While we may see some further weakness in the short term the 7 charts on gold and 1 each on silver, platinum and palladium below suggest that the outlook is good for 2014 and the coming years.

and palladium below suggest that the outlook is good for 2014 and the coming years.

So says Mark O’Byrne (goldcore.com) in edited excerpts from his original article* entitled 7 key gold charts: “Bull market ahead”.

[The following is presented by Lorimer Wilson, editor of www.munKNEE.com and may have been edited ([ ]), abridged (…) and/or reformatted (some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. This paragraph must be included in any article re-posting to avoid copyright infringement.]

O’Byrne goes on to say in further edited excerpts:

Often “a picture paints a thousand words” and the 7 key gold charts [plus one each on silver, platinum and palladium] below should make gold bears nervous. The charts were compiled by Nick Laird of ShareLynx.com (Sharelynx.com is a great website for charts and well worth the subscription.)

So without further ado, lets look at these important gold charts.

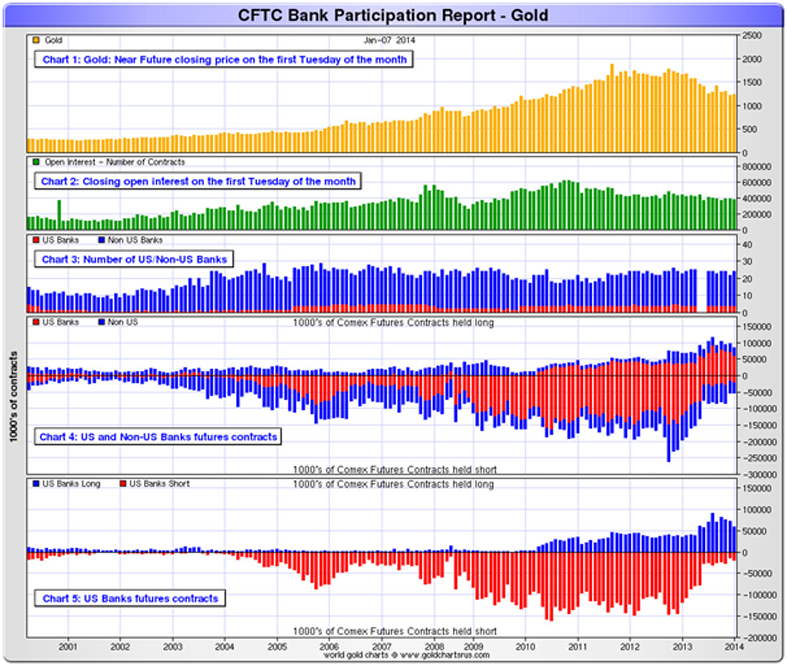

Gold Chart 1 – The banks are long gold …

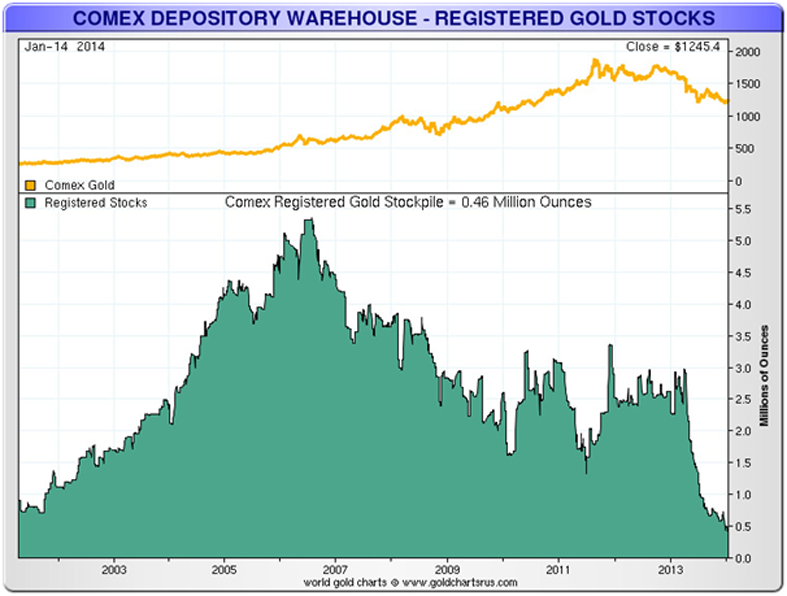

Gold Chart 2 – Gold stocks are being withdrawn …

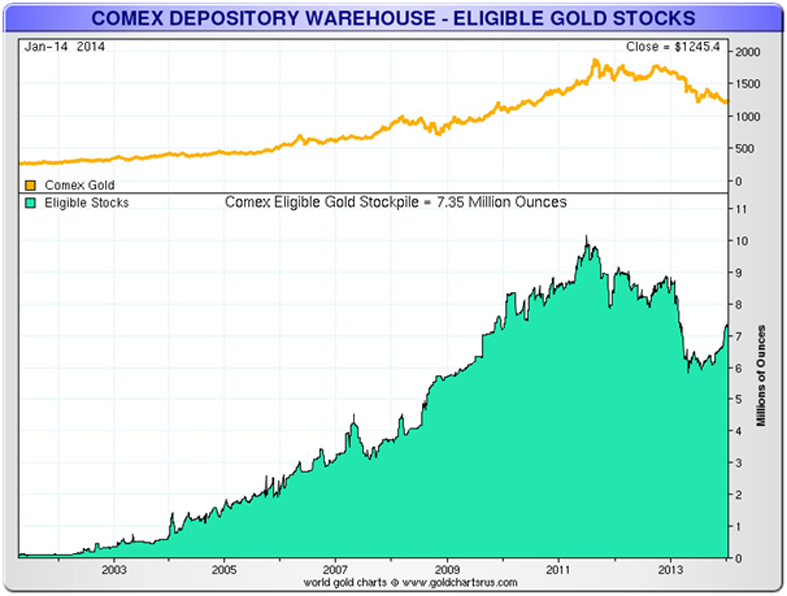

Gold Chart 3 – Supplies are being held back …

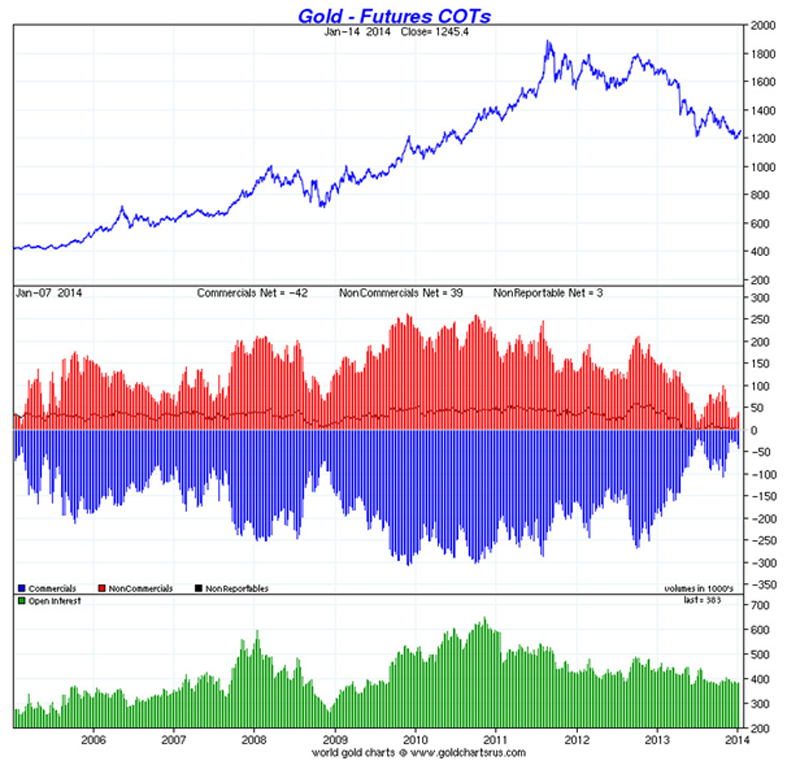

Gold Chart 4 – COT Data shows that banks and others are positioned perfectly for a bull run to start …

