultimately headed because that answer defines where stock, bond and currency prices are ultimately headed and the reality, dear reader, is that the Fed simply cannot — and will not — allow interest rates to crawl very high. Why is that you ask? Read on!

7. Goldbugs Should Pray for Higher Interest Rates – Here’s Why

Interest rates cannot stay low forever so, while the Fed’s low interest rate policy is pushing stock and bond prices higher, it is also infusing potential energy into the gold market. Therefore, it is only a matter of “When?” and not “If?” this trend reverses and gold catapults higher.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money