Economist Gary Shilling, excellent forecaster of past recessions and chief pooh-pooher of today’s market enthusiasm, thinks consumers are in worse shape than they’re letting on …[and,] while his general pessimism puts him very much at odds with the market for the first few months of the year, it looks like he’s gaining some followers. [Take a look at his] point-by-point explanations of his opinions, [supported by charts , and see if you, too, come to the same conclusions.] Words: 740

chief pooh-pooher of today’s market enthusiasm, thinks consumers are in worse shape than they’re letting on …[and,] while his general pessimism puts him very much at odds with the market for the first few months of the year, it looks like he’s gaining some followers. [Take a look at his] point-by-point explanations of his opinions, [supported by charts , and see if you, too, come to the same conclusions.] Words: 740

So says Dee Gill (www.Ycharts.com) in edited excerpts from an article* posted on SeekingAlpha.com which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has edited below for length and clarity – see Editor’s Note at the bottom of the page. This paragraph must be included in any article re-posting to avoid copyright infringement.

Gill goes on to say, in part:

Shilling forecasts a recession this year, a prediction that a falling unemployment rate and rising retail sales figures [has] done little to change. Consumers buying fun stuff like iPads and clothing [has] ramped up retail sales figures this year and brought along stock prices in several sectors with them [Read: Stop! If You Sell in May and Go Away This Year You’ll Regret It – Here’s Why] as the chart of the S&P 500 shows below but he is skeptical of using consumer behavior as a reliable indicator of the general public’s actual situation.

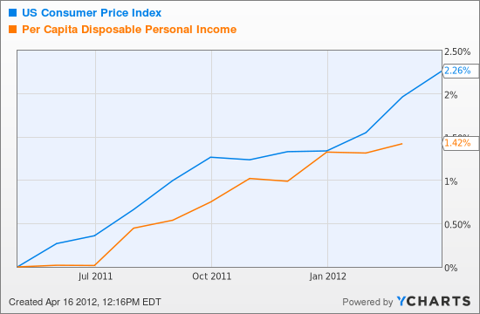

By many accounts, consumers have even less money than they did a year ago, because prices of goods have gone up [see chart below], and not just gasoline prices, which he considers of limited importance. [Read: An Inflation Inferno is Expected – but When?]

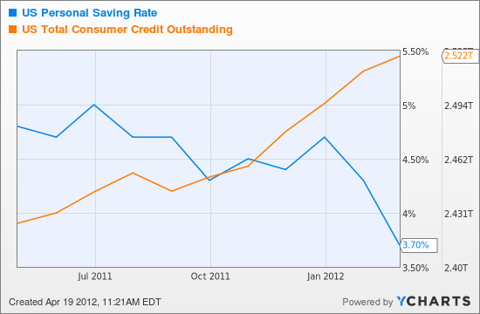

In the past year, earnings have not gone up at the pace of costs which means consumers are using more savings or borrowing to buy things. In the past year alone, debt has edged up, but the savings rate has dropped sharply [see chart below]. Shilling sees this as an unsustainable situation that will lead to a drop in consumer confidence – another indicator showing happy times recently – before wages and employment increase. [Read: Have Your Say in World Consumer Confidence Index Survey – Here’s How and Majority of Americans Finally Agree on Something – and Its Economic!]

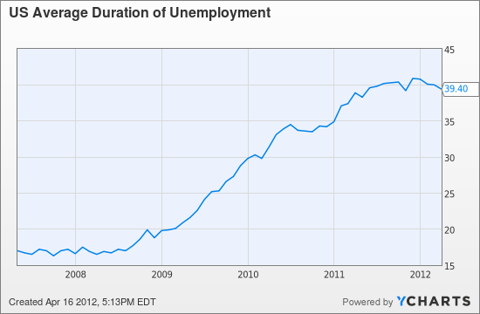

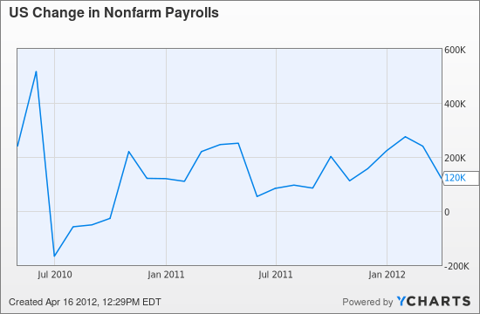

[While] the overall employment rate has gone down he points out that a drop in claims for unemployment, or even a rise in job openings, isn’t the same as new hiring. Employers are being very picky, and a lot of today’s unemployed have been out of the workforce so long that their skills are rusty or unappreciated. [Read: What Does ‘Structural’ Unemployment Mean? What Does It Mean for Future Economic Growth ?] Since recovery began, some unemployed have dropped out of the job search, and the length of time for unemployment has risen sharply [as the chart below clearly shows].Payroll numbers for the past couple of year don’t suggest a promising trend either [as the chart below shows].

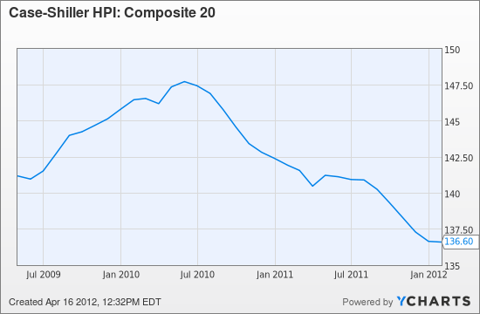

Meanwhile, home mortgages that still exceed market values keep qualified workers from moving for better job opportunities. Shilling warns of a possible 20% additional drop in housing prices [Read: U.S. House Prices Have MUCH Further To Fall! Here’s Why] – a prediction that got more attention when January’s prices broke a steady decline and remained about flat. If this really is the restart of falling prices, those consumer confidence figures behind so much of the market’s happiness this year will surely tank.

