We are trying to get out of a debt led crisis with more debt. The facts show this and we have compiled some of the more troubling data by putting the entire debt market into perspective here [and it clearly shows that] we flat out have an addiction to borrowing. [Read on!] Words: 600

and we have compiled some of the more troubling data by putting the entire debt market into perspective here [and it clearly shows that] we flat out have an addiction to borrowing. [Read on!] Words: 600

So say excerpts from an article* at www.mybudget360.com which Lorimer Wilson, editor of www.munKNEE.com (Your Key to Making Money!), has further edited below for length and clarity. (This paragraph must be included in any article re-posting to avoid copyright infringement.)

The article goes on to say, in part:

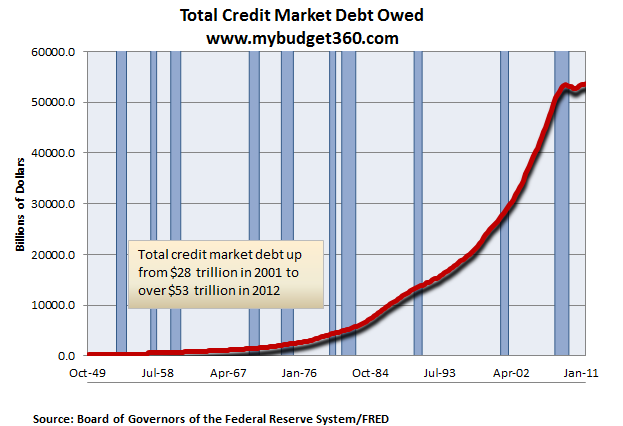

The total market of debt shows our addiction to borrowed money. It is now up to an astonishing $53 trillion and continues to grow. Take a look at this frightening data:

In 2001 total credit market debt was up to $28 trillion. Today it is now well above $53 trillion and inching closer to slapping on another trillion dollars this year. If you look at Greece as a microcosm of the bigger issue, you realize they are treating a solvency issue as if it were a liquidity issue. Let us be absolutely clear that all of this debt will never be paid off. This warrants repeating: The $53 trillion in total credit market debt will never be fully repaid [and, in spite of that,] it continues to grow…

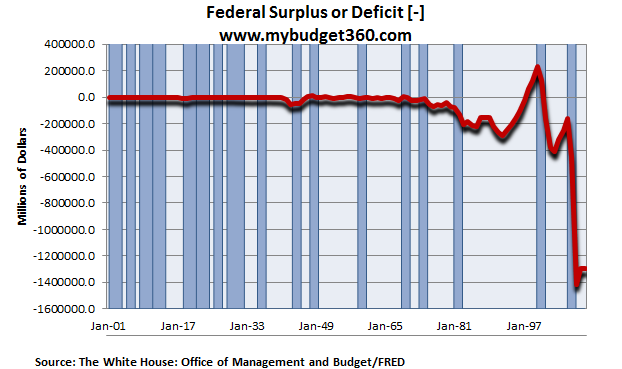

Do people really think we,[the U.S.] are going to pay off our $15 trillion national debt when our deficits look like this:

We’ve been running continuous budget deficits since the late 1970s. We had a brief respite when it came to having a surplus with the tech boom but that was blown out the window completely with the real estate mania. Contrary to what most will say, deficits do matter and massive deficits really matter.

Why spend time surfing the internet looking for informative and well-written articles when we do it for you. We assess hundreds of articles every day, identify the best and then post edited excerpts of them to provide you with a fast and easy read. Sign-up for Automatic Receipt of Articles in your Inbox and follow us on

FACEBOOK | and/or

TWITTER so as not to miss any of the best financial articles on the internet.

