As history all too clearly shows, investors always do the “opposite” of what they should when it comes to investing their own money. They “buy high” as the emotion of “greed” overtakes logic and “sell low” as “fear” impairs the decision making process. Here are 5 of the most insidious biases that will keep you from achieving your long term investment goals.

The above comments are edited excerpts from an article* by

The following article is presented courtesy of Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), www.FinancialArticleSummariesToday.com (A site for sore eyes and inquisitive minds) and the FREE Market Intelligence Report newsletter (register here; sample here) and has been edited, abridged and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.

Roberts goes on to say in further edited excerpts:

Here are 5 of the most insidious biases that will keep you from achieving your long term investment goals.

1) Confirmation Bias

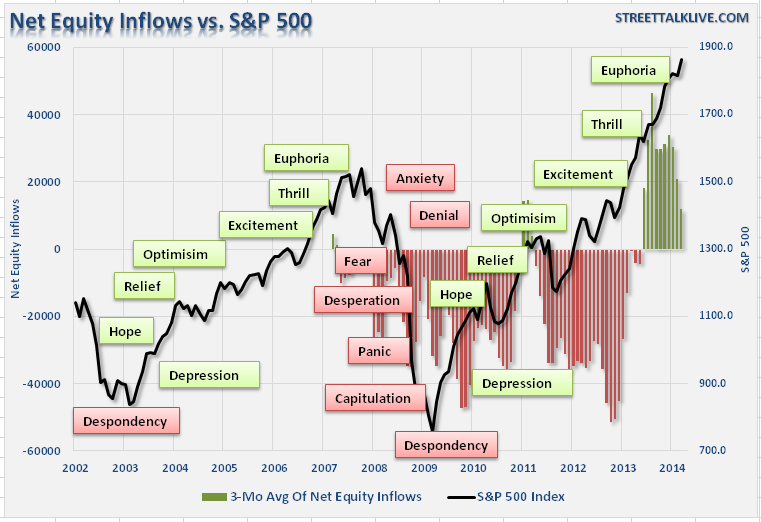

As individuals, we tend to seek out information that conforms to our current beliefs. If one believes that the stock market is going to rise, one tends to only seek out news and information that supports that position. This confirmation bias is a primary driver of the psychological investing cycle of individuals as shown below.

The issue of “confirmation bias” also creates a problem for the media. Since the media requires “paid advertisers” to create revenue, viewer or readership is paramount to obtaining those clients. As financial markets are rising, presenting non-confirming views of the financial markets lowers views and reads as investors seek sources to “confirm” their current beliefs. Individuals want “affirmation” that they current thought process is correct. As human beings, we hate being told that we are wrong, so we tend to seek out sources that tell us we are “right.”

2) Gambler’s Fallacy

The “Gambler’s Fallacy” is one of the biggest issues faced by individuals when investing. As emotionally driven human beings, we tend to put a tremendous amount of weight on previous events believing that future outcomes will somehow be the same.

The bias is clearly addressed at the bottom of every piece of financial literature – “Past performance is no guarantee of future results.” However, despite that statement being plastered everywhere in the financial universe, individuals consistently dismiss the warning and focus on past returns expecting similar results in the future.

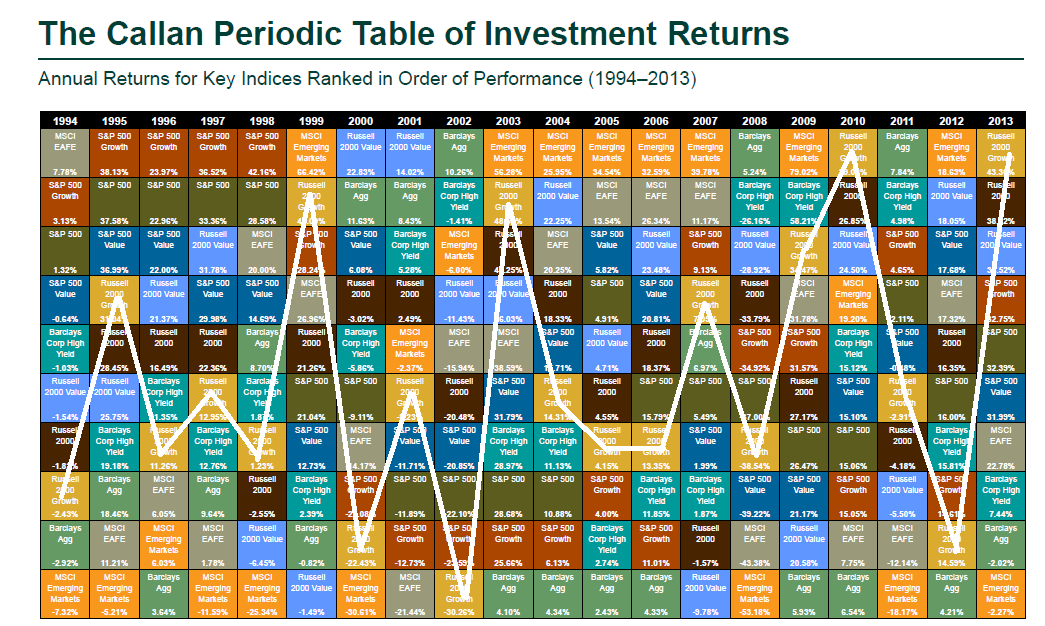

Performance chasing has a high propensity to fail continually causing investors to jump from one late cycle strategy to the next. This is shown in the periodic table of returns below. “Hot hands” only tend to last on average 2-3 years before going “cold.”

