The consensus amongst analysts is that gold is grossly under-valued in view of its  bullish fundamentals and now presents a once-in-a-lifetime opportunity for millions of investors worldwide who wanted to own gold but were heretofore leery of its lofty price. Below are 9 fundamental factors behind these bullish opinions.

bullish fundamentals and now presents a once-in-a-lifetime opportunity for millions of investors worldwide who wanted to own gold but were heretofore leery of its lofty price. Below are 9 fundamental factors behind these bullish opinions.

The above introductory comments are edited excerpts from an article* by Vronsky (gold-eagle.com) entitled Golden Opportunity For Global Investors.

Vronsky goes on to say in further edited excerpts:

Below are 9 fundamental factors for these bullish opinions on the oldest form of money:

1. Universal acceptance of gold as a timeless currency and store of value

The history of gold begins in remote antiquity…[with] the first use of gold as money is claimed by the citizens of the Kingdom of Lydia (western Turkey) in 700B.C…

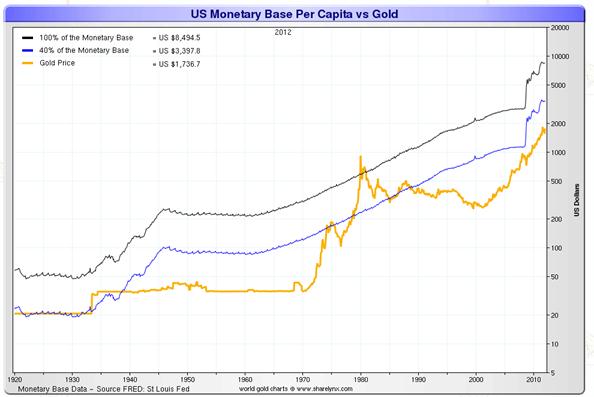

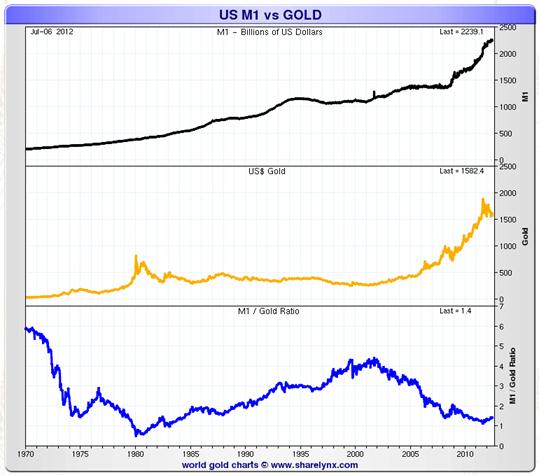

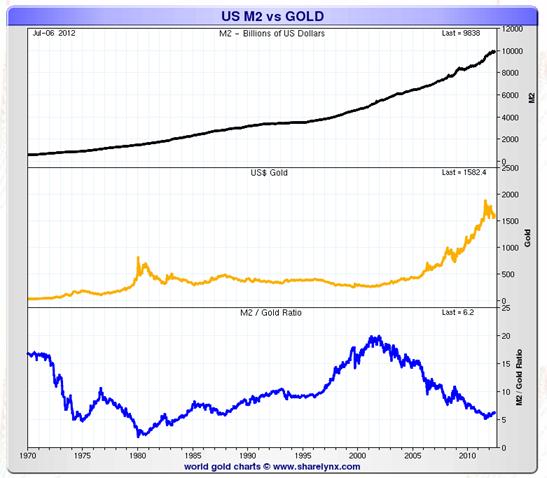

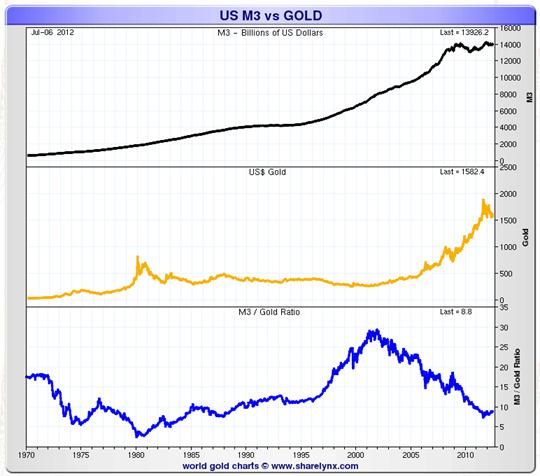

2. Gold’s value runs parallel with growth in the monetary base and to money supply

The following charts clearly indicate that…over the long run the Monetary Base and Money Supply are primary drivers of the gold price.

a) The U.S. monetary base to gold price ratio, from 1930 until 2012:

b) The U.S. M1 money supply to gold price ratio, from 1970 until 2012:

c) The U.S. M2 money supply to gold price ratio, from 1970 until 2012:

d) The U.S. M3 money supply to gold price ratio, from 1970 until 2012:

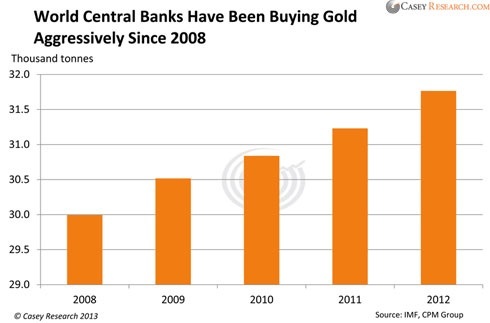

3. Many major central banks are accumulating gold reserves

…It is reported [that] more than 500 tonnes of gold were snapped up by central banks in 2013…and this does NOT take into account China’s gold purchases as it is not public knowledge…

The big reason to buy gold now, proponents argue, is that it should hold its value better than fiat currencies that aren’t backed by hard assets, such as the [U.S.] dollar or Japanese yen. The Federal Reserve, along with central banks in Europe and Japan, have issued so much debt — and pumped so much cash into their economies — that they’ll eventually have to inflate their way out of debt by devaluing their currencies, according to this line of thinking.

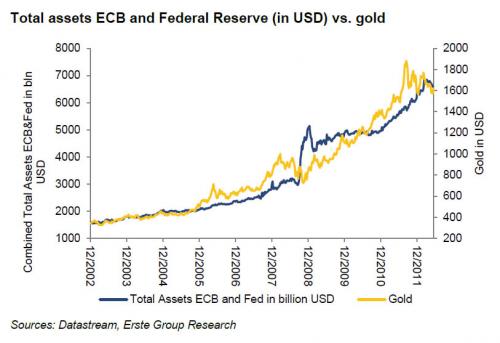

4. Total assets of the ECB and Federal Reserve (in US$) vs. the gold price

Another primary driver of the gold price is the ever increasing total assets of the ECB and the Federal Reserve… It is indeed astounding how the increases in total bank assets have fuelled the price of gold in parallel fashion.

5. China’s dire need to diversity its overt FOREX risk away from the U.S. dollar

China’s total foreign exchange reserves were $3.8 trillion U.S. dollars in 2013 [which was] a sharp increase from the mid-90s…

To substantially reduce China’s dangerous FOREX risk, it must buy thousands of tonnes of gold to shore up its thin Total Foreign Reserves [which serves as] a driver for gold demand...

6. In recent years precious few have invested in gold

In 1968 nearly 5% of total global financial assets were invested in gold and today (2014) gold investments accounts for only 1% of total global financial assets.

Historically it has been an accepted tenet of portfolio management that gold should represent 5-10% of any investment portfolio, if just for the reason that it has a negative market beta but, with gold only accounting for less than 1% of investment portfolios, institutional and individual, how the hell can this possibly be the statistical profile of an asset that is in a bubble stage? [The fact is] there is an absolute tsunami-sized flood of capital that still has yet to flow into the sector before we can even begin to whisper the “B” word.

7. The U.S. federal debt vs. the price of gold

Today’s Federal Debt (the gross amount of debt outstanding issued by the US Treasury and held by the public and federal government accounts) is about $17,952,841,077,000 and counting. Needless to say, this continually ascending U.S. Federal Debt will fuel gold and silver to…record highs [and result in] precious metal mining company shares flying into orbit hundreds of percent higher than today’s values.

The chart below is testament that since 1962, the US Federal Debt has (on-balance) also fuelled the price of gold higher.

8. Internet communication to easily transmit gold’s message – instantly and worldwide

Once the price of gold has put in a definitive bottom, the news will be communicated instantly worldwide via Internet publications and emails . Consequently, the gold price will quickly soar as international investors stampede into gold…

9. The U.S. Dollar is on course to lose its global reserve currency status

Major world powers are maneuvering to replace the U.S. dollar as the world’s primary Total Reserve Currency…[and these events will result in] a mass exodus from Uncle Sam’s currency resulting in a precipitous decline of the US Dollar Index. Consequently, this will lead to a massive resurgence in the value of gold and silver and a resurgence in prices of precious metal mining company stocks. In fact the prices of mining stocks will inevitably and eventually go ballistic because their current values are the lowest relative to gold since 2001. (See chart below)

Conclusion

Although there are short-term technical aspects that gold must deal with, fundamentals will ultimately prevail. To be sure the greatest weakness of fundamentals is the almost total absence of timing and, as everyone knows, timing is essential to maximizing profits.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.gold-eagle.com/article/golden-opportunity-global-investors

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. What Impact Do U.S. Monetary Policy Announcements Have On the Price of Gold?

This article presents a historical analysis of the impact of U.S. monetary policy announcements on the price of gold in U.S. dollars over subsequent 3-month periods beginning with the Federal Reserve’s extra-ordinary 75 basis point Fed Funds rate cut in January 2008 and the most significant central bank policy announcements since. The findings are very interesting, indeed. Read More »

2. Gold Price Dependent on Extent of Money Supply NOT Direction of US Dollar Index – Here’s Why

When the USD starts to rise many assume that this is negative for paper gold ETFs such as GLD as well as physical gold. I’m sure you have heard it before, if the USD goes up then gold goes down, and vice versa…but, in reality, this “rule of thumb” isn’t the case and, in actuality, it would be impossible for the USD and gold to trade inversely with each other. Let me explain. Read More »

3. What Do Current Low Interest Rates Mean For the Future Price of Gold?

Investors commonly assume that rising interest rates adversely impact the gold price, and vice versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income but this intuition is unfounded. Let me explain why that is the case ans why, as such, gold investors shouldn’t fear rising interest rates. Read More »

4. What Affect Will Rising Interest Rates Have On Inflation & the Future Price of Gold?

Though the stock, bond and currency markets, at the moment, are preoccupied with the question of when the first interest-rate increase will happen, the real story lies in where interest rates are ultimately headed because that answer defines where stock, bond and currency prices are ultimately headed and the reality, dear reader, is that the Fed simply cannot — and will not — allow interest rates to crawl very high. Why is that you ask? Read on! Read More »

5. Goldbugs Should Pray for Higher Interest Rates – Here’s Why

Interest rates cannot stay low forever so, while the Fed’s low interest rate policy is pushing stock and bond prices higher, it is also infusing potential energy into the gold market. Therefore, it is only a matter of “When?” and not “If?” this trend reverses and gold catapults higher. Read More »

6. Weak Gold Price & Falling Interest Rates Say Current Monetary Policy Is Too Tight – Here’s Why

A change in monetary, fiscal, and regulatory policy is necessary to beat back the forces of recession and deflation. If the messages of falling gold prices and falling interest rates are not enough to gain the attention of policy makers, I suspect that the specter of future falling stock prices throughout the world will be. That is what is in store for us if the recessionary/deflationary bias in the world economy that gold and bonds are signaling, reasserts itself. Read More »

7. Jump Aboard the Gold & Silver Train – NOW! Here’s Why

The smart money has been moving into precious metals during dips in recent months as many view the sector as one of the last places to find real value given that stocks, bonds, real estate, and nearly every other asset class, has been inflated to lofty levels by the FED’s easy money policies since 2009. I believe we are witnessing one of the last great buying opportunities in precious metals. When prices start moving higher again, there will be little time to jump aboard the train. The downside risk at this juncture pales in comparison to the upside potential. Read More »

8. Gold Will Take Off Dramatically! Here’s When & Why

Gold’s bull market is NOT finished, but is instead on the verge of launching into a startling climactic period into late 2016, or early 2017. This article explains why. Read More »

9. Gold Production to Drop By 50%; Few New Discoveries Will Exacerbate Problem

The amount of gold becoming available for production in the near term will be well under 50% of that currently being produced and the longer-term downward trend in discoveries will likely continue for at least the next few years. Read More »

10. Gold Demand In China & India – What Does the Future Hold?

Lifted by a continued surge in Asian gold sales, consumer demand for gold reached an all-time high in 2013 at 3,893 tonnes. Amazingly, 54% of this demand came from two places: India and China. However, it is only recently that the East has dominated global demand for the yellow metal. In this infographic, we look at India and China specifically to see why demand keeps expanding in the East. Read More »

11. China’s Role in the Future of Gold

In this infographic we look at how gold growth in China will impact the future of the precious metal. In Q4 of 2011 and continuing into 2012, China has bought more gold overall than even India and will continue to play an important role in consumption.

12. The Future Price of Gold and the 2% Factor

It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Let me explain. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money