So says Bob Kirtley (www.gold-prices.biz) in edited excerpts from his original article* entitled Gold And Silver Prices Set To Rocket To Higher Ground .

Lorimer Wilson, editor of www.munKNEE.com

Kirtley, goes on to say, in part:

The U.S. Dollar Index to Drop Dramatically

The chart below shows the 50dma crossing over the 200dma in a downward motion, which is sometimes referred to as the ‘cross of death’ as it usually signals that a negative move is upon us. We now expect the dollar to drift lower and test the ’72’ level on the U.S. Dollar Index.

(click to enlarge)

The demise of the dollar and other fiat currencies brings with it an increase in the price of hard assets. Over the last decade or so, our hard asset of choice has been the precious metals sector, mainly physical gold and silver and they have served us well….

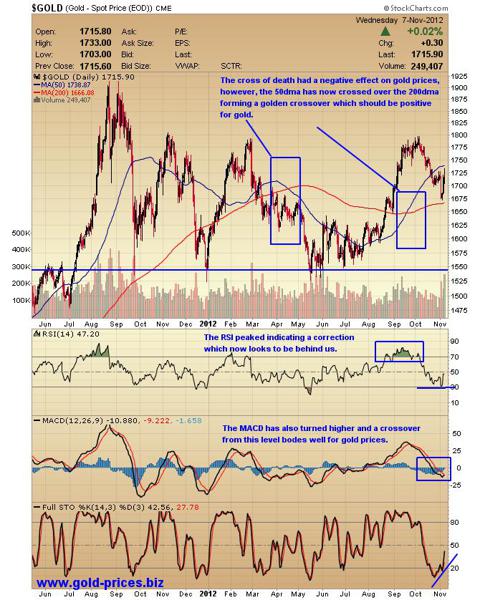

The chart below shows that gold prices have been through a lengthy period of consolidation following an all-time high formed in 2011. We draw your attention to the 50dma which has crossed over the 200dma in an upward motion which is sometimes referred to as the golden cross . Also note that gold returned from its recent high to take tea with the 200dma, which is a real good starting point for its next rally. The technical indicators are turning up from a low level and the MACD looks likely to form its own crossover suggesting that gold prices are about to move higher

(click to enlarge)

Bullish on Gold & Silver

Our own opinion is that g old and silver will rally from this point through to the early part of next year, making now a good time to accumulate more of the physical metals. Once above the $1800.00/oz level, gold will be well positioned to make a run at a new all-time high. We also expect silver prices to catch the wind and move to much higher ground. The gold to silver ratio currently stands at 54, if this ratio were to contract, as we suspect it will, then silver prices could well and truly explode

Sign up HERE to receive munKNEE.com’s unique newsletter, Your Daily Intelligence Report

contains the “best of the best” financial, economic and investment articles that can be found on the internet presented in an “edited excerpts format” to provide brevity and clarity of content to ensure you a fast and easy read. Stop wasting time searching the internet looking for articles worth reading. We do it for you and bring them to you each day. Sign up HERE

Not Bullish on Gold Stocks (Producers)

Investing in a small selection of good quality gold producers is the preference of many investors…but the moment we are not enthusiastic about them as they appear to lack the ability to keep pace with gold as evidenced by the HUI (the gold bugs index of UN-hedged gold producers) which is trading at a disappointing 485.56. Please don’t be put off by us though, as many of our peers see the mining sector as a good buying opportunity at these levels.

Who in the world is currently reading this article along with you? Click here

Prefer Options

As speculators we look for a ‘leverage’ return when placing a trade and so our attention is focused on the options sector. If we are correct in our premise that both gold and silver are going higher, then a few well-thought out option trades should provide a portfolio with a real boost. Well that’s our plan and we are sticking to it, as they say. You will need a strong stomach as the oscillations can be a tad nerve wracking and you will also need the discipline to close trades on a frequent basis as options are not a ‘buy and hold’ for the long-term vehicle. Time is of the essence, with most options expiring worthless.

Conclusion

Finally, move out of the folding stuff as and when you can and acquire some hard assets in a sector that you are comfortable with. Be prepared to work your socks off as none of this is going to be easy, it is going to be a white knuckle ride with violent oscillations being the order of the day. If you can find the time to do your own ‘due diligence’ then you should survive and even prosper in the coming years, so please give your own financial situation the attention it deserves….

