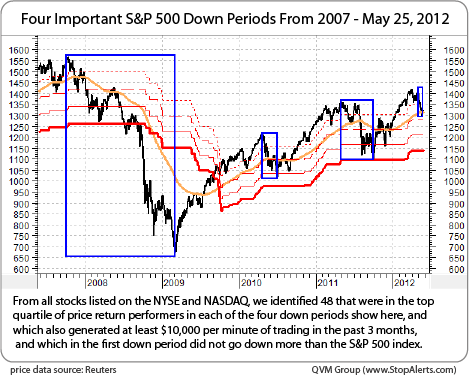

As investors become more and more worried about the world economy…it makes sense to us to look into stocks that held up best in periods of market decline. Managing risk is as important as reaching for return. One aspect of managing for risk is the past behavior of particular stocks in negative market periods. Toward that end, we identified four key, recent down periods for the S&P 500, and identified those liquid stocks that were in the top quartile for price return in each of those four periods, and did at least as well as the S&P 500 index in the 2008 crash period. [Take a look!] Words: 620

makes sense to us to look into stocks that held up best in periods of market decline. Managing risk is as important as reaching for return. One aspect of managing for risk is the past behavior of particular stocks in negative market periods. Toward that end, we identified four key, recent down periods for the S&P 500, and identified those liquid stocks that were in the top quartile for price return in each of those four periods, and did at least as well as the S&P 500 index in the 2008 crash period. [Take a look!] Words: 620

So says StopAlerts in an article* posted on Seeking Alpha.

Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited the article below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

The article goes on to say, in part:

The bear was in 2008-2009, and the corrections were in 2010, 2011 and ongoing in 2012 and we ran the test against the 6824 NYSE and NASDAQ stocks in the MetaStock database.

We understand (and are required by regulations to say) that past performance is no guarantee of future performance. Nonetheless, we believe the past does provide some clues about the future. We believe that by looking for stocks that have repeatedly weathered storms better than others, the odds tilt somewhat in favor of those stocks doing better in near-term future storms.

…Here is the list of the 48 individual stocks that passed our filter. You’ll have to look further into the names for additional insight, but this is not a bad list to begin a search for safety while remaining in stocks.

Some of these stocks are probably real dogs going forward, and some may be gems. What you seek may not be what we would seek, but probably most of us would be intrigued by stocks that resisted down drafts more than most others over multiple down market movements.

Note: None of these names are purchase recommendations. This list is provided as time saving service to the do-it-yourself investor who would like to research within a subset of the stock universe that has the price decline resistance history these names have shown.

| Security Name | Symbol |

| AMERISOURCEBERGEN ORD | ABC |

| BARRICK GOLD ORD | ABX |

| ALLIANCEBERNSTEIN INCOME CF | ACG |

| AGNICO EAGLE MINES ORD | AEM |

| ANWORTH MORTGAGE REIT | ANH |

| YAMANA GOLD ORD | AUY |

| BALCHEM ORD | BCPC |

| BROWN FORMAN CL B ORD | BF.B |

| BIOGEN IDEC ORD | BIIB |

| BRISTOL MYERS SQUIBB ORD | BMY |

| COLGATE PALMOLIVE ORD | CL |

| CLOROX ORD | CLX |

| CMS ENERGY ORD | CMS |

| CLECO ORD | CNL |

| DOLLAR TREE ORD | DLTR |

| DIAMOND FOODS ORD | DMND |

| DUKE ENERGY ORD | DUK |

| ECOLAB ORD | ECL |

| CONSOLIDATED EDISON ORD | ED |

| FAMILY DOLLAR STORES ORD | FDO |

| FLOWERS FOODS ORD | FLO |

| GENERAL MILLS ORD | GIS |

| HJ HEINZ ORD | HNZ |

| HORMEL FOODS ORD | HRL |

| HERSHEY FOODS ORD | HSY |

| HEARTWARE INTERNATIONAL ORD | HTWR |

| IDENIX PHARMACEUTICALS ORD | IDIX |

| KELLOGG ORD | K |

| KENSEY NASH ORD | KNSY |

| COCA-COLA FEMSA ADR REP 10 SR L ORD | KOF |

| MCCORMICK ORD | MKC |

| MONSTER BEVERAGE ORD | MNST |

| ALTRIA GROUP ORD | MO |

| NEXTERA ENERGY ORD | NEE |

| NEWMONT MINING ORD | NEM |

| NJ RESOURCES ORD | NJR |

| ANNALY CAPITAL MANAGEMENT REIT | NLY |

| NORTHEAST UTILITIES ORD | NU |

| PG&E ORD | PCG |

| PROCTER & GAMBLE ORD | PG |

| PROGRESS ENERGY ORD | PGN |

| PERRIGO ORD | PRGO |

| ROYAL GOLD ORD | RGLD |

| ROSS STORES ORD | ROST |

| SEATTLE GENETICS ORD | SGEN |

| STERICYCLE ORD | SRCL |

| SXC HEALTH SOLUTIONS ORD | SXCI |

| VOLCANO ORD | VOLC |

Conclusion

Whatever warts some of the above stocks may have, you have to give them some recognition for beating thousands of other stocks in the dimension of decline resistance in three separate corrections and a bear over four consecutive years.

