An article by bullionvault.com that has been severely edited ([ ]) and abridged (….) by the Managing Editor of munKNEE.com for the sake of clarity and brevity to ensure a fast and easy read.

An Introduction

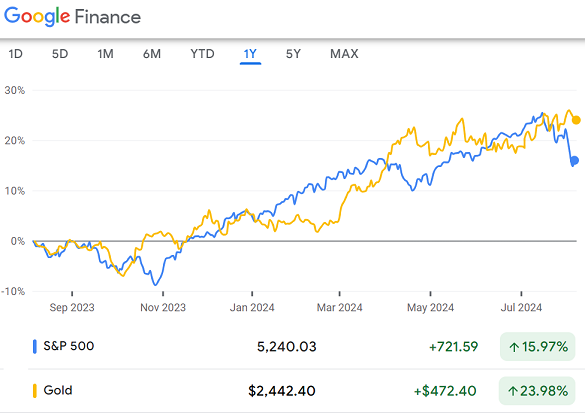

…When leveraged traders…saw margin calls pouring in from their brokers ahead of the New York opening on Monday, it forced them to liquidate winning positions to cover their losses elsewhere. [By the end of the day global stocks had] lost more than 5% from the same point last month on the MSCI World Index. Gold, in contrast, continued to show a 2% gain at the start of London trade. This isn’t unusual. Indeed, it’s how most equity crashes have played out historically…

Gold did exactly what short-term traders needed it to do offering a deep and liquid market in which to raise urgent cash. More importantly, gold did exactly what investors would want it to do to…rising across the longer-term to offset the grinding long-term losses in the stock market.

Gold’s Price vs. the Stock Market

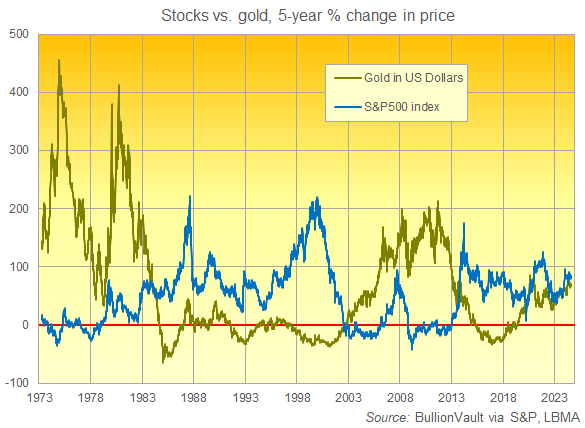

- …The price of gold shows pretty much no correlation with or against the stock market…[and], when we look at the price change across all 5-year horizons, which is what our chart above does, gold has diverged from equities…less than 51% of the time…

- On a weekly basis, however, gold has traded higher when the U.S. stock market fell from 5 years earlier 98.0% of the time…

munKNEE.com Your Key to Making Money

munKNEE.com Your Key to Making Money