Shilling’s reason for bearishness is a lot more complicated than our little summary here can show. We haven’t even touched on his cynicism about corporate earnings that beat forecasts, or his views that still-broke state and local governments can seriously hurt recovery, for example, [Read: Municipal Bankruptcy Crisis in U.S. to Have Dire National Consequences! Here’s Why – and How] or, for that matter, on the reasons that multitudes think he’s way off base in his conclusions.

In coming months, when the S&P takes a dive on some worrisome consumer indicator [Read: Charles Nenner: Dow to Peak in 2012 and Then Decline to 5,000!], consider Shilling’s reasoning. It’ll be one more tool in understanding whether you’re looking at a buying opportunity or something else entirely [Read: Richard Russell’s Alarming (Alarmist?) Views on the VERY Near Future: Crime, Chaos, Collapse & Skyrocketing Gold].

Editor’s Note: The above article has been has edited ([ ]), abridged (…), and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

*http://seekingalpha.com/article/515441-freaking-out-with-bearish-economist-gary-shilling-chart-by-chart (To access the article please copy the URL and paste it into your browser.)

Automatic Delivery Available! If you enjoy this site and would like to have every article sent to you then go HERE and sign up to receive Your Daily Intelligence Report. We provide an easy “unsubscribe” feature should you decide to opt out at any time.

Pass it ON. Tell your friends and co-workers about us! We think munKNEE.com is one of the highest quality (content and presentation) financial sites on the internet and our current readers seem to be confirming that. Visits have been doubling yearly and pages-per-visit and time-on-site continue to reach record highs.

Spread the word. munKNEE should be in everybody’s inbox and MONEY in everybody’s wallet!

Related Articles:

1. U.S. House Prices Have MUCH Further To Fall! Here’s Why

There has been a deluge of articles recently about the upticks in the housing data…[yet, while] I do not dispute the improvement in the data regarding home starts, permits, pending sales, etc.,… [see graph below] these data points are still mired at very depressed levels so the assumption is that if home building is stabilizing then it is only a function of time until home prices began to rise as well. Right? Not so fast.. [Let me explain.] Words: 1100

2. Have Your Say in World Consumer Confidence Index Survey – Here’s How

According to the latest real-time Worldwide Consumer Confidence Index most respondents believe that their economic circumstances will improve over the next 6 months even though such confidence has declined marginally from 30 days ago. You don’t feel the same way? OK, read on and actually participate in the survey to have your view of things so recorded. It is fast and easy to do. Here’s how. Words: 410

3. Municipal Bankruptcy Crisis in U.S. to Have Dire National Consequences! Here’s Why – and How

The plight of municipalities in the U.S., and their struggles under the weight of enormous pension budget deficits, are reaching the critical phase [with] many municipalities [now]contemplating bankruptcy. [That, in turn, is causing]… municipalities [to eliminate jobs (150,000 – 175,000 in 2012) providing significant headwinds to jobs growth nationally [which, in turn, will adversely affect] economic growth…[causing even] more municipalities to declare bankruptcy and [their] states, in turn, run to the Federal government for help. Words: 567

Get ready…Save some cash, load up with gold and silver, and be patient…Start by buying top-grade dividend-paying stocks and gold on dips or corrections, and hold your gold. This era will see the catastrophic collapse of all fiat money. Gold should skyrocket. Get ready for crime and violence…

5. What Does ‘Structural’ Unemployment Mean? What Does It Mean for Future Economic Growth ?

It is important when your read articles on Job Reports that you understand what Structural Unemployment is, and what it means to economic growth. [This short article will attempt to do just that.] Words: 432

6. Majority of Americans Finally Agree on Something – and Its Economic!

No matter how you break it down — whether by party/ideology, household income, age, or any other category — the majority of Americans agree on one thing…..[Here are the details.] Words: 260

7. Charles Nenner: Dow to Peak in 2012 and Then Decline to 5,000!

Charles Nenner has been accurately predicting movements in the liquid markets for more than 25 years, and his most recent cycle analysis predicts that the current stock market rally is going to last through Q2 and then begin a major descent in 2013 – with the Dow eventually reaching 5,000! Read on to learn how Nenner’s unique system works and what he forecasts for commodities, currencies, bonds, interest rates and more. Words: 400

8. Stop! If You Sell in May and Go Away This Year You’ll Regret It – Here’s Why

[The adage “sell in May and go away” refers to selling one’s stocks in May, going into cash, and then waiting until November before buying back into the market. That] has worked the past two years…[This time round, however,] we believe there is a high probability that you would be buying at a higher price [in November] than… [what if you were to sell out] in May of 2012. [Let us explain why we are of that view.] Words: 4069. An Inflation Inferno is Expected – but When?

Daniel Thornton, an economist at the Federal Reserve Bank of St. Louis, argues that the Fed’s policy of providing liquidity has “enormous potential to increase the money supply,” resulting in what The Wall Street Journal’s Real Time Economics blog calls “an inflation inferno.” [Personally,] I think it’s too soon to make significant changes to a portfolio based on inflation fears. Here’s why. Words: 550

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money