*http://seekingalpha.com/article/620081-stocks-that-declined-least-in-2008-crash-and-2010-and-2011-corrections (To access the above article please copy the URL and paste it into your browser.)

Editor’s Note: The above article may have been edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Financial Advisors/Planners: These Articles are a MUST Read!

There are hundreds of articles posted every month with supposed insights into how best to manage one’s money to generate the greatest return with the least amount of risk. Not many deliver the knowledge they claim to convey. Here are a few that do and should be of particular interest to all you investment advisors/planners out there.

2. This New ‘Peak Fear’ Indicator Gives You an Investment Edge

We are at a major crossroads in the equity and bond markets. We could see a major ‘risk-on’ rally in the S&P 500 BUT if no equity rally ensues, and U.S. Treasury note yields keep falling, then something terrible is about to strike at the heart of the global capital markets…. [As such, it is imperative that you keep a close eye on this new ‘Peak Price’ indicator. Let me explain.] Words: 450

3. Ignore Guru Opinions: 66% Get It WRONG More Than 50% of the Time! Here’s How They Compare

Can experts, whether self-proclaimed or endorsed by others (publications), provide reliable stock market timing guidance? Do some experts clearly show better intuition about overall market direction than others? [NO is the answer to the first question and YES to the second. Let us explain how we came to those conclusions.] Words:360

4. The P/E Ratio: Its Strengths and Limitations

When it comes to valuing stocks, the price-to-earnings (P/E) ratio is the number one metric for investors that want an instant fix on what the market thinks of a company. [That being said]…there are health warnings to heed if you don’t want to be left exposed by its limitations. [Let me explain.] Words: 1101

5. Don’t Invest in Mutual Funds! Here’s Why

The amount of evidence stacking up that…mutual funds…do not provide value for their investors is just staggering…While there are certainly signs that the public’s tolerance of excessive fees and executive pay is falling, the likelihood of significant structural change in the finance industry is still remote. Given such a backdrop the probability remains that investors in funds will, on average, continue to underperform their benchmarks. So what is an investor to do? [Read on!] Words: 830

6. Should Technical Analysis Be Ignored? We Think So – Here’s Why

The Web is crawling with technical analysis (TA)…[and,] given its popularity, [begs the questions as to whether or not there] really is something to it. [Based on our research,] the short answer is no, not really, at least not in developed markets like the US or the UK… Furthermore, most of the popular TA indicators that are bandied around are nonsense jargon and should be ignored as useless noise. [Let us explain our position.] Words: 2143

7. Motivated Stock Pickers CAN Beat the Market! Here’s How

What hope can there be for motivated stock pickers – no matter how much they sweat and toil – to outperform the low-cost index funds that simply mechanically track the market? Well – in spite of the absurd rise of the Nobel-acclaimed, and highly promoted, Efficient Market Hypothesis that claims that individual investors can’t beat the market – it turns out there is plenty! Just ask Warren Buffett, for one. [Let me explain.] Words: 1574

8. Extreme Investing: Do Leveraged ETFs Belong in Your Portfolio?

Some analysts and commentators are warning that this year (2012) could match or surpass the dire conditions experienced in 2008 with the promise of more turbulence from the Eurozone, further political wrangles over dealing with the U.S. budget deficit and a potential host of problems in emerging market countries such as a possible Chinese banking and real estate crash. [While you] should fear plummeting stock markets…there are actually some interesting ways to play the downside or hedge your portfolio. [Let me explain.] Words: 990

9. Your Portfolio Isn’t Adequately Diversified Without 7-15% in Precious Metals – Here’s Why

The traditional view of portfolio management is that three asset classes, stocks, bonds and cash, are sufficient to achieve diversification. This view is, quite simply, wrong because over the past 10 years gold, silver and platinum have singularly outperformed virtually all major widely accepted investment indexes. Precious metals should be considered an independent asset class and an allocation to precious metals, as the most uncorrelated asset group, is essential for proper portfolio diversification. [Let me explain.] Words: 2137

10. What Works on Wall Street? James O’Shaughnessy Tells All!

History has shown that investors who stick to disciplined, fundamental-focused strategies give themselves a good chance of beating the market over the long haul and one of the investment gurus who has compiled the most data on that topic is James O’Shaughnessy, whose book What Works on Wall Street became something of a bible for investment strategies when it was released 15 years ago. Now, O’Shaughnessy has released an updated version of his book, with a plethora of new data on various investment strategies. Using data that stretches back to before the Great Depression in some cases, O’Shaughnessy back-tests numerous strategies, and comes to some very intriguing conclusions. [Let me share some of them with you.] Words: 1345