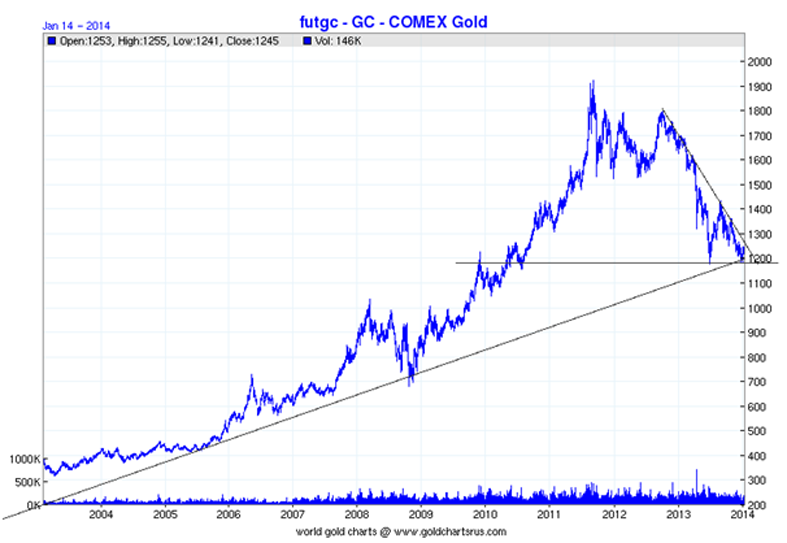

Gold Chart 5 – Pivot point time – double bottom …

Gold Chart 6 – Never been a better buy …

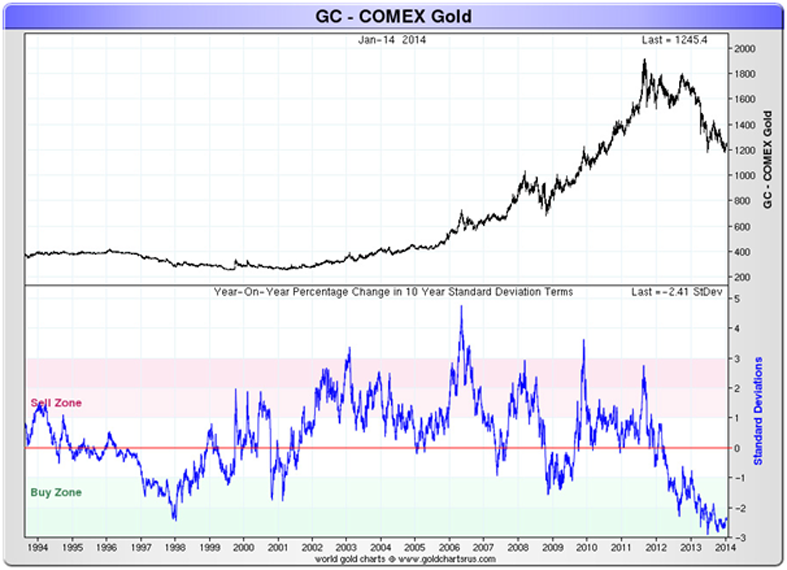

Gold Chart 7 – Just bounced off one of it’s most oversold phases …

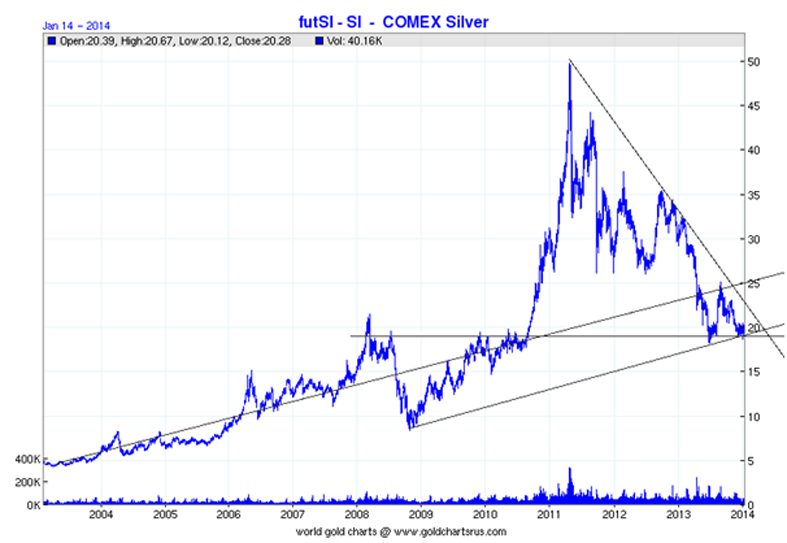

Silver Chart – Silver double bottom …

Palladium Chart – Time to breakout …

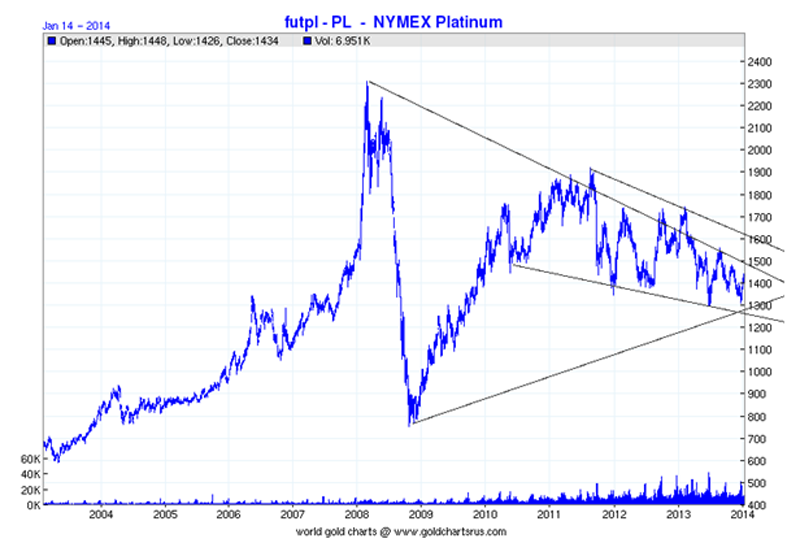

Platinum Chart – Time to get out of it’s funk …

Sentiment is as bad as we have seen it in the precious metals market. As the charts show, such sentiment, price action and oversold conditions tend to coincide with major lows in gold and silver prices and multi-month price gains.

The Future For Gold

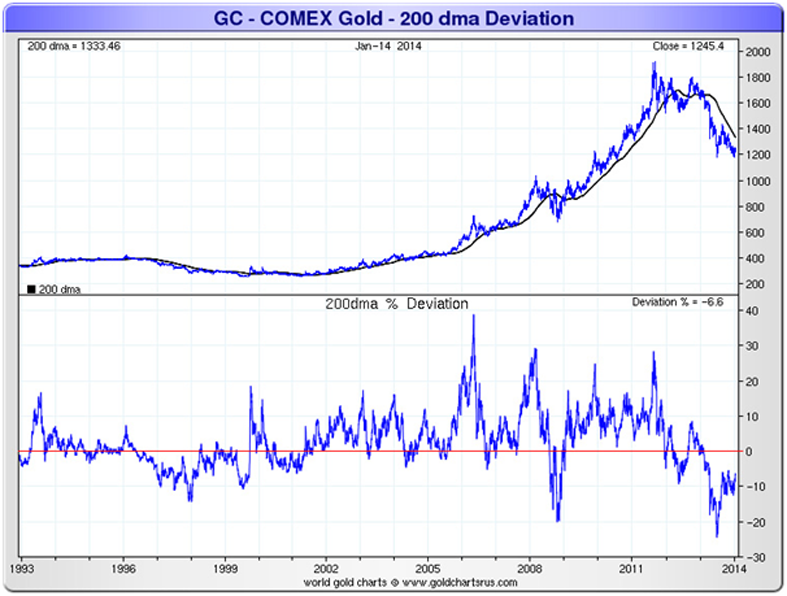

Very poor sentiment towards gold and oversold conditions is reminiscent of the conditions seen in late 2008 and January 2009 [as seen in the chart below] when gold prices had fallen by more than 25% in 9 months. Subsequently, gold rose from a low on January 15, 2009 at $802.60/oz to a high less than 12 months later at $1,215/oz for a gain of over 50%. A similar move today would see gold above $1,800/oz by year end.

We believe similar gains may be seen in the coming months and years. Investors should position themselves accordingly.

[Editor’s Note: The author’s views and conclusions in the above article are unaltered and no personal comments have been included to maintain the integrity of the original post. Furthermore, the views, conclusions and any recommendations offered in this article are not to be construed as an endorsement of such by the editor.]