*http://www.gold-prices.biz/home/gold-and-silver-prices-set-to-rocket-to-higher-ground.html

Editor’s Note: The above post may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Gold Projected to Reach $4,000/ozt. Sometime Between Late 2015 & Mid 2017! Here’s My Rationale

<img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2012/11/gold-bar5-90×65.jpg” alt=”gold-bar5″ title=”gold-bar5″ /> I am not predicting a future price of gold or the date that gold will trade at $4,000, but I am making a projection based on rational analysis that indicates a likely time period for gold to trade at $4,000 per troy ounce. Yes, $4,000 gold is completely plausible if you assume the following:

2. Update: 51 Analysts Now Maintain that Gold is Going to $5,500 – $6,500/ozt. in 2015!

<img title=”gold_ounce350_4dcc90a055e04-190×190″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” alt=”gold_ounce350_4dcc90a055e04-190×190″ width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” data-lazy-type=”image” /> <img title=”gold_ounce350_4dcc90a055e04-190×190″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” alt=”gold_ounce350_4dcc90a055e04-190×190″ width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” data-lazy-type=”image” /> <img title=”gold_ounce350_4dcc90a055e04-190×190″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” alt=”gold_ounce350_4dcc90a055e04-190×190″ width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” data-lazy-type=”image” /> <img title=”gold_ounce350_4dcc90a055e04-190×190″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” alt=”gold_ounce350_4dcc90a055e04-190×190″ width=”90″ height=”65″ data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” /> <img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_ounce350_4dcc90a055e04-190×190-90×65.jpg” alt=”gold_ounce350_4dcc90a055e04-190×190″ title=”gold_ounce350_4dcc90a055e04-190×190″ /> Lately analyst after analyst (161 at last count) has been climbing on board the golden wagon with prognostications as to what the parabolic peak price for gold will eventually be. That being said, however, only 51 have been bold enough to include the year in which they think their peak price estimate will occur and they are listed below. Take a look at who is projecting what, by when and why. Words: 644

3. Gold Should Be At $4,666 These Days – Here’s Why

<img title=”golden dollar” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/07/golden-dollar1.jpg” alt=”golden dollar” width=”54″ height=”54″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/07/golden-dollar1.jpg” data-lazy-type=”image” /> <img width=”54″ height=”54″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/07/golden-dollar1.jpg” alt=”golden dollar” title=”golden dollar” /> Since the Financial Crisis erupted in 2007, the US Federal Reserve has engaged in dozens of interventions/ bailouts to try and prop up the financial system…and the amount of money printed is absolutely staggering. As a result of this, inflation hedges, particularly Gold, have been soaring…[but] for gold, for example, to hit a new all time high adjusted for inflation, it would have to clear at least $2,193 per ounce. If you go by 1970 dollars (when gold started its last bull market) it would have to hit $4,666 per ounce. Words: 581

4. Alf Field: Gold STILL Targeted to Reach $4,500 – Preceded By Violent Upside Action

We now have a really strong probability that the correction which started at $1913 on 23 August 2011 has been completed both in terms of Elliott waves and also in terms of time elapsed. If this is correct, the gold price should soon be expressing itself in violent upside action as it moves into the third of third wave which is still targeted to reach $4,500. [Let me explain in detail (with charts) how and why my most recent analyses confirm my earlier target of $4,500.] Words: 1085

5. New Analysis Suggests a Parabolic Rise in Price of Gold to $4,380/ozt.

<img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ /> According to my 2000 calculations, if interest rates and inflation stay constant over the next 2 years, we could expect to see (with 95.2% certainty) a parabolic peak price for gold of $4,380 per troy ounce by then! Let me explain what assumptions I made and the methods I undertook to arrive at that number and you can decide just how realistic it is. Words: 740

6. Egon von Greyerz: Gold & Silver Off to the Races – to $4,500+ & $100+ Each – Here’s Why

<img title=”gold_price_surges_weak_jobs_data” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_price_surges_weak_jobs_data-90×65.jpg” alt=”gold_price_surges_weak_jobs_data” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_price_surges_weak_jobs_data-90×65.jpg” data-lazy-type=”image” /> <img title=”gold_price_surges_weak_jobs_data” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_price_surges_weak_jobs_data-90×65.jpg” alt=”gold_price_surges_weak_jobs_data” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_price_surges_weak_jobs_data-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold_price_surges_weak_jobs_data-90×65.jpg” alt=”gold_price_surges_weak_jobs_data” title=”gold_price_surges_weak_jobs_data” /> The closing of the gold window back in August 1971 has led governments worldwide to create endless amounts of worthless paper money and the resulting credit bubble has created a world debt exposure of over US$ 1 quadrillion (including derivatives). It has also created perceived wealth for big parts of the world’s population – a wealth which is only backed by promises to pay and by grossly inflated assets. Few people realise that this wealth is totally illusory and will implode considerably faster than the time it took to create it. [Let me explain.] Words: 890

7. Goldrunner: Price Target of $10,000 to $12,000 for Gold Still Holds

<img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img width=”86″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ title=”gold-bars4″ /> My Fractal Gold chart work is a direct comparison of Gold, today, to the late 70’s Gold Parabola. Thus, “timing” is taken directly from the late 70’s cycle, with price targets created from a combination of the late 70’s Gold price and different technical analysis techniques. We developed a price target back in 2006/ 2007 for Gold to reach the $10,000 to $12,000 range during this Gold Bull and we still stand by that forecast. Let me explain where we are at this point in time.

8. Nick Barisheff: $10,000 Gold is Coming! Here’s Why

<img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /><noscript><img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” data-lazy-type=”image” /> <img title=”gold-bars4″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/01/gold-bars4.jpg” alt=”gold-bars4″ width=”86″ height=”65″ /> This is not a typical bull market. Gold is not rising in value, but instead, currencies are losing purchasing power against gold and, therefore, gold can rise as high as currencies can fall. Since currencies are falling because of increasing debt, gold can rise as high as government debt can grow. Based on official estimates, America’s debt is projected to reach $23 trillion in 2015 and, if its correlation with the price of gold remains the same, the indicated gold price would be $2,600 per ounce. However, if history is any example, it’s a safe bet that government expenditure estimates will be greatly exceeded, and [this] rising debt will cause the price of gold to rise to $10,000…over the next five years. (Let me explain further.] Words: 1767

9. Gold’s Recent Price Action Suggests Ultimate Top of $5,000/ozt.

<img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” data-lazy-type=”image” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” data-lazy-type=”image” /> <img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /> The correlation between the gold price from 1968 until 1979 and from early 2000 until today is an amazing 89.65%! More specifically, the correlation from 1975 until April 1979 and from January 2008 until today is an astonishing 97.83% suggesting that gold will reach an ultimate top of $5,000 per troy ounce before the bubble bursts. Words: 330

10. The Future Price of Gold and the 2% Factor

<img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” data-lazy-type=”image” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” data-lazy-type=”image” /> <img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /> It is my contention that the price of gold rallies whenever the U.S. dollar’s real short-term interest rate is below 2%, falls whenever the real short rate is above 2%, and holds steady at the equilibrium rate of 2%. Furthermore, for every one percentage point real rates differ from 2%, gold moves by eight times that amount per year. So if the real rates are at 1%, gold will move up at an 8% annualized rate. If real rates are at 0%, then gold will move up at a 16% rate (that’s been about the story for the past decade). Conversely, if the real rate jumps to 3%, then gold will drop at an 8% rate. [Let me explain.] Words: 982

11. Gold Will Reach $3,000/$4,000/$5,000 Before This Bull Market Is Over! Here are 12 Factors Why

<img title=”gold bars and coins” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold-bars-and-coins-90×65.png” alt=”gold bars and coins” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold-bars-and-coins-90×65.png” data-lazy-type=”image” /> <img title=”gold bars and coins” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold-bars-and-coins-90×65.png” alt=”gold bars and coins” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold-bars-and-coins-90×65.png” data-lazy-type=”image” /> <img title=”gold bars and coins” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/gold-bars-and-coins-90×65.png” alt=”gold bars and coins” width=”90″ height=”65″ /> I believe that the price of gold will… reach… $3,000, $4,000, and even $5,000 [per troy] ounce…during the course of this long-lasting bull market, a bull market that still has years of life left to it…[although] prices will remain extremely volatile – with big swings both up and down along a rising trend…The future price of gold is a function of past and prospective world economic, demographic, and political developments [and in this article] I review some of these developments and trends – so that you can come to your own “golden” conclusions. Words: 3800

12. Why You Should Now Invest in Silver vs. Gold

<img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/08/gold-silver2-90×65.jpg” alt=”gold-silver2″ title=”gold-silver2″ /> The price of silver is going to go much, much higher – much higher – over the next decade [relative to gold according to Jim Rogers and I concur. Below are 5 solid reasons why I believe that is the case.] Words: 767

13. Silver’s Price Could Outpace That of Gold – Here’s Why

<img title=”gold-silver” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/05/gold-silver-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”gold-silver” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/05/gold-silver-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” title=”gold-silver” /> The value of silver has skyrocketed in recent decades –leading many investing experts to believe that silver’s price could outpace gold for the first time in history. This infographic covers silver’s meteoric increase and the factors that have led to silver’s exploding value…[and] takes a nod to the future to see where silver’s price may be headed based on the most up to date demand data.

14. Gold:Silver Ratio Suggests MUCH Higher Price of Silver in Next Few Years

<img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/ <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> The majority of analysts are now of the opinion that gold will reach a parabolic peak price somewhere in excess of $5,000 per troy ounce in the next few years. Given the fact that the historical movement of silver is 90 – 95% correlated with that of gold suggests that a much higher price for silver can also be anticipated. Couple that with the fact that silver is currently greatly undervalued relative to its average long-term historical relationship with gold, silver could escalate dramatically in price over the next few years. How much? This article takes a look at historical gold:silver ratios and what attaining certain relationships would mean for the price of silver should specific price levels for gold be realized. Words: 691

15. Goldrunner: Silver to Rocket to $60 – $68 and Then Much Higher

<img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/ <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> Personally, based on the fundamentals at hand and the fact that Gold doubled its log channel around this point in the cycle; I expect Silver to bust up out of its log channel in 2013. Initially, I look for Silver to reach the $60 to $68 level, first and hold open the possibility for Silver to do much more on the upside as the 70’s Silver Chart reflects.

16. Gold: What Does a “Troy” Ounce or “18/24 Karat” Gold Really Mean?

<img title=”gold” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img title=”gold” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” alt=”gold” width=”77″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” data-lazy-type=”image” /> <img width=”77″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/gold.jpg” alt=”gold” title=”gold” /> You have no doubt read countless articles on the price of gold costing “x dollars per ounce” and possibly own a gold ring or some other piece of gold jewellery but do you really understand exactly what you are buying? What’s the difference between 1 troy ounce of gold and 1 (regular) ounce? What’s the difference between 18 and 10 karat gold? Let me explain. Words: 637

17. Moolman: Long-Term Chart Suggests Silver Will Comfortably Pass $150 By End of 2013

<img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/ <img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /><noscript><img title=”Silver Bars” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/09/Silver-Bars-90×65.jpg” alt=”Silver Bars” title=”Silver Bars” /> Thanks to this similarity in events, as well as the similarity in sequence, of the price movement of silver from the beginning of 1966 to the beginning of 1980 with the end of 1999 to the end 2013, my analysis suggests that silver will comfortably pass $150 by that date. Let me explain my rationale. Words: 338

18. Gold Has Just About Bottomed: Now’s the Time to Buy, BUy, BUY! Here’s Why

<img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2012/02/credit-suisse-gold-bars-90×65.jpg” alt=”credit-suisse-gold-bars” title=”credit-suisse-gold-bars” /> If you aren’t already in, this coming Monday or Tuesday (Nov. 5-6th) should represent an exceptional buying opportunity as gold moves into its final intermediate cycle bottom. Now that the 38% retracement has been breached I would look for a final exhaustion move to test the 50% level early next week as we move into the elections. Words: 284

19. Goldrunner: Gold & Silver to Bottom This Week & Then Spurt to $2,050 and $41 Areas – Here’s Why

<img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/05/gold-silver-90×65.jpg” alt=”gold-silver” title=”gold-silver” /> The upside potential following this correction still looks huge for Gold and for Silver. We expect Gold and Silver to soon make a run back up to the recent highs – but at a sharper angle than they fell. [Let me explain why this will likely be the case.] Words: 528

20. Gold & HUI About to Turn Upwards, Reach All-time Highs By Year-end and Continue Dramatically Higher into 2014! Here’s Why

<img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/08/gold-correction-90×65.jpg” alt=”gold-correction” title=”gold-correction” /> …Gold is about to undergo a profit-taking event…as a result of the USD beginning a rally, probably beginning today. I’m looking for the dollar index to test the downward sloping 200 day moving average [see chart below] before rolling over and continuing the secular trend. This should drive gold down into a final intermediate degree bottom around $1694 or so before testing the all-time highs at or slightly above $1900 sometime before the end of the year. [Let me explain why that is most likely going to happen.] Words: 401

21. Dr. Nu Yu: Once Gold Surpasses $1,800/ozt & Silver $36/ozt Both Will Become VERY Bullish – Here’s Why

<img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/08/buy-gold-90×65.jpg” alt=”buy-gold” title=”buy-gold” /> Gold could become very bullish once it breaks through the upper horizontal resistance line at $1,800/ozt. Likewise for silver once it breaks through $36. Once these prices are surpassed the HUI should also take off. Check out my technical analysis below for details.

22. Commodity Trading: Which Option Options (if any) Belong in Your Portfolio?

<img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2009/10/commodities.jpg” alt=”commodities” title=”commodities” /> Commodity investing has been around for decades, but it was only recently that their popularity has spread to the general public. It is now generally recommended that investors set aside anywhere from 5% to 10% of their capital for a commodity allocation, as these hard assets generally offer uncorrelated returns essential to diversification. While many investors utilize stocks, ETFs, and futures to obtain their commodity exposure, options contracts can often be a better alternative to not only your commodity holdings, but for the remainder of your portfolio as well [Let me tell you more about options and also why they might/should have a place in your portfolio]. Words: 995

23. Options Are a Gold Bull’s Better Play Than Owning High Beta Miners – Here’s Why

<img title=”crowne-gold-silver-bullion_l” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/crowne-gold-silver-bullion_l1-90×65.jpg” alt=”crowne-gold-silver-bullion_l” width=”90″ height=”65″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/crowne-gold-silver-bullion_l1-90×65.jpg” data-lazy-type=”image” /> <img width=”90″ height=”65″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2011/11/crowne-gold-silver-bullion_l1-90×65.jpg” alt=”crowne-gold-silver-bullion_l” title=”crowne-gold-silver-bullion_l” /> Whilst it is true, more often than not, that mining stocks move in the same direction as gold [and historically outperform that of the physical metal based on their better beta statistics] there are periods where this relationship does not hold. That is one of the reasons we currently have no interest in trading or investing in mining stocks. Why form a bullish view on gold and buy mining stocks based on this view, only to see gold rise and mining stocks fall? [Instead,]… our preferred strategy to optimize and maximize potential profits… is using options that are directed based on the price of gold with no other factors influencing their performance. [Let us explain why.] Words: 1234

24. Options: The Best Way to Optimize Leverage of Your Gold Investments

<img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /> In our quest for the best gold investment vehicle – one that exerts direct undiluted correlated returns to the gold price with added leverage that is quantifiable to a reasonable accuracy – we think that options are the best choice. Words: 690

25. Interested in Buying Gold or Silver Mining Company Warrants? Here’s How

<img title=”World’s First 100-kg, .99999% Pure Gold Bullion Coin” src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/08/gold1.jpg” alt=”World’s First 100-kg, .99999% Pure Gold Bullion Coin” width=”90″ height=”60″ data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/08/gold1.jpg” data-lazy-type=”image” /> <img width=”90″ height=”60″ src=”https://gos.ixm.mybluehost.me/wp-content/uploads/2010/08/gold1.jpg” alt=”World’s First 100-kg, .99999% Pure Gold Bullion Coin” title=”World’s First 100-kg, .99999% Pure Gold Bullion Coin” /> Buying and selling warrants associated with commodity-related companies (including those of gold and silver miners) can be very confusing if you are not aware of the unique information required to do so and understand just how to go about it. Below you will find all the information you need to know on the subject. Words: 2110

26. What Are Warrants, Options & LEAPS?

<img src=”https://gos.ixm.mybluehost.me/wp-content/plugins/bj-lazy-load/img/placeholder.gif” data-lazy-type=”image” data-lazy-src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /><noscript><img src=”https://gos.ixm.mybluehost.me/wp-content/themes/Transcript/images/thumbs/archive.jpg” alt=”” /> Investors are always looking for ways to maximize their gains and warrants, options and LEAPS are a good way to do just that. These investment vehicles are very similar to each other except for issue of time. [Let me explain.] Words: 752

27. This Chart Proves That Your Currency Is Being Debauched At An Accelerating (Parabolic) Rate! Got Gold?

[According to the chart in this article,] all currencies are being debauched. The price of gold in each currency approximates a parabola, meaning the use of printing presses is accelerating. Each unit of currency is losing purchasing power at an increasing rate. The trend points to a worldwide currency collapse unless the creation of money stops. [Take a look!]. Words: 282

Washington-centric controlled economy with a rolling program of borrow, print, spend and pretend; similar to the last four years….[What affect will such fiscal irresponsibility have on the U.S. dollar, gold and silver? Read on!] Words: 717

Washington-centric controlled economy with a rolling program of borrow, print, spend and pretend; similar to the last four years….[What affect will such fiscal irresponsibility have on the U.S. dollar, gold and silver? Read on!] Words: 717

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money