Let us be abundantly clear that the total market debt is incredible. You now start having this challenging race where you are trying to avoid having your total debt surpass your annual GDP. The US has passed that mark and so have many other countries. The results in the long-run are never positive especially when people wise up and start asking for their money back. Since most don’t have the funds, they pay for it via inflation and a devaluation of their currencies…

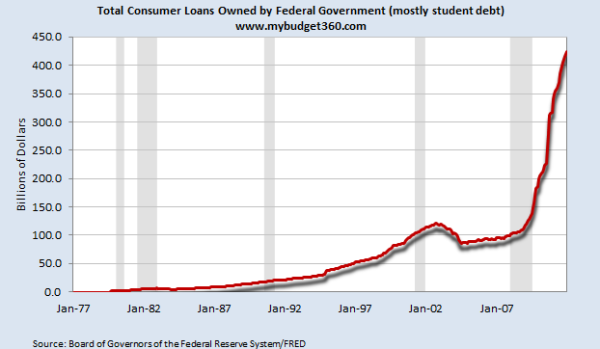

Higher Education (Student Loan) Debt

The access to easy debt creates massive amounts of bubbles. We saw this in housing and now we are seeing it here in the U.S. with the giant higher education bubble. [Take a look at the chart below which shows just how serious the situation is.]

Keep in mind this is only a tiny part of the student debt market. This year we will surpass $1 trillion point for student loan debt. I believe this will be another crisis that will hit and many indebted students are already feeling this. Many are being sucked into paper mill for-profits that are essentially scam factories that raid the government backed student loan funds. They lobby Congress to make it easier for them to report horrific placement data and change the metric on default reporting so it doesn’t look as atrocious. Even with these softballs from our bought out politicians, the data is still horrible.

Conclusion

A debt bubble cannot be solved with more debt…The financial media missed the tech bubble bust and the housing bubble bust so gear up because they will miss the next debt bubble bust as well.

*http://www.mybudget360.com/day-of-reckoning-for-global-total-debt-total-credit-market-debt-consumer-debt-large-charge-of-household-debt-trillions/

Editor’s Note: The above article has been has edited ([ ]), abridged (…) and reformatted (including the title, some sub-titles and bold/italics emphases) for the sake of clarity and brevity to ensure a fast and easy read. The article’s views and conclusions are unaltered and no personal comments have been included to maintain the integrity of the original article.

Related Articles:

1. Americans Greasing the Tracks for a Financial Crash! Here’s Why

For the bulls yesterday’s news of a much higher-than-anticipated jump in consumer borrowing is yet more proof that the recovery is on track. [For the bears it is outright confirmation that America’s spending is setting it up for a major financial crash! Let me explain.] Words: 527

2. National Debt Burden per Capita-to-Income Index at 50 Year High – and Growing!

Wars and depressions largely characterize the periods of time where there have been significant run-ups in the level of the U.S. National Debt Burden per Capita [i.e. the U.S. National Debt Burden per Capita-to-income Index], with the debt taken on to support the costs of the U.S. Civil War and World War II being the most significant. Today… it is perhaps most comparable to the Great Depression. [Take a look.] Words: 326

3. 75% of Americans are in Deep _ _ _t!

Rising education and medical costs, on-going credit card interest payments, well used personal lines of credit and large mortgage debt and home equity loans – most a penchant for living beyond their means – is keeping 75% of American households in some degree of debt. Take a look and then pass it on to your friends, neighbors and co-workers.

4. The Global Debt Clock: A World Debt Comparison

The clock is ticking. Every second, it seems, someone in the world takes on more debt. The idea of a debt clock for an individual nation… [is old hat – see links below to many such debt clocks – but] our clock (here) shows the global figure for all (or almost all) government debts in dollar terms. Words: 300

5. In Debt? Here are 10 Ways Out

When people talk about getting their personal finances in order, they usually try to find relatively pain-free and low-cost ways to reduce debt and increase savings but this is a long-term approach which some people just cannot “afford”. [For them] …it may be worthwhile to consider taking the hard way out of debt. [Let me explain.] Words: 1370

6. American Grads: Here’s a Great Guide to Personal Finance

Graduating from college can be an exciting and stressful time. Suddenly you need to find a job, replay loans and make solid financial decisions. Fortunately, you don’t need to be unprepared. Below are some budgeting basics to keep your spending under control, some suggestions on how to set financial goals and a list of the top 10 American cities for starting out.

7. 2 Ways to Reduce Your Debts Using the “Snowball” Method

What is the best way to reduce debt? The most-efficient means is probably the snowball method. There are two main variations of the snowball method, but you must consider your personality to determine which of the two is right for you. [Let me explain.] Words: 1251

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money