*http://www.goldcore.com/goldcore_blog/Seven_Key_Gold_Charts_Bull_Market_Ahead (GoldCore Limited trading as GoldCore is registered in the Companies Registration Office under Company number 377252. Registered for VAT under number 6397252A. © 2014)

Related Articles:

(The articles posted on munKNEE.com deliberately present a diverse perspective on subjects discussed. Below are links, with introductory paragraphs, to a variety of related articles designed to help you become truly informed regarding both sides of the issues so that you can assess the merits of all points of view and come to your own conclusion.)

1. Gold & Silver to Plunge – Again – Then Move Up Dramatically Later in 2014

Back in early May, 2013, I correctly forecast the lows in gold & silver which occurred 2 months later. Today, my new analyses of gold & silver indicates they both will show further weakness during the first quarter of 2014 before both jumping dramatically in price before the end of 2014. Below are the specific details of my forecasts (with charts) to help you reap substantial financial rewards should you wish to avail yourself of my insightful analyses. Read More »

2. Nick Barisheff: “Today’s the 2nd-Greatest Opportunity to Buy Gold Since 2002!”

Last year…saw gold’s greatest decline in 32 years…but I’m still confident that gold’s bullish fundamentals are still intact and that what I said in my recently published book, $10,000 Gold, still holds true. Here’s why. Read More »

3. It’s PARAMOUNT to OWN some PHYSICAL Gold & Silver – Here’s WHY

Stop lamenting the current price of gold and silver and questioning the validity of owning PMs because without gold and/or silver it will be almost impossible to survive what is to come. No one knows when, but when it does, and it is a historical certainty, are you really going to care what you paid for your gold and silver? Read More »

4. Noonan: “Gold” War Has Replaced Cold War in China/Russia vs. U.S. Struggle for Economic Dominance

With the Western central bankers conducting a clearance sale, and depleting their physical holdings in the process, China and Russia are importing gold at cheaper and cheaper price levels. In the war for gold, the East and West are still winning, but for vastly different reasons. Let me explain. Read More »

5. Noonan: Charts Suggest Lower Lows for Gold & Silver to Come in 2014

Because the natural laws of supply and demand do not apply to gold and silver, the only way we can track the influence of endless paper supply on the market is through the most reliable source, the market itself, and the best way to track the market is through charts.Let’s take a look at what they are conveying today. Read More »

6. Gold In 2014: Price Forecasts ($900 – $1,435) & Commentary

Below are a series of forecasts and predictions of what 2014 could bring for the price of gold (as low as $900/ozt. & no higher than $1,435/ozt.) and the reasons why with interesting commentary by some individual investors and gold enthusiasts. Read More »

7. China Converting U.S. Dollar Debt Holdings Into Gold At Accelerating Rate

China, Russia and other nations are exiting their dollar-denominated holdings in favor of gold. This action should put pressure on the dollar and U.S. treasuries, pushing not only central banks, but mainstream investors towards the safety of precious metals and other tangible assets that cannot be defaulted on. There will be a rush out of dollars and into assets with no counter-party risk, it is just a matter of how soon it happens. Read More »

8. “$10,000 Gold” Exclusive Excerpts from Nick Barisheff’s New Book

$10,000 Gold offers a candid insight into the current state of the economy, the underlying causes of gold’s rising value and why the price of gold will continue climbing to $10,000/ounce and beyond in the years to come. The book contends that intelligent investors have no choice but to invest in this precious metal to stay safe no matter what lies ahead. Read More »

9. Just Gold & Silver: The Most Read Such Articles In 2013

munKNEE.com will receive well over 1,000,000 visitors again in 2013 and is now the “go-to” destination for diversified commentary and analyses on the current gold & silver doldrums and the future expectations for these precious metals. Below are introductions (with links) to the 13 most read such articles in 2013 in order of popularity. Interestingly, each of the 13 are as relevant today as the day they were posted so they are well worth taking the time to read. Read More »

10. The Pros & Cons of Buying Gold Bars vs. Ingots vs. Coins

It is during difficult times [such as these when] quantitative easing and currency wars have highlighted the volatility and vulnerability of currencies…that the true, safe value of gold really stands out. It is now easier for you to convert your savings into gold than ever before and this article outlines the reason for buying physical gold and the advantages and disadvantages of buying gold bars, ingots and/or coins. Read on! Words: 853 Read More »

11. Gold To Begin a Parabolic Rise In 2014 – Here’s Why

We are now starting the hyperinflationary phase in the USA and many other countries – and this will all start in 2014. What will be the trigger? The answer is simple – the fall of the U.S. dollar. Read More »