11. Don’t Confuse “Risk” with “Volatility” – It Could Have Dire Consequences on Your Investments

[I am surprised at the large number of] investment professionals who confuse risk and volatility… regularly and thoroughly confusing these two concepts to the point where the terms are treated as being virtually synonymous. This has resulted in the flawed investment principle that reducing volatility will (and must) reduce risk. Such thinking is deeply misguided, and following it has dire consequences for investors. [Let me explain more about what risk and volatility are and are not.] Words: 110012. Market -Timing Pays BIG Dividends for Income Investors – Here’s Why

Many income investors have been taught to believe that “market-timing” is anathema to their investment objectives and/or that it can’t be done successfully… I will argue that this piece of conventional wisdom is false – dangerously false. In a three-part series of essays, I will argue that market-timing needs to be incorporated as a fundamental component of income investing. I will demonstrate why market-timing is important, when it should be applied and how it should be implemented. [Read on!] Words: 1956

13. Bonds Are NOT a Safe Place to Be – Here’s Why

For those who think bonds are a safe place to be, you might want to reconsider. In addition to rising sovereign risk (yes, for the U.S. as well as other countries), there is interest rate risk….[should you not] hold it to maturity. If interest rates rise, then the value of your bond falls (Bonds can produce capital gains/losses, just like stocks.) and the possibility of interest rates rising is pretty good. Words: 530

14. Ride the Market Waves With These 6 Momentum Indicators

It is hard to know what to buy or sell let alone just when to prudently do so. Thank goodness there are indicators available that provide information of stock and index movement of a more immediate nature to help you make such important decisions. This article describes the 6 most popular Momentum Indicators. If ever there was a “cut and save” investment advisory this is it! Words: 1234

15. Here’s How to Time the Market!

There are many indicators available that provide information on stock and index movement to help you time the market and make money. Market strength and volatility are two such categories of indicators and a description of six of them are described in this “cut and save” article. Read on! Words: 974

16. Yes, You Can Time the Market – Use These Trend Indicators

Remember, the trend is your friend and now you have an arsenal of such indicators to make an extensive and in-depth assessment of whether you should be buying or selling. If ever there was a “cut and save” investment advisory this article is it. Words: 1579

17. Understanding the Patterns, Trends, Indicators and Formations of Technical Analysis

Technical Analysis is the discipline of finding reliable patterns, trends, indicators and formations, mainly in price, for buying and selling assets…To a large degree, technical analysis is a self-fulfilling prophesy [in that] it is effectively an unofficial agreement amongst market participants to impose more order on what would otherwise be more random. The key is to understand which patterns, formations and indicators are widely adhered to, so as to become useful predictors of price action [and this article does just that. Let me explain.] Words: 470

18. Which is Riskier? Investing in Gold & Silver or in the Dow 30 Stocks?

While gold is slightly more volatile than the Dow 30, on average, all of the individual components are more volatile than gold and only half are less volatile than silver and platinum. [So much for] the prevailing myth…that they are risky investments due to their volatility. [Let’s take a closer look at the specifics.] Words: 250

19. Should Stocks Be the Cornerstone of Your Portfolio?

There is a common notion that stocks, at least if held for a long-time, outperform other assets [and, as such,] should be the cornerstone of any long-term portfolio. [While that is indeed true,] it is best to focus first on how much you are able and willing to lose (i.e. what risk you are able and willing to bear) when determining the optimal allocation for your portfolio. [Only] then [should you] think about what potential investment returns you might be able to capture. [Let me explain.] Words: 1503

20. Become a Dividend Investor & Retire Comfortably- Here’s How

I invest in dividend paying stocks in order to generate a sufficient income stream that will meet and exceed my expenses in retirement. “Retirement” to me is the point where my dividend income exceeds my annual expenses by 1.5 times, which means that I no longer have to work for money. In order to get there I am following several simple, but crucial, principles [which I would like to share with you]. Words: 830

21. 10 Index ETFs for Building an Ideal Retirement Oriented Portfolio

Constructing a portfolio for the retirement years requires one to focus on portfolio risk or uncertainty while not neglecting return. If the portfolio asset allocation plan is too conservative, the return will not meet lifestyle expectations. Inflation is again on the rise and this needs to be taken into consideration when putting together a retirement oriented portfolio. Below is a combination of index ETFs that project respectable returns while holding down portfolio volatility. Words: 455

22. Why, Pray Tell, Would I Want to Own Gold??

Comments I have made that “when this [financial crisis] finally ends the big winners are apt to be the ones who have lost the least purchasing power. Keeping score in nominal dollars is likely to be meaningless. Gold tends to hold its purchasing power regardless of what happens to fiat currency.” have prompted questions about a) how to achieve such purchasing power with physical gold when this stage is reached, b) how to go about buying things with gold coins and c) how gold would be utilized under the assumption that a barter system would develop when dollars become worthless. [Let me explain.] Words: 700

23. If You Don’t Think Gold IS a ‘Safe Haven’ Then You Don’t Know the Meaning of the Term!

It would seem that there is a considerable lack of understanding about what the term “safe haven” actually means when it comes to gold. Let me explain just what it means – and does not mean. Words: 740

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money