I…[see] various signs that indicate that gold bulls may have to endure one more  capitulation to the downside before the next leg of the bull market begins. In what follows I identify what could send the gold price lower…[and suggest] some investment strategies [to consider].

capitulation to the downside before the next leg of the bull market begins. In what follows I identify what could send the gold price lower…[and suggest] some investment strategies [to consider].

The above introductory comments are edited excerpts from an article* by Ben Kramer-Miller (GoldStockBull.com) entitled Is The Gold Bear Market Really Over?.

Kramer-Miller goes on to say in further edited excerpts:

What Could Send the Gold Price Lower?

1—Gold Didn’t Test Its 2009 Breakout Point

Gold has experienced two significant corrections since the bull market began at the turn of the century. The first was in 2008 and the second began in 2011 and many investors believe ended at the end of 2013. One thing that differs between the two, besides their durations, is that when the market bottomed in 2008 it hit a major support level—about $700/oz.—that had previously been resistance from April, 2006 through August, 2007, but we have not seen this in the recent bear market. The last breakout point was the resistance level of about $1,000/oz. where the market peaked in 2008 and under which the market consolidated until the end of 2009. The breakout led to the subsequent rally all the way to $1,900/oz. in 2011. Now, if the pattern were going to repeat, the gold market should test the $1,000/oz. level, but as you can see on the following chart of the SPDR Gold Trust (GLD) we haven’t seen this.

Technical analysts would argue that a test or even a quick breach of the $1,000/oz. level would wipe out the speculative money that entered the market after the gold price broke to its new all-time high, and that this would be needed in order to set the stage for a fundamentally driven leg higher.

2—Stocks and Bonds Remain In Favor

Broadly speaking I am not bullish of stocks, and I am downright bearish of bonds but there is no denying that these assets have been performing well over the short and intermediate term. While the mainstream financial press would have you believe that these assets trade opposite to one another they are historically correlated. They are both financial assets, meaning that they are claims against another entity that owes something to the stock or bond holder (e.g. dividends or interest). Despite the fact that stocks and bonds are richly valued on an historic basis investors don’t seem to care. Bonds will remain expensive because central banks will see to it that interest rates remain low, and stocks respond to this: while stock may be historically overvalued on a price to earnings or on a dividend yield basis, when these earnings and yields are compared with bond yields they appear to be attractive, especially in the case of companies that can borrow money to buy their competitors or to buy back their own stock.

With financial assets in favor real assets are, by extension, out of favor. While we are seeing strength in select commodities such as zinc, palladium, coffee, and lean hogs, the broader complex is floundering.

Now financial assets are, broadly speaking, overvalued while commodities are generally undervalued, and this includes gold but the market is not at a point where these disparities really matter. So long as money remains cheap bond prices can rise and anything that has a yield can rise with them. At some point this situation will reverse itself, and this could happen very quickly in response to some black swan event. As investors we need to be prepared for this and I will address this in the next section, but for now it suffices to say that it makes sense to yield to Newton’s first law of motion, and acknowledge that financial assets will keep rising while tangible assets will keep falling.

3—Chinese Gold Demand Is “Falling”

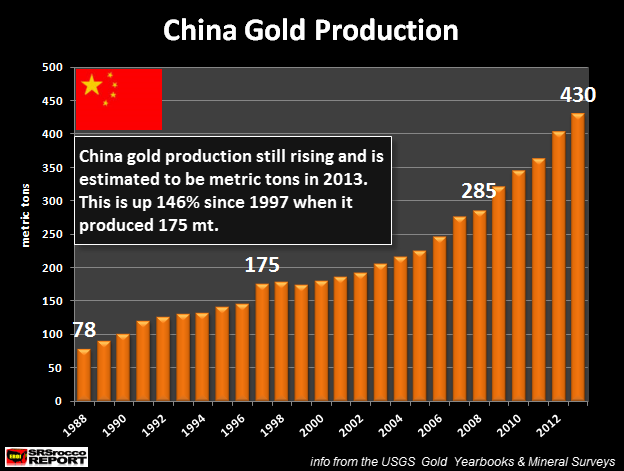

I put the word “falling” in quotation marks because this is the narrative that we are seeing in the mainstream media from sources such as Bloomberg, and Reuters. Technically this is true—demand is down year over year but in a broader context I feel that the claim that Chinese gold production is falling is disingenuous, and we can see this from the following chart.

From this chart we can clearly see that demand is down in the near-term, but it is up sharply over the past few years. Nevertheless the prevailing narrative is that Chinese demand is down, and this is generating bearishness and apathy among investors.

Now just to be clear I think the chart above is extremely bullish and, furthermore, the gold withdrawals data (the red, vertical lines) doesn’t tell the whole story, because, [as can be seen in the chart below] Chinese gold production has been rising year over year and none of this gold leaves China so Chinese demand for gold is actually not down as much as the first chart would suggest.

Nevertheless, despite these caveats, investors are concerned that Chinese gold demand is shrinking, and this could continue to keep them out of the market or even lead some speculators to take short positions.

4—Federal Reserve Tapering Is Perceived To Be Bearish for Gold

Many investors are concerned that if the Federal Reserve continues to taper, and if it eventually stops pumping money into the market, that this is bearish for gold. The intuition is that there will be less money in the financial system to bid up gold prices. While this makes sense it is misguided—the money needed to bid up gold prices dramatically from here is already in the system. Furthermore…there is a strong correlation between the Fed tightening and a rising gold price. Nevertheless, the misconception prevails, and when the Fed ends its quantitative easing program in October we could see a knee-jerk reaction in the gold price to the down side.

5—The U.S. Dollar Index Has Been Strengthening

One of the big surprises this year has been the strength in the [U.S.] Dollar Index, as you can see on the following chart. This strength has led investors to believe that the U.S. dollar itself is strong, and it leads investors to avoid investments in gold and in other commodities.

Gold bulls know that [U.S.] Dollar Index strength is not the same thing as USD strength – the former simply means that the USD is increasing in value relative to a basket of currencies that includes the Euro, the Yen, the Pound, and others…[and not that] the USD itself is strong…but, nevertheless, in the short run perception can often trump reality, and a rising [U.S.] Dollar Index can be short-term bearish for gold.

What Should You Do?

On the one hand there are several catalysts that could drive the gold price lower in the near term, despite the fact that, as I’ve hinted above, many of these catalysts aren’t really bearish for gold. On the other hand gold remains undervalued, and furthermore, even if gold can fall another 20% or so its upside potential dwarfs this potential correction which might not even take place so, if you’re an investor looking to accumulate gold, what should you do?

1—Dollar Cost Average

Unless you’re in the business of trying to time the market don’t try to time the market. Allocate a consistent amount of money from your income or your savings to the gold market each week or month or whatever works best for you. This way you will be increasing your exposure on a regular basis so you won’t miss the upward move should the aforementioned correction never materialize. You will also be able to capitalize should we get such a correction. Chances are you won’t catch the exact bottom, but if you’re buying on a weekly or a monthly basis you’ll buy some near the bottom, and because you’re allocating the same amount of Dollars each time period you will buy more gold near the bottom and lower your average buy price.

2—Avoid Leverage!

The worst thing you can do in this environment is to use leverage. If you use leverage you might face a margin call near the bottom of the market and lose your position. You’re buying gold to protect your wealth, not to gamble. If you must have some leverage then devote some of your portfolio to out of the money call options or to the mining space, but options and miners are not gold, and they come with other risk factors.

As a corollary to this you should avoid gold miners that have a lot of debt or high production costs. These companies can easily go bankrupt if the gold price falls to $1,000/oz. and they miss an interest or debt payment. We saw companies with quality assets go bankrupt because they were leveraged and couldn’t contain their costs when the gold market was weak (e.g. Jaguar Mining) so, unless you are gambling or an industry expert, you should filter out any mining companies from consideration that have too much debt or that can’t turn a profit in this environment.

3—Finally, Ignore the Hype and Stay Disciplined

As the gold market remains weak and the stock market strengthens it becomes tempting to give up on gold. The media has demonized gold despite the fact that it has been one of the best performing assets this century. Banks and analysts have been paraded in front of the cameras at CNBC and Bloomberg espousing the new bull market in stocks and the end of the bull market in gold but very little has changed over the past three years and, in fact, the bull case for gold has gotten decidedly stronger while the financial system has become more indebted and stocks continue to trade at historically high valuations. All that has changed is the prevalent narrative and perception. With this in mind don’t get caught up in the bubble mentality that has swept across Wall St. that is willing to pay 50-100 times earnings for social media stocks (assuming they have earnings) and 20 – 30 times earnings for consumer staple stocks.

Gold is undervalued, and under-owned. It might take a while longer for the market to realize this, but the upward revision to the gold price is likely to be significant once the top is blown off.

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://www.goldstockbull.com/articles/gold-bear-market-really/ (Copyright © 2014 Gold Stock Bull – All Rights Reserved; Get the Gold Stock Bull newsletter, model portfolio and trade alerts by becoming a premium member. You can try out the service for 3 months at only $99 and cancel at anytime if you aren’t 100% satisfied.)

If you liked this article then “Follow the munKNEE” & get each new post via

- Our Newsletter (sample here)

- Twitter (#munknee)

Related Articles:

1. Gold: Likely to Fall to $950 – $1100; Unlikely to Rise Above $2,000 – Here’s Why

An analysis of the ratio between the market capitalization of gold (MCG) and the gross world product (GWP) over the past 63 years suggests that the current price for gold has further to fall and that it would not be wise to begin buying gold until prices have fallen below at least $1100 or $950. Read More »

2. Gold Will Drop to $900 – Silver to $15 – Before Going Parabolic!

Back in early May, 2013, I correctly forecast the lows in gold & silver which occurred 2 months later. Today, my new analyses indicates they both will show further weakness before both jumping dramatically in price by the end of 2014. Below are the specific details of my forecasts (with charts) to help you reap substantial financial rewards should you wish to avail yourself of my insightful analyses. Read More »

3. Final “thud” In Gold to $1,190 Level Coming! Here’s Why

In spite of the June 2014 pop [I expect to see]…a dip to below the $1190/oz level at some point between now and the end of the month. Here’s why. Read More »

4. Gold Price to Plunge: The Inside Scoop

We will allow all of you here today, in the weeks running up to the seizure of the world’s gold, to put in place your trading strategies in anticipation of the ’Mother of All Insider Trades’. This will allow you and your organizations to profit beyond your wildest dreams when we ‘drop the hammer’ and reduce the price of gold to $20.67 USD. Read More »

5. What Are Factors That Motivate Gold Saying Today?

What happens when gold has transitions from a cyclical bull market to a cyclical bear market? what motivates gold to enter a bull market phase? This article has the answers. Read More »

6. Decline In Gold Due to Stupidity, Greed & Stubbornness!

It never ceases to amaze me just how dumb and misinformed financial commentators are, often looking in all the wrong places for script, when the fact is that stupidity, greed, and stubbornness runs rampant amongst paper market gold speculators. Read More »

7. These 4 Indicators Say ” the immediate outlook doesn’t look good for gold”

Below are the four most important factors that influence the price of gold indicators….If you understand and correctly interpret these four indicators, I guarantee you’ll make more intelligent buy/sell decisions. More importantly, you’ll make more profitable ones as well. Read More »

8. Noonan: Charts Suggest Potential Support for Gold Down at $1,040 to $1,100

If you want to make rabbit stew, first, you have to catch the rabbit so hopefully, first, we’ll see some concrete signs that a bottom is in before the regurgitation of “Gold is going to $10,000!” starts showing up in a host of new articles pandering for attention. The best way is to decide for yourself…so let us go to the most reliable source, the market, and see what the prices of gold and silver have to say about what everyone else has been saying about them. People have been known to exaggerate, even lie in their “opinions,” but the market never does either. Read More »

9. Gold Going Down to $1,160 – $1,200 & Silver to $15 – $18. Here’s Why

An earlier article on gold & silver went viral with almost 30,000 reads on munKNEE.com alone and continues to be read by hundreds of goldbugs daily. Below is an updated chart and analysis suggesting that gold & silver have further to drop before they go parabolic. Take a look and share it with friends. Read More »

10. Gold to Plummet to $1,200 – $1,250 & Ultimately Drop to $1,000 – $1,100

Greg Guenthner has stated that once gold breached $1,350 it would plummet to $1,200 – $1.250. So far, so good, but will his $1,000 – $1,100 price for gold come true?

11. Nouriel Roubini: Gold to Be Gutted! Here’s Why

Roubini expects gold will fall below $1,000/oz, taking prices down to approximately 30% from current levels; a point not seen since 2007. Here’s why. Read More »

12. Gold Bugs: Look Out Below! Gold Could Drop to $1,000

Scott Grannis thinks gold could fall to $1000, or even less, as it realigns with other commodity prices.

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money