12. 12 Reasons Why Gold Should Bounce Sharply Higher in 2014

Is it time to throw in the towel? Is the bull market in precious metals really over? I don’t think so because my analyses suggest that nearly all of the fundamental factors that have been driving the gold price higher in the past decade have only strengthened in the past two years. Now that the correction has most likely run its course, I expect gold to rebound into the close of the year and bounce sharply higher in 2014. Here are the 12 reasons why. Read More »

13. Growth In National Debt Is 86% Correlated to the Price of Gold! Got Gold?

The correlation between the gold price, silver price and the debt growth has been amazingly accurate since 2001. Government spends too much money to perform a few essential services and to buy votes, wars, and welfare, and thereby increases its debt almost every year, while gold and silver prices, on average, match the increases in accumulated national debt. Read More »

14. These Sites Are the BEST Places to Buy Gold & Silver Online – Here’s Why

Our review of the best places to buy gold online…[are] dependent on what your goal with the gold is — amassing physical bullion for financial security or to speculate on gold prices. Below are strategies and recommended dealers for each approach: Words: 532 Read More »

15. What’s the Difference Between 1 Gold Karat, 1 Diamond Carat and 1 Troy Ounce?

You have no doubt read countless articles on the price of gold costing “x dollars per ounce”, own a gold ring or some other piece of gold jewellery and/or wear or have bought/plan to buy a diamond ring but do you really understand exactly what you are buying? What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? What’s the difference between a .75 and a 1.0 carat diamond? Let me explain. Words: 1102 Read More »

16. How Will the Price of Gold Evolve Into 2014 and Beyond? A Perspective

How will the price of gold develop into 2014 and in the following years? [Read on as] we try a look into the future. Words: 2600 Read More »

17. Should You Invest In Gold or Silver, Neither or Both?

…It’s not unreasonable that gold and silver (along with platinum) are often lumped together in the precious metal basket…but it’s important to distinguish between silver and gold rather than assume that the two metals are interchangeable. Words: 385 Read More »

18. 6 Rules for Buying & Selling Gold & Silver the Right Way

Here are 6 rules for buying and selling gold, silver and gold palladium the right way. [You’ll] not only get the best-possible prices but also [know] how to feel good about the quality of your purchase! Read More »

19. Gold: Buy Now & You Buy Right! Here Are 4 Reasons Why

Q: Is now the time to buy more gold or to finally get in the game? A: Yes. Make sure that you take advantage of today’s price and “mine” your own gold. [Here are 4 reasons why that is the case.] Read More »

20. Physical Gold Cannot Possibly Lose Out Over Fiat & Digital Currencies – Here’s Why

Gold cannot possibly lose its central position as the pre-eminent money used by the world for thousands of years. The aggressive measures of the Anglo-American Axis with regard to gold are absurd and they will lead to total disaster both for the Axis, and for the world which has been forced to follow its lead for over forty years. Read More »

21. The Gold Story Is NOT Over. Far From It. Here’s Why

Is it time to admit defeat, sell our positions, slink into a cave, and lick our wounds? Absolutely not. The only thing that changed over the past 60 days was the price of gold, and perhaps the mainstream’s perception of our industry. The realities of the fiscal and monetary state of the world, however, did not. Amid the ongoing rollercoaster ride of gold prices, clearheaded thinking reveals reasons to be optimistic. Read More »

22. 4 Specific Reasons Why Owning Gold Still Matters

I’m not going to predict a speedy recovery for gold prices. That said, I continue to believe that gold offers investors safety in an uncertain world and, while I remain optimistic about the recovery of the U.S. economy and stellar financial performance of some companies, there is reason for concern on a global level. That’s why I think every investor…must own gold. Read More »

23. Noonan: Is Gold’s Decline Being Caused By Fed Payback Time to China?

The manipulated raids in the gold market since last April may be hurting the Precious Metals game players, weakening their confidence and “disproving” gold’s worth against a fiat currency, but they serve a greater purpose, as in Federal Reserve payback time to China. Here’s why. Read More »

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money

Despite the excellent charts provided above, I believe that it will be a World event, not historic trends will send PM’s “through the roof,” which will send investors scurrying to acquire PM’s at prices that make our current prices a true bargain.