I traced out the returns of the Russell 2000 for illustrative purposes but importantly you should notice that whatever is at the top of the list in some years tends to fall to the bottom of the list in subsequent years. “Performance chasing” is a major detraction from investor’s long term investment returns.

3) Probability Neglect

When it comes to “risk taking” there are two ways to assess the potential outcome. There are “possibilities” and “probabilities.” As individual’s we tend to lean toward what is possible such as playing the “lottery.” The statistical probabilities of winning the lottery are astronomical, in fact, you are more likely to die on the way to purchase the ticket than actually winning the lottery. However, it is the “possibility” of being fabulously wealthy that makes the lottery so successful as a “tax on poor people.”

However, as investors we tend to neglect the “probabilities” of any given action which is specifically the statistical measure of “risk” undertaken with any given investment. As individuals, our bias is to “chase” stocks that have already shown the biggest increase in price as it is “possible” they could move even higher. However, the “probability” is that most of the gains are likely already built into the current move and that a corrective action will occur first.

Robert Rubin, former Secretary of the Treasury, once stated;

“Most people are in denial about uncertainty. They assume they’re lucky, and that the unpredictable can be reliably forecast. This keeps business brisk for palm readers, psychics, and stockbrokers, but it’s a terrible way to deal with uncertainty. If there are no absolutes, then all decisions become matters of judging the probability of different outcomes, and the costs and benefits of each. Then, on that basis, you can make a good decision.”

Probability neglect is another major component to why investors consistently “buy high and sell low.”

Stay connected!

- Register for our Newsletter (sample here)

- Find us on Facebook

- Follow us on Twitter (#munknee)

- Subscribe via RSS

4) Herd Bias

Though we are often unconscious of the action, humans tend to “go with the crowd.” Much of this behavior relates back to “confirmation” of our decisions but also the need for acceptance. The thought process is rooted in the belief that if “everyone else” is doing something, they if I want to be accepted I need to do it too.

In life, “conforming” to the norm is socially accepted and in many ways expected. However, in the financial markets the “herding” behavior is what drives market excesses during advances and declines.

As Howard Marks once stated: “Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong. Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

Moving against the “herd” is where the most profits are generated by investors in the long term. The difficulty for most individuals, unfortunately, is knowing when to “bet” against the stampede.

5) Anchoring Effect

This is also known as a “relativity trap” which is the tendency for us to compare our current situation within our own limited experiences. For example, I would be willing to bet that you could tell me exactly what you paid for your first home and what you eventually sold it for. However, can you tell me what exactly what you paid for your first bar of soap, your first hamburger or your first pair of shoes? Probably not.

The reason is that the purchase of the home was a major “life” event. Therefore, we attach particular significance to that event and remember it vividly. If there was a gain between the purchase and sale price of the home, it was a positive event and therefore we assume that the next home purchase will have a similar result. We are mentally “anchored” to that event and base our future decisions around a very limited data.

When it comes to investing we do very much the same thing. If we buy a stock and it goes up, we remember that event. Therefore, we become anchored to that stock as opposed to one that lost value. Individuals tend to “shun” stocks that lost value even if they were simply bought and sold at the wrong times due to investor error. After all, it is not “our” fault that the investment lost money; it was just a bad stock. Right?

This “anchoring” effect also contributes to performance chasing over time. If you made money with ABC stock but lost money on DEF, then you “anchor” on ABC and keep buying it as it rises. When the stock begins its inevitable “reversion,” investors remain “anchored” on past performance until the “pain of ownership” exceeds their emotional threshold. It is then that they panic “sell” and are now “anchored” to a negative experience and never buy shares of ABC again.

***

In the end, we are just human. Despite the best of our intentions, it is nearly impossible for an individual to be devoid of the emotional biases that inevitably lead to poor investment decision making over time. This is why all great investors have strict investment disciplines that they follow to reduce the impact of human emotions.

Take a step back from the media and Wall Street commentary for a moment and make an honest assessment of the financial markets today.

- Does the current extension of the financial markets appear to be rational?

- Are individuals currently assessing the “possibilities” or the “probabilities” in the markets?

As individuals, we are investing our hard earned “savings” into the Wall Street casino. Our job is to “bet” when the “odds” of winning are in our favor.

With interest rates at abnormally low levels, inflation rising, economic data continuing the “muddle” through and the Federal Reserve extracting their support; exactly how “strong” is that hand you are betting on?

Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.

*http://streettalklive.com/index.php/daily-x-change/2265-5-cognitive-biases-that-are-negatively-impacting-your-portfolio.html (Copyright © STA Wealth Management)

Related Article:

1. Investment Truths: “Does a 10% Loss + a 10% Gain Put You Back to Even?” & 29 Other Insights

Here’s my list of the most common errors investors make and some related